How to reduce stamp duty

Andy Shead, Senior Mortgage Advisor

Andy Shead, Senior Mortgage AdvisorBuying a house can be one of the biggest financial decisions you'll make in your lifetime - and there is a LOT to think about beyond just finding a property you like. One of the key things to take into consideration is Stamp Duty Land Tax.

While most home buyers will not be able to avoid Stamp Duty - some might be able to reduce the amount of tax they pay or avoid paying it altogether - keep reading to find out more!

Quick summary: How to lower your Stamp Duty

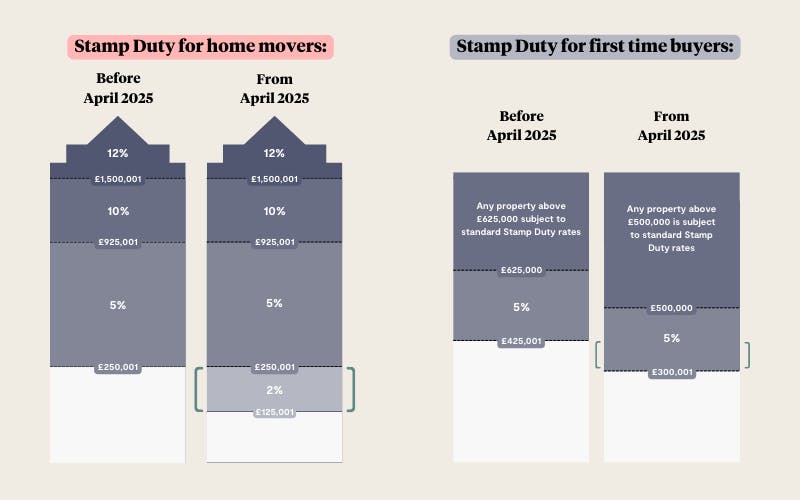

- Threshold Changes: As of April 1, 2025, the 0% threshold drops to £125,000 for home movers and £300,000 for first-time buyers. Any portion of the house value over this you'll pay Stamp Duty on.

- Price Negotiation: Lowering the purchase price or paying for fixtures/fittings separately can move you into a lower tax bracket.

- Developer Incentives: Some new-build developers may agree to pay the Stamp Duty bill on your behalf to secure a sale.

- Refund Eligibility: You can claim a refund on the 3% surcharge if you sell your previous main residence within 36 months of buying a new one.

- Mortgage Boosters: Using an "Income Boost" can help couples retain first-time buyer relief if only one partner has owned property before.

Need help accommodating higher Stamp Duty?

See all the ways you could boost your mortgage affordability with a free, personalised mortgage recommendation from Tembo.

What is Stamp Duty?

Stamp Duty Land Tax (otherwise known as SDLT or Stamp Duty for short) is a tax paid when you buy property or land in England and Northern Ireland, with Scotland and Wales having their own equivalent tax, each with slightly different regulations.

In England and Northern Ireland, Stamp Duty is paid on a sliding scale, increasing as property prices increase and if you are moving up the ladder, or purchasing a second property.

Why do we have Stamp Duty?

Stamp Duty is a significant source of revenue for the government. It was first introduced in England in 1694 as a temporary measure to fund a war with France, but it proved so successful it became a permanent tax. Today, it continues to be a reliable money-spinner for the government. Between April and November 2025, £13.6 billion was collected in Stamp Duty taxes by the government, a rise of £1.4bn year-on-year.

Who is exempt from Stamp Duty?

Everyone buying a main residence property (i.e. not an additional second home) is exempt from paying Stamp Duty up to a property price of £125,000 for residential properties (or up to £300,000 if you're a first-time buyer), meaning you won’t pay any stamp duty on anything up to this threshold. Anything above this amount will be taxed based on the band you fall into.

Stamp Duty example

If you are a first-time buyer, a £250,000 property wouldn’t cost you anything in Stamp Duty. But if you have owned a home before, even if you don’t live there any more, the same £250,000 property would cost you £2,500 in Stamp Duty.

What are the new Stamp Duty thresholds?

From 1st April 2025, the Stamp Duty thresholds for those moving up the ladder have dropped to £125,000 - meaning any portion of a property's value over this you'll pay Stamp Duty on. For first-time buyers, the threshold has dropped to £300,000, so anything over that you'll pay Stamp Duty on.

