Boost what you could afford with a Guarantor mortgage

Guarantor mortgages allow aspiring home buyers to boost their mortgage affordability through the support of another person, usually a relative. They will use their income, savings or property as the security on the mortgage, boosting what the buyer can borrow or put down as a deposit.

See how a guarantor mortgage could help you today by creating a personalised Tembo plan.

Average £88,000 boost to affordability

+110 lenders including high-street names

Available 7-days a week, plus evenings

What is a guarantor mortgage?

A guarantor is someone who supports your mortgage application, using their income, savings or property as security. Also known as a family-assisted mortgage, guarantor mortgages are a great solution for someone who is struggling to afford the home they want to buy, either because they haven't got enough saved up as a deposit, or they can't borrow enough on their income. Mortgage guarantors tend to be relatives, but friends can also guarantee a mortgage.

How does a guarantor mortgage work?

A guarantor mortgage works like a standard mortgage, but instead of securing the loan solely against the property you're buying, a guarantor provides extra security with their savings, income or home equity. If you pay on time, your guarantor's collateral is released after the agreed period, but if you miss payments, the guarantor becomes legally responsible for covering them.

What types of guarantor mortgages are there?

Guarantor mortgages come in different guises, but the main types use either a guarantor’s income, property or savings as security. By having security, the buyer is viewed as less of a risk by the lender, which allows you to borrow more.

Income Boost

If your income is what’s restricting your borrowing power, adding a mortgage guarantor’s income to your application will increase the amount you can borrow. Your guarantor won't be on the deeds of the property, but if you are unable to pay the repayments, they'll have to step in.

