Can't get into your dream home?

Try a Deposit Boost from Nationwide. A Deposit Boost is a way for a willing family member or friend to remortgage or take out a lifetime mortgage on their own property. The proceeds are then gifted to you to put towards your deposit, so you can get into your own place.

More about Deposit Boosts

A Deposit Boost is a safe & ethical way to release money from a friend or family members property to top up an existing house deposit or create one from scratch.

Deposit Boosts Explained

What is it?

A Deposit Boost is a form of remortgage or lifetime mortgage taken out by a family member or friend on their property. The proceeds are then gifted to the buyer to put towards their deposit.

How it could work for you

Let's say you've got a Decision in Principle from Nationwide for £180,000 with a £20,000 deposit. You want to buy a property of £240,000 meaning you need a Deposit Boost of £40,000 to buy your home.

Benefits

The main benefit is so you can buy a home sooner. It can also be used to reduce the buyer's Loan-to-value (LTV) so they can access lower interest-rates.

Risks & Considerations

As with all loans and mortgages, it's important to understand the potential risks and eligibility criteria when making a decision. The Booster will be liable for their own mortgage

Deposit Boost Example Breakdown

So let’s say your dream home is £200,000 but the maximum you can afford is a home for £160,000.

booster

With Tembo and an eligible booster, we could get you that home.

buyer

Your Dad wants to fill the £40,000 gap

He can do so by releasing money from a property, using a Deposit Boost. So he speaks to a Nationwide Specialist Mortgage Advisor to check his eligibility and recommend the best way to unlock money from his property.

See the available options.

He releases £40,000 from his property and gifts it to you

As the Deposit Boost is a mortgage your dad's name, he is legally responsible for monthly payments. Repayments start at £80 p/m for a £40,000 loan.

With your new deposit, your Nationwide Mortgage Advisor will arrange a mortgage to buy your home

A bigger deposit means lower interest rates.

Your Booster has helped you get on the ladder!

Time to enjoy your home!

Deposit Boost options to release money from a Boosters property

Retirement Interest-Only Repayment

This type of mortgage is like a standard interest only mortgage but with some differences that could be useful for over 55s.

With this mortgage, unlike a standard interest-only mortgage, there is no restriction on the mortgage term. This means the capital is usually paid off when the last borrower moves into long-term care or dies.

Lower monthly payments as the Booster only pays interest each month

Rates start from 2.39%

Retirement Capital Repayment

This type of mortgage is like a standard repayment mortgage but with some differences that could be useful for over 55s.

With this mortgage, unlike a standard repayment mortgage, there is no restriction on the mortgage term. This means the capital is usually paid off when the last borrower moves into long-term care or dies.

Higher monthly payments as the Booster pays capital and interest back each month

Rates start from 2.39%

Standard Remortgage Repayment

This type of mortgage is a standard repayment mortgage open to all borrowers but is not always suitable for those in retirement.

With a standard repayment remortgage, the length you are able to take out the mortgage is restricted, and you'll have to repay the mortgage at a certain age (around 75).

Higher monthly payments as the Booster pays capital and interest back each month

Rates start from 1.29%

Lifetime (Equity Release) Mortgage

The Lifetime mortgage is a type of equity release. This type of equity release unlocks the value built up in your home as a tax-free lump sum.

Your mortgage is paid off from the proceeds of the sale of your home when the last borrower moves into long term care or dies.

You don’t have to make monthly capital or interest payments. But, if you don’t, bear in mind that the balance will increase over the term.

Rates start from 3.07%

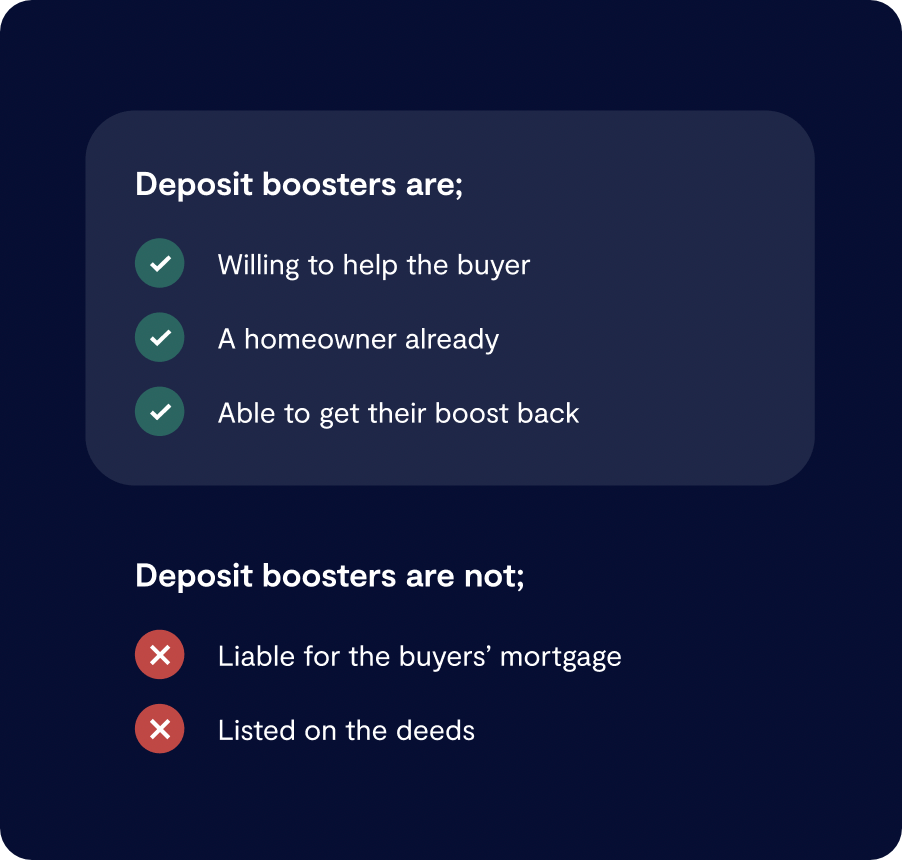

Booster eligibility criteria

Get startedHow to buy a home using a Deposit Boost

Step 1 - Check your eligibility

Register online and Tembo's smart technology will scan the market to find the best deal for the buyer and their family

Step 2 - Chat to an Nationwide Specialist Mortgage Adviser

Our Mortgage Advisers will are trained to help families find a way to buy a home. They'll advise the Booster on their best option and help the buyer find the perfect mortgage to buy their home.

Step 3 - Mortgage Application & Offer

Once we've found a suitable mortgage and you're ready to proceed, we'll submit both the boosters and the buyers mortgage application and guide you through to completion.

Chat to a Nationwide Specialist Mortgage Adviser

Chat to an adviser who specialises in advising families on how to buy a home.

More about our partnership with Tembo

Buying a home is harder than ever

Nationwide has partnered with Tembo who is championing a new and fairer way - helping a new generation of buyers get a foot on the ladder

Buy your home with your family

Our innovative products help increase the amount you can borrow. Increase your deposit using a Deposit Boost.

Get a Tembo plan online

Your Tembo plan will check your eligibility for a Deposit Boost and show you how much you need.