Tembo Market Watch: December 2025

Anya Gair, Head of Organic

Anya Gair, Head of OrganicWhether you're a first-time buyer, a homeowner, or just keeping an eye on the market, here’s what you need to know - from the UK's Best Mortgage Broker.

TLDR:

- Bank of England's votes to drop base rate drop to 3.75%, after three months of holds

- Mortgage rates as low as 3.51% now available as price war between lenders continues. See what rate you could get here.

- House prices are cooling off, but what's happening depends on where you live.

- Good news for first-time buyers: Lower mortgage rates mean monthly repayments look a lot more affordable now. Discover your buying budget with a free Tembo plan.

- Now is the time to review your savings accounts as rates could drop following the base rate announcement.

Let’s break down exactly what’s happening, and what this means for your wallet.

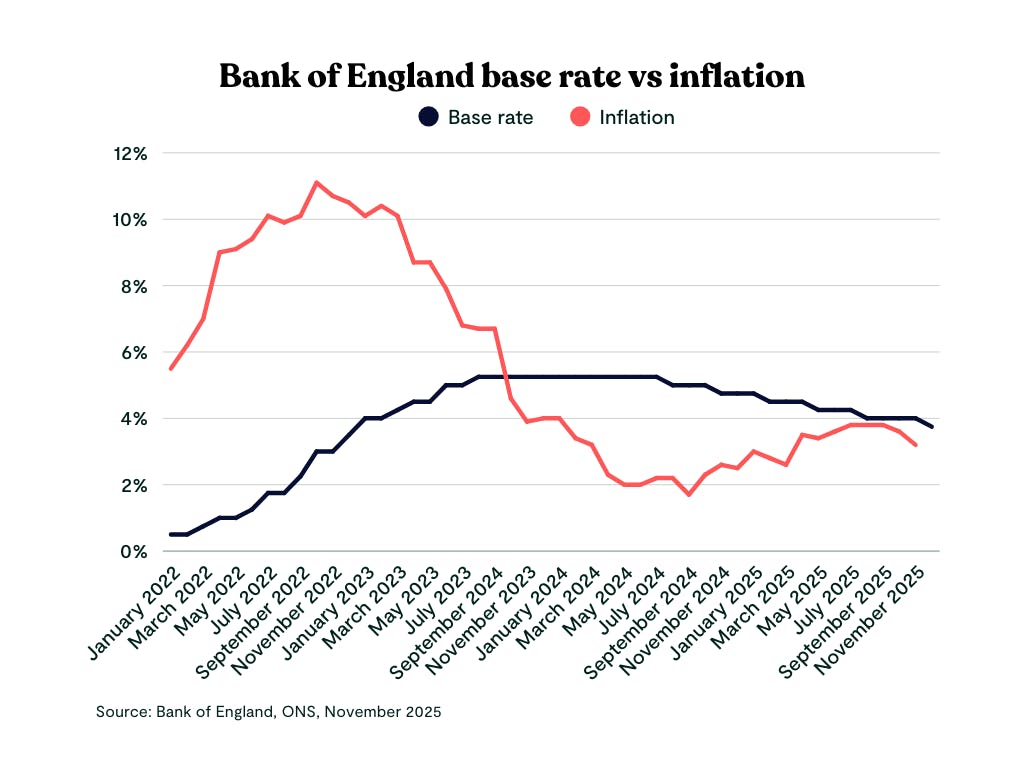

Bank of England votes to cut base rate to 3.75%

After months of the base rate staying steady, the Bank of England has finally taken the plunge, voting to cut the base rate by 0.25% to 3.75% at their 18th December 2025 meeting.

This isn't just a number on a spreadsheet; it’s a signal that the economic tide is turning. In short: inflation is behaving itself again.

The latest data shows it dropped to 3.2% in November 2025. While that’s still above the "perfect" target of 2%, it’s trending in the right direction. Today's vote shows that the Bank of England is now confident enough in this downward trend to start easing off the brakes.

If you’ve been holding your breath waiting for a good time to remortgage or buy, after today's announcement you can finally breathe.

This cut from 4.0% to 3.75% is a bit of an early Christmas present for borrowers. It signals that the central bank believes the worst of the cost-of-living crisis is behind us, even if grocery bills still feel a pinch higher than we’d like.

Mortgage rates drop to as low as 3.51% as price war between lenders continues

Here’s the secret about base rate cuts: mortgage lenders don’t wait for the official announcement. They usually price their deals based on what they think will happen. This is why lenders have been cutting their rates over the last few weeks, scrambling over each other to offer the best deals.

Across our panel of over 100 lenders, we are seeing some fixed-rate deals dipping close to the magic 3.5% mark for the first time in ages.

Need mortgage help? Talk to Tembo, the UK's Best Mortgage Broker four years running

Want to find out your true buying budget without applying? Need to remortgage quickly? Create a Tembo plan to discover all your mortgage options from across the market in minutes.

What does this mean for you?