Savings as Security

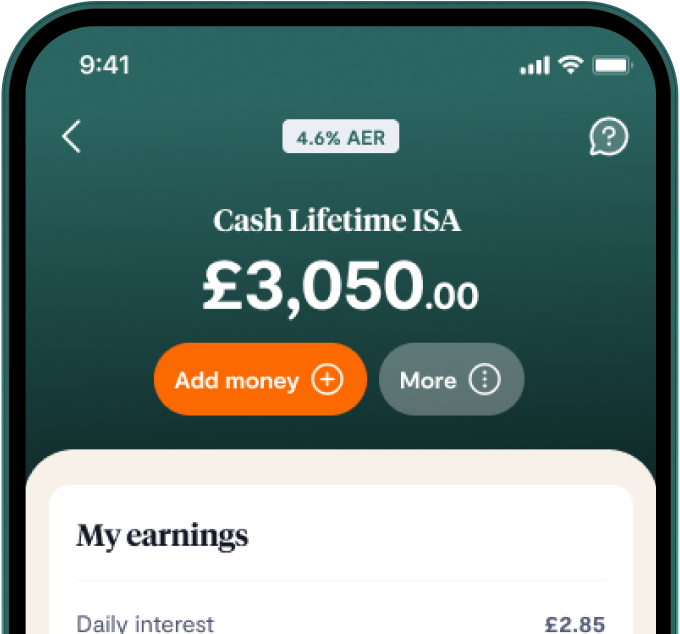

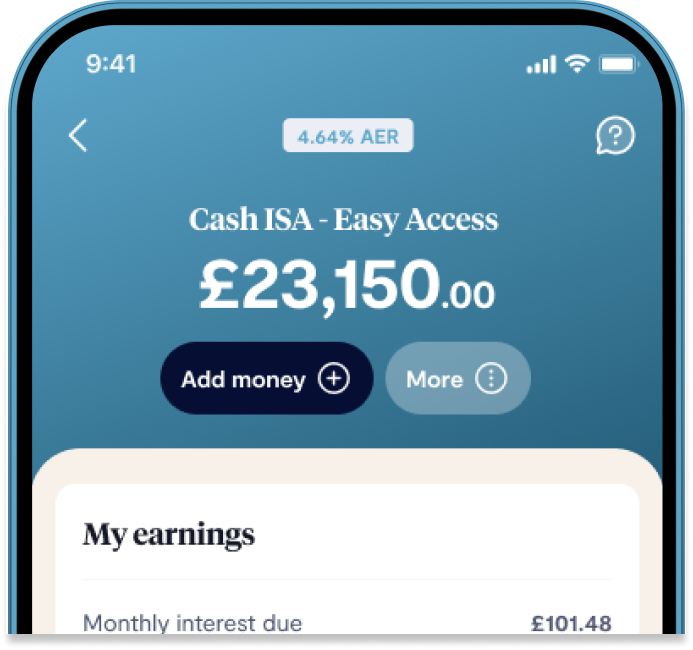

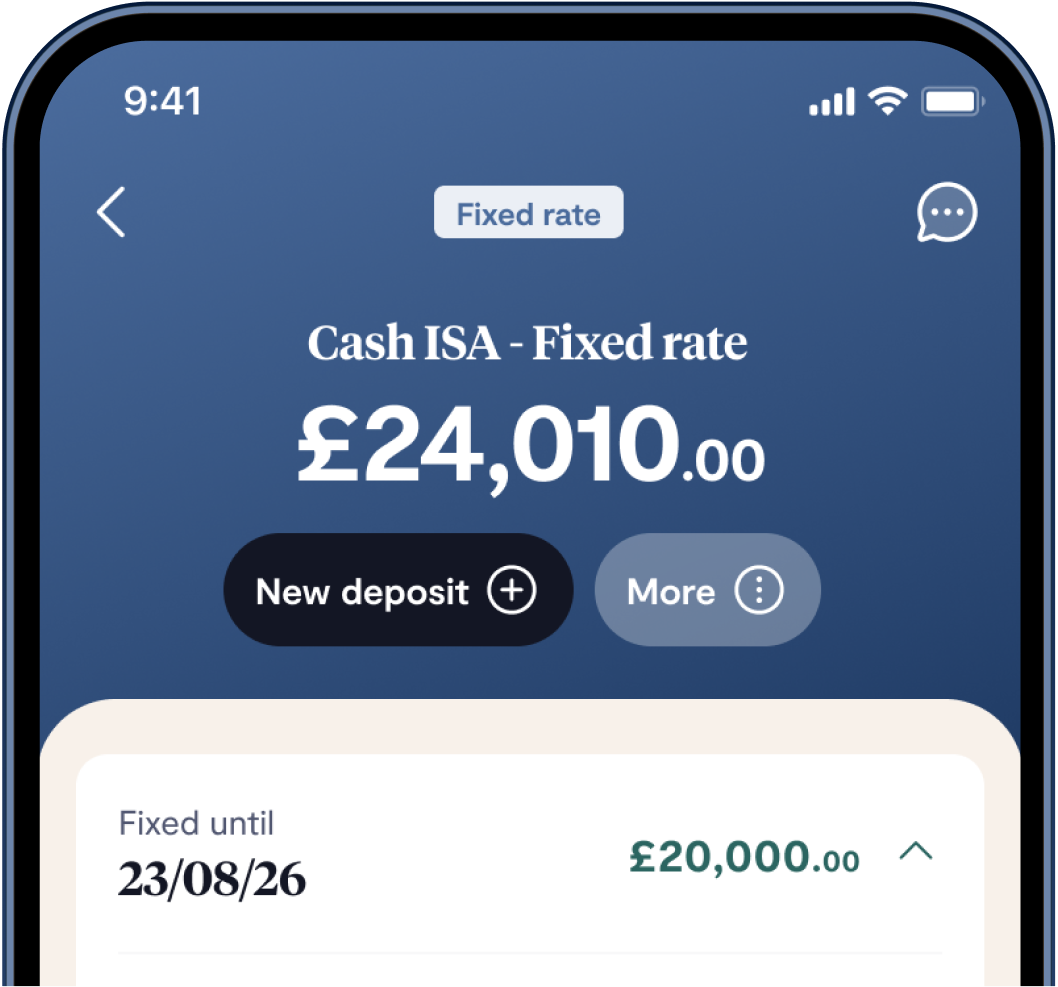

If your guarantor does have cash savings, they can be used as security to increase how much you can borrow. They'll their savings in a special account for a set number of years. At the end, they'll get their money back plus interest - as long as you keep up with your repayments.

Deposit Boost

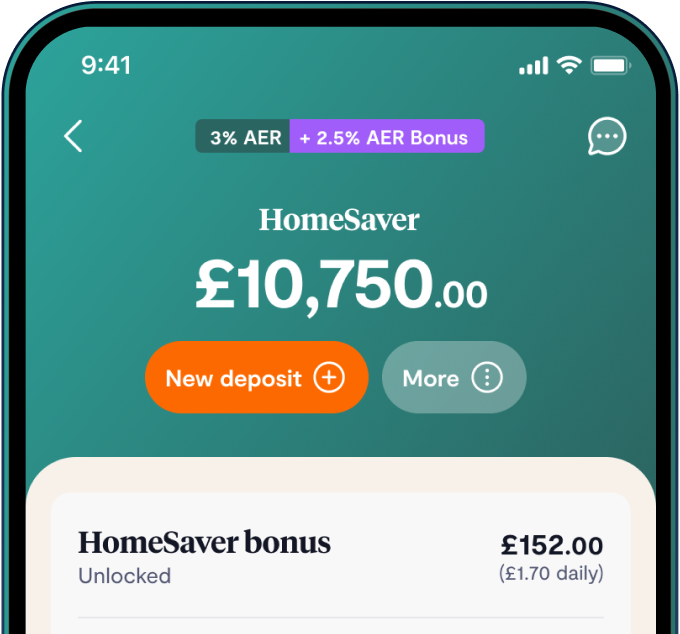

Boost your house deposit with help from your loved ones. They'll use a small mortgage to unlock money from their home, which can then be gifted to you. With a bigger house deposit, you may be able to unlock better mortgage rates or afford a more expensive property.

Why use Tembo?

Voted Britain's Best Mortgage Broker four years running, we are specialists in a range of guarantor mortgages that could help you buy sooner or boost your budget. But don't just take our word for it. Watch some of our customer stories to see how we helped them make home happen, even against the odds.

Single income first-time buyer

Buying with complex income

Using income to boost affordability

Remortgaging to gift a deposit

Acting as a silent guarantor

Expert support at every step

It’s not always easy to know exactly how to take the first step. Our service is designed to help guide you through the whole process, with award-winning mortgage advice from start to finish

We’ll find you the best deal

From 25,000+ products and 110+ lenders

Same day appointments

Book an instant appointment 7-days a week

A dedicated case manager & advisor

By your side from hello to getting your keys

Instant property valuations

Free home reports with 120+ data points

Advice from UK’s Best Mortgage Broker

As voted by our customers four years running

A lightning quick service

Average time to mortgage offer is just 10 days

Protection & insurance advice

The cover you need to protect you & yours

Hassle-free moving service

Easy utilities, moving & services set-up

Access to our panel of conveyancers

Tried & tested paid legal guidance from our experts

Got questions? We've got answers

See all FAQsFrequently asked questions

Learn more

We've hand-picked our top guides to answer your guarantor mortgage questions. You can explore all of our guides in our Learn Hub.