How much should I have in savings?

Your ideal savings amount depends on your income, lifestyle, and goals, like whether you’re saving to buy a house, saving for a wedding, or hoping to retire one day. So in this guide we’ll break down what’s ‘normal’, what’s realistic, and help you figure out what’s best for you.

In this guide

- What is a good savings amount?

- What are the average savings by age in the UK?

- What is the ideal amount to have in savings?

- How much should I have in savings for an emergency fund?

- How much should I have in savings to buy a house?

- How much should I have in savings for a wedding?

- How much should I have in savings for retirement?

What is a good savings amount?

There’s no single number that works for everyone, but a good savings amount is one that gives you a buffer for short-term shocks and helps you progress towards long-term goals such as going travelling or starting your own business.

As a starting point, aim to have at least one month’s worth of expenses saved in an emergency fund. You need just enough to cover your rent or mortgage, bills, food, and travel costs if something unexpected happens.

Once you’ve built that first layer of security, you could build an even bigger emergency fund or start saving for bigger milestones like buying a home or starting a family.

Many people find it helpful to split their savings into separate pots. For example, you might have one for emergencies, one for short-term goals (like holidays or car costs), and one for long-term plans (like a house deposit or retirement). This can make it easier to stick to your savings goals and make the most of different savings accounts designed for specific purposes.

Wondering where to start? Take a look at our guide on how to save money for our top saving tips.

Getting a mortgage? You deserve a Tembonus

With our HomeSaver savings account, there'll be a reward waiting for you at the finish line, whether you're buying your first place, your next, or remortgaging.

What are the average savings by age in the UK?

Your age can play a significant role in your ability to save. Older generations tend to have more in the bank than Millennials and Gen Z savers, which is helped by the fact that over 75% of all property wealth in the UK is owned by the over 55s. Owning a home makes you better off in the long run than renting a similar property, as you are not only protected from rising rent costs but also can build up your own property equity over time. The older you are, the more you tend to take home each month in earnings.