- Fixed rate mortgage: If your fixed deal is ending soon, the panic stations are closed. You can now find two-year and five-year fixes that are significantly cheaper than what was available even a few weeks ago. Now is the time to see what rate you could get. Remember, mortgage offers typically last between 3-6 months, and with Tembo's rate checking service, you can reapply at no extra costs if rates drop down the line.

- Tracker mortgages: If you’re on a tracker, your rate will drop almost immediately as these types of deals follow the base rate.

- Variable rate mortgages: Similar to tracker mortgages, if you're on a variable rate your repayments will likely decrease. However, it's at your lender's discretion how much of the base rate cut they pass on to you.

First-time buyers: Affordability is improving. While house prices haven't crashed, lower interest rates mean monthly repayments look a lot more affordable than they did earlier in the year. See what you could afford here.

Pro tip

Don't hold off looking for a deal. Lenders are offering these lower rates now to lock in customers before the year ends

North-south house price divide widens

While mortgage rates are falling, house prices are telling a tale of two kingdoms.

London, usually the golden child of property growth, is taking a backseat. Forecasts suggest that price growth in the capital will be flat over the next year. This is partly down to affordability. Prices in London are already so high that even a small dip in mortgage rates doesn't lower the barrier to entry for many. Plus, looming tax changes for high-value homes (over £2 million) are putting a damper on the luxury market.

Meanwhile, the Midlands and the North are having a moment. Areas like the East Midlands and the North West are predicted to outperform London significantly over the next few years. In fact, cities like Carlisle are seeing homes sell faster than anywhere else in the UK.

If you’re looking for capital growth, the "safe bet" of London brick and mortar might not be the powerhouse it once was. The smart money seems to be looking further north.

Overall, annual house prices inflation stands at 1.3%, but house price growth is expected to be modest in 2026, and with the uncertainty of the Autumn Budget now behind us, the market looks set to enter the new year with renewed confidence.

Renters finally catch a break (sort of)

If you’re renting, you’ve probably had a rough couple of years. But there is a glimmer of light here too.

Rental growth has slowed to 2.2%, the lowest rate of increase in four years. This is largely because the frantic demand we saw post-pandemic has cooled off. Net migration has dropped, and more first-time buyers are finally escaping the rental trap thanks to those improving mortgage rates we mentioned earlier.

However, supply is still tight. While there are more homes available to rent than last year (up about 15%), it’s still a competitive market. But at least rents are now rising slower than average earnings, which should start to ease the affordability squeeze as we head into 2026.

Savers: Act fast or miss out

For the last year or two, you could leave cash in a savings account and earn a decent return without trying very hard. Those days are numbered. As the base rate falls, savings rates will likely follow suit.

Savings rates are likely to start easing after today’s news, but gradually, as providers will adjust their rates at different speeds. It’s still worthwhile putting savings away as early as you can - even small amounts will benefit from time and the impact of compounding.

Shahi Sattar

Director of Savings at Tembo

If you have a chunk of cash sitting in an easy-access account, now is the time to move it to a more competitive rate. You might want to lock in a fixed-rate account while providers are still offering deals around the 4% mark, like our 1 Year Fixed Rate ISA.

Protect yourself from rate drops. Lock in 4.14% on your savings today

Earn a market-leading rate on your savings with our Fixed Rate ISA. Plus add more funds later on to lock-in for 12-months from the date they are added, at the rate available at the time.

What should you do? Our top tips

The economy is shifting gears. We are moving from a period of high inflation and high rates to a more stable, albeit slower, economic environment.

- If you’re a homeowner: Check your mortgage deal. If you're within six months of your fixed rate ending, start shopping around now. You could lock in a rate today to protect yourself, and if rates drop further before you switch, you can usually jump to the cheaper deal (and with our rate checking service, you can re-apply at no extra cost!)

- If you’re a home buyer: Don’t be afraid to negotiate. With homes taking longer to sell (currently averaging 37 days), you have more power than you think, especially in the South.

- If you’re a saver: Make sure your savings are working hard for you by earning interest with a competitive interest rate. Check out our latest savings rates here.

What’s next for the market?

The 3.75% base rate is a welcome step back towards lower interest rates for mortgages. It’s not a magic wand that fixes everything overnight, but for the first time in a long time, the wind is blowing in the right direction for borrowers.

We could see more price reductions going into the new year, but it's unlikely the base rate drop immediately will impact deals (apart from trackers). Most lenders price their deals in anticipation of what they see the market doing, instead of after.

Andy Shead

Senior Mortgage Advisor at Tembo

So it's unlikely we will see an immediate impact on mortgage rates after today's announcement, but this doesn't mean the recent price war is over.

For savers, it's likely we'll see savings rates shift over the coming weeks to reflect the lower base rate. So now is good a time as any to re-assess where your money is ahead of a fresh new year.

Check back in our latest articles to keep informed on the latest movements. Or discover how you could save faster, or buy sooner, through our award-winning savings app and mortgage service.

Discover your true buying budget in minutes

Create a free Tembo plan to discover all the ways you could buy or remortgage from across 20,000 mortgages. It’s free and there’s no credit check involved!