Edinburgh house buying guide

Looking for houses for sale in Edinburgh, but unsure which area to choose? You’re in the right place, our Edinburgh buying guide will show you the best places to live. To see what you could afford and how you might get on the ladder sooner, create a free Tembo plan — or try out our Mortgage Calculator.

£269,900 Average Property Price

+0.8% Annual House Price Change

£88,000 Average Affordability Boost

Where should I buy in Edinburgh?

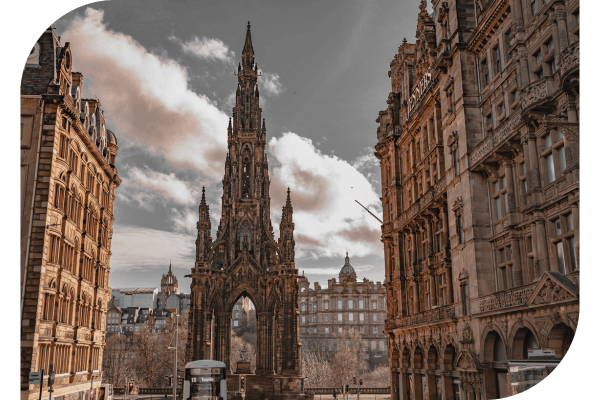

The Scottish capital is known for being a compact, bustling city with lots of history. Founded before the 7th century AD, the Old Town was built onto an extinct volcano! Complete with winding streets filled with pubs, shops, museums and cafes, it's a history-lover's dream.

As well as it's history, Edinburgh is also known for being the greenest city in the UK, thanks to having the best air quality and most amount of green spaces per head. It's also a centre for culture, hosting events like the Edinburgh International Festival and the Fringe each year - the world's largest arts festival. A hub of learning since the Renaissance, Edinburgh is also a pioneer in the sciences, technology and financial services, as well as digital technologies, film and creative industries.

Keep reading to find out the top 3 places to buy a home in Edinburgh.

Average property price

New Town

The charming Georgian part of the city centre, New Town is known for its rows of elegant townhouses. There's plenty of bars, restaurants and cafes to enjoy your weekends in, as well as being a stone's throw away from all the shops you could possibly need. Plus, you'll be in the prime location for celebrating Edinburgh's world-famous Christmas and Hogmanay celebrations!

Transport

Within walking distance of the city centre, this grand neighbourhood is perfect for young professionals who want to be close to the centre of things without having to deal with as many tourists as the Old Town.

Local Schools

There are only a few primary schools in Edinburgh's New Town, mainly Saint Mary's PC and Stockbridge Primary School, as well as MDK Primary and Leith Walk Primary slightly further afield. There are two main high schools - Drummond Community High School and Edinburgh Academy which is private.

Property price growth

Over the last year, property prices in Edinburgh's New Town were similar to the previous year.

History

Edinburgh's New Town is like the orderly cousin to the city's more historic Old Town. Developed in stages between 1767 and 1850, the New Town boasts signature neo-classical and Georgian architecture.

Before this, Edinburgh was a city of tens of thousands of citizens cramped into the old city walls where filth, disease and crime flourished - the Porteous Riots and Jacobite Rebellion were symptoms of the discontent that resulted.

The city council responded with the creation of the New Town, built with a bold and imaginative design unlike the current city.

Average property price

Stockbridge

North of the city centre, Stockbridge was once a small village on the outskirts of the city. While it's part of Edinburgh today, it still retains a villagey feel and local charm.

Stockbridge is a much more quiet neighbourhood than Leith or New Town, and is largely residential, making it a better choice for families or those who crave a calmer environment. But don't worry, you'll still be spoilt for choice as Stockbridge is known for its range of independent shops, cafes and restaurants.

There's also the Royal Botanic Gardens and nearby Dean Village to enjoy, as well as plenty of sports clubs and activity centres like the Glenogle Swim Centre.