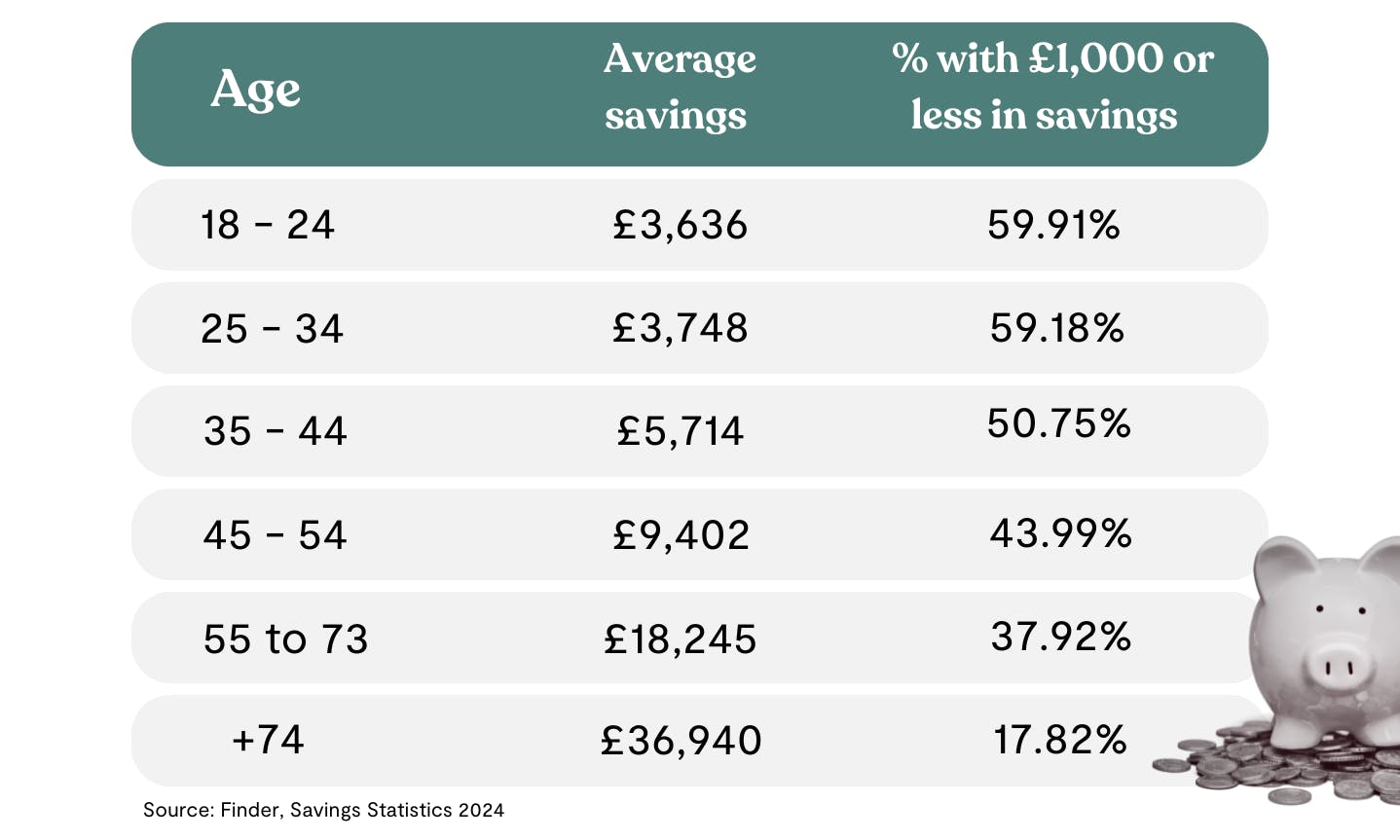

Those aged 18-34 have on average under £3,800 in savings, while those aged 35-44 have £5,700 on average. This grows to closer to £10,000 when you get to the 45-54 year olds, and closer to £20,000 or more for the 55s and up.

However, these averages can make it seem like everyone but you has money put aside, when this isn’t the case. Almost 60% of those aged 18 to 34 have less than £1,000 in savings.

And although the average 55 to 73-year-old has almost £20,000 in savings, almost 38% of those in that age bracket have less than a grand tucked away. Across all age groups, a quarter of UK adults (11.5m people) have less than £100 in their savings accounts, with one in six people having no savings at all.

So if you’re struggling to save, you’re certainly not alone!

Let’s take a look at some of the factors that can affect how much you have in savings:

Your income impacts your ability to save

Your income is another metric that determines how much you’re likely to have in savings. People with higher incomes tend to have more disposable income than those on lower incomes, making it easier to save for the future.

However, saving can still be a challenge even with an above-average salary. As our income increases, we might move to a bigger house, drive a better car and go on more holidays, resulting in larger mortgage payments or rent, energy bills and expenses.

This is often referred to as ‘lifestyle inflation’. There’s nothing wrong with spending more money following a pay rise, but it can make it harder to get out of debt, save for retirement, and cope with financial emergencies or a loss of income.

Renting can make it harder to save

Many renters find it harder to save for the future than they would if they had a mortgage or owned their home outright. This is partly because renters tend to spend a greater percentage of their income on housing than other households - 81% of renters in the UK are spending more than 30% of their take-home pay on rent. While mortgage holders tend to spend around 20% of their earnings on mortgage payments.

More than a quarter of renters have no savings and half reported having less than three months’ worth of rent set aside - so it’s no wonder that so many renters struggle to get on the property ladder!

To make matters worse, many renters have seen their living costs increase over the last few years, due to landlords passing on higher mortgage rates and regulatory costs to tenants.

… but homeowners don’t necessarily have it easy

Although renters can find it harder to save than homeowners, even those who’ve gotten onto the property ladder can struggle to grow their savings.

Mortgage rates have risen significantly over the last few years and for many homeowners, this has caused an increase in their monthly expenditure.

Up to 1.5m households are expected to reach the end of a fixed-rate mortgage deal in 2024, leading to then remortgaging onto a new deal. This could cause an annual increase of £1,800 for a typical family.

Struggling with the cost of your mortgage?

We can help you find ways to reduce your monthly payments, making it easier for you to save for holidays, emergencies and retirement. Find out how much you could borrow with our remortgage calculator, or create a personalised Tembo recommendation to see all your options.

The singlehood penalty

If you’re single or you live alone, you may find it harder to save for the future than those who are in a relationship and living with their partner or spouse. People who live alone spend 92% of their disposable income each month compared to those in two-adult households who spend 83% of their disposable income. It’s hard to save for the future when you’ve got no one to split your subscriptions and utility bills with. And don’t get us started on the cost of attending a wedding alone!

If you’re trying to buy a house on your own, we can help. We’ve helped thousands of first-time buyers to boost their affordability and get on the property ladder, even with a small deposit. Get started today by creating a free, personalised mortgage recommendation.

Health is wealth

Half of working-age people with poor health have no savings whatsoever, compared to 35% with good health. This is partly because people with poor health tend to have a lower household income, and may also face higher costs such as higher heating bills or home adaptation costs, leaving them with less remaining income to save.

Earn 2.7x more interest with a Tembo Cash ISA vs saving with the Big 4 banks

Earn the market-leading rate of 3.8% AER (variable) with Tembo's Cash ISA. That's almost £400 more in interest over 5-years if you save with Tembo*! Get started today. Download the award-winning Tembo app and open a Cash ISA with just £10.

What is the ideal amount to have in savings?

A good rule to follow is to try to put 20% of your take-home pay into savings each month. This should go towards building up your emergency fund or saving for long-term goals like buying your first house, funding a holiday or saving up for retirement.

If you would struggle to save 20% of your earnings each month, start with what you can and build it up from there. Look at ways to reduce your spending by creating a budget (and sticking to it) and exploring ways to increase your earnings, like upskilling at work, asking for a pay rise or switching jobs for better pay.

The important thing is to start saving, and not to compare yourself too much to your friends, family or people on social media. Saving is tough, so starting today is the best thing you can do, even if you can only save a small amount!

Explore our range of competitive savings accounts here.

How much should I have in savings for an emergency fund?

A good rule of thumb is to save three to six months’ worth of essential expenses for an emergency. If your monthly costs come to around £1,500, that means aiming for £4,500–£9,000 in your emergency fund.

If your income varies, you’ve got children, or you’re the main earner in your household, you may want a slightly bigger buffer. But don’t let that target put you off, because everyone has to start somewhere. Even £500 or £1,000 can make a real difference if something unexpected happens.

Keep your emergency fund in an easy-access savings account with a competitive interest rate, so you can withdraw the money quickly if you need it while still earning a bit of interest.

How much should I have in savings to buy a house?

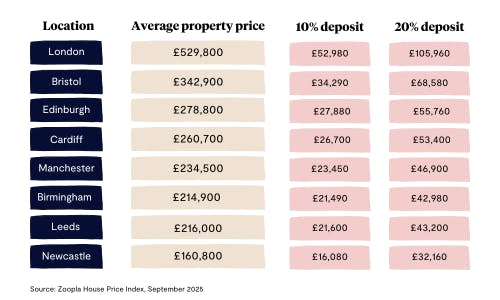

The amount you’ll need in savings depends on the price of the home, where you’re buying, and the type of mortgage you get. We can get a rough idea of how much you might need by looking at the average property prices across the UK:

As you can see, your money will stretch much further outside London and the South, meaning you can get on the ladder with a much smaller amount in savings.

If you haven’t already, start looking at properties on Rightmove and Zoopla to see how much homes cost in your area. Traditionally, you’ll need a deposit of around 10% of the property’s price to get a mortgage. So if you’re buying a £250,000 home, that means saving about £25,000. (Keep in mind that you’ll also need to set money aside for fees).

Struggling to save? You may be able to buy with a smaller deposit of 5%, or even no deposit at all if you use a guarantor mortgage, family boost mortgage, or specialist mortgage like Skipton’s Track Record Mortgage. You’ll usually need a good credit score and a steady income to qualify, but speak to a mortgage specialist to weigh up your options.

If you can save a 20% deposit or more, you’ll often get access to better mortgage rates and lower monthly repayments, which can save you thousands over the life of your mortgage.

And if saving feels out of reach, there’s help available. Save up to £4,000 a year in a Lifetime ISA (LISA) and the government will boost your savings by 25%, giving you up to £1,000 extra each year towards your first home.

Save faster for your first home with the market-leading Cash Lifetime ISA

Save up to £4,000 per tax year in our Cash Lifetime ISA that comes with a market-leading 3.8% AER interest rate (variable). Plus, get a 25% government bonus of up to £1,000 per tax year to boost your first home deposit or retirement pot. Download our app and start by adding just £1.

Withdrawals from a Lifetime ISA for any purpose other than buying a first home (up to a value of £450,000) or for retirement (60+) incur a 25% government penalty, meaning you may get back less than you paid in.

How much should I have in savings for a wedding?

It depends on what you want from your wedding. Some couples spend as little as £500 on a simple ceremony with close friends and family, while others prefer a larger celebration. For context, the average cost of a UK wedding is now costs almost £24,000. But remember, that’s just an average, not a rule. What matters most is creating a day that feels right for you, not what everyone else is spending.

Once you have a rough budget in mind, break it down into monthly savings goals based on your wedding date. For example, if you’re aiming to save £10,000 in two years, you’d need to put away around £420 a month.

To reach your goal faster, keep your money in a high-interest savings account or Cash ISA so your savings grow in the background while you focus on planning your big day.

How much should I have in savings for retirement?

How much you’ll need for retirement really depends on your age, income, and the kind of lifestyle you want later in life. If you’re hoping to retire in your 50s, you’ll need to save more than you would if you’re happy to keep working into your 70s. Whatever your goal, it’s never too late (or too early) to start planning.

The earlier you begin saving, the better. That’s because of compound interest; your money earns interest, and then that interest earns interest too. So even small amounts saved regularly in your 20s or 30s can grow into something much bigger by the time you retire. And if you can afford to, try to increase your contributions as your income grows.

To get a sense of what life in retirement might cost, take a look at the Retirement Living Standards from the Pensions and Lifetime Savings Association (PLSA). They estimate that a single person will need roughly:

- £14,400 a year for a minimum lifestyle (covering the essentials)

- £31,300 a year for a moderate lifestyle (a few holidays and meals out)

- £43,100 a year for a comfortable lifestyle (more flexibility and luxuries)

But how much do you need to save to reach this goal? Well, there’s something called the ‘25x rule’ which says you’ll need 25 times your desired annual income saved by the time you retire.

So, if you’d like an income of £31,000 a year, you’d need roughly £775,000 saved across your pensions, ISAs and other investments by the time you retire.

That might sound daunting, but it’s far easier than you might think. For example, if you started saving at age 35 and invested your money with an average annual return of 5%, you’d only need to invest around £650 a month to reach £775,000 by age 65. Start ten years earlier, and that drops to about £350 a month.

If you have a workplace pension, you can get there even sooner (or with smaller contributions) as you’ll get tax relief on your contributions and your employer will pay into your pension too. If you’re self-employed, you can save for retirement in a private pension or Lifetime ISA, which can offer multiple tax benefits, even though you won’t get help from an employer.

Find out more in our guide How much do I need in a pension?

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

You might also like

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 3.80% would have £390.68 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate December 2025.