- Home Movers: Threshold drops to £125,000 (tax is payable on any value above this).

- First-Time Buyers: Threshold drops to £300,000 (tax is payable on any value above this).

You can find out more about the changes to Stamp Duty in our blog here.

Do I have to pay Stamp Duty if I own a buy-to-let?

Yes. Buy-to-let purchases are charged at the standard Stamp Duty rates, plus an additional 3% surcharge. The amount of Stamp Duty you pay depends on the property's price:

- Up to £125,000: 3%

- £125,001 to £250,000: 5%

- £250,001 to £925,000: 8%

Am I eligible for Stamp Duty exemption?

There are certain situations where you may be exempt from paying Stamp Duty - including being a first-time buyer (up to a certain price threshold). However, the criteria for the following scenarios tend to be quite specific, so it's best to read up on the HMRC guidance or speak to an expert first.

These include:

- First-time buyers - subject to higher thresholds than second-time buyers.

- Building or construction companies buying an individual’s home

- Employers buying an employee’s house

- A local authority making compulsory purchases

- Property developers providing amenities to communities

- Companies transferring property to another company

- Charities buying for charitable purposes

- Right-to-buy properties

- Registered social landlords

- Crown employees

How to reduce stamp duty

There are a couple of different ways you might be able to legally reduce - or even completely avoid - stamp duty, or decrease the amount you have to pay when purchasing your home, from applying for stamp duty refunds, to agreeing on a lower property price with the seller of your new home, to even using specialist mortgage products.

Here are 6 different ways you might be able to avoid stamp duty...

1. Haggle on the purchase price

If a buyer can convince the home seller to lower their asking price, they could potentially reduce their stamp duty bill. They'll obviously save money on the price of the property, too!

To learn more, take a look at our guide to negotiating house prices.

If you’re buying in a popular area where the market is fast-paced, this tactic is less likely to work. Offering the seller less than they’ve asked for might inspire them to accept someone else’s offer instead. So if a buyer has spotted their dream home, haggling to save money on stamp duty might not be worth the risk!

Unsure if you're in a position to buy?

Look no further than a Tembo plan! Our smart tech will compare your eligibility to thousands of mortgage products in a matter of minutes to find the best deal for you, including ways to increase your buying power.

2. Ask for new-build incentives

Buying a new build? Some developers offer various discounts and benefits in an attempt to attract buyers. If the house you’re buying is above the stamp duty threshold, ask the developer if they’ll pay your stamp duty for you. The worst they can say is no, and you'll be no worse off than if you didn’'t try!

3. Pay for fixtures and fittings separately

If the seller is willing to leave items such as carpets, curtains, ovens or furniture behind when they move out, make sure the cost of these fixtures and fittings hasn’t been factored into the property price. This will only make your stamp duty bill higher.

Buyers could always offer to pay for these items separately so they're not taxable. It’s a good idea to speak to a solicitor about this before making any arrangements with the sellers. HMRC demands this is done on a ‘just and reasonable basis’, so you don’t want to take things too far.

4. Transfer a property

If you’ve been gifted a property or someone’s left you their home in their will, you won’t have to pay stamp duty on its market value as long as the title deeds have been transferred to you.

However, there's an important consideration to keep in mind. If you’ve been transferred just a share in a property (say, for example, you and your sister have inherited a house together) and you take on the responsibility for some or all of the mortgage, stamp duty may be payable.

5. Apply for a stamp duty refund

If you've bought a second home in the last few years but you'd like to sell your first one, you may be able to get a refund on some of the stamp duty you've paid.

Let’s imagine you’re struggling to sell your existing home, but you’re in a position to buy a second one. You’d have to pay an extra 3% stamp duty additional home surcharge when purchasing your new home, even if you plan to sell the first one as soon as possible.

Thankfully, there’s a rule which lets you claim back that 3% surcharge if you sell your first home within three years of buying the second one.

6. Add a Booster to your mortgage

If you’d like to buy a house with your partner but only one of you is a first-time buyer, you won’t be eligible for the first-time buyer stamp duty relief. However, there is a way around this if one of you becomes a Booster

An Income Boost helps first-time buyers get on the property ladder by adding a friend or family member’s income to the mortgage application. It’s