Transport

Only a 20 minute walk into the centre of Edinburgh, Stockbridge is ideally located for those who want to be close to city. You can also take a bus to the centre is a similar amount of time, or cycle for 6 minutes!

Local schools

The main primary school in Stockbridge is Stockbridge Primary, but there is also Dalry Primary and Broughton Primary slightly further afield. Secondary school wise, the main candidate is Broughton High School, but there is also a few private schools including Stewart's Melville College, Edinburgh Academy and Fettes College.

Property price growth

Over the last year, property prices in Stockbridge were 8% down on the previous year.

History

Stockbridge's name comes from wooden foot bridge, back when it was the northern most extension of Edinburgh's New Town. The area was a separate entity until the development of the New Town, and was mainly designed by one man - Sir Henry Raeburn who was born in the area.

Throughout the 18th and 19th centuries, Stockbridge became the go-to place for artists, poets and writers, contributing to its Bohemian culture that is still evident today.

Average property price

Leith

A historical port area, Leith has always had its own character. Home to a range of property styles, as well as some of Edinburgh's best cafes, bars and restaurants, there is certainly a lot on offer in this city suburb.

In fact, Leith was even named one of the top five “coolest” places in the world by Time Out Magazine in 2021!

While there is good transport links into the centre, you can also take a more leisurely root in on foot via the picturesque Water of Leith Walkway.

Transport

Slightly further out of the city, Leith is only a brisk 35 minute walk into the centre. Alternatively, you can catch a bus for 20 minutes, or drive into the centre in around 10 minutes.

Local schools

Being more residential than Stockbridge or the New Town, Leith has plenty of primary schools to choose from including Leith Walk, Abbeyhill and Royal Mile Primary. For secondary schools, it's worth considering Leith Academy and Trinity Academy.

Property price growth

Over the last year, property prices in Leith were similar to the previous year.

History

There's archaeological evidence of settlement along the banks of the Water of Leith since prehistoric times. But the first written record of Leith was in 1128 when Kind David I granted some of his lands in North Leith to Holyrood Abbey.

In 1560 Mary of Guise ruled the whole of Scotland from Leith as Regent while her daughter, Mary, Queen of Scots remained in France - her coat of arms can be seen in South Leith Parish Church!

Historically, Leith was the city's port, although it wasn't part of Edinburgh until 1920 it was often the landing point for many notable names. The town would be where Mary, Queen of Scots arrives in 1561. When she abdicated in 1567, starting the civil war, James VI's troops stationed themselves in Leith during the "Wars between Leith and Edinburgh".

Struggling to buy a home in Edinburgh? We can help

Tembo specialises in helping buyers and home movers boost what they can afford so they can buy sooner. Create your free Tembo plan today for a personalised recommendation.

See today's best interest rates

If you're in a hurry to buy, make sure you don't miss out on the best mortgage rates from our panel of lenders. See today's current rates with our Interest Rate Tracker, or create a free Tembo plan for a personalised rate.

Interest Rate Tracker5* rated and thousands of happy customers

The application process

4 simple steps to getting the keys to your new home

Make a Tembo plan

Check your eligibility for a range of buying schemes, and get a personalised recommendation with interest rates and repayments in under 10-minutes.

Talk to an expert

Book a call with our experts to complete the qualification process, and we’ll cover off any questions you might have about any of the budget boosting schemes we advise on.

Find a property

Once you’ve found a property, your dedicated advisor will undertake full affordability checks to prepare the mortgage application. Then we’ll submit it on your behalf!

Make home happen

During conveyancing, we’ll liaise with the seller and your solicitors to ensure a smooth purchase. We’ll also provide a free protection review for your insurance needs.

Got questions? We've got answers

See all FAQsFrequently asked questions

Explore other locations

Data sourced from Zoopla's November 2023 House Price Index and Rightmove property prices. Accurate as of 05/12/2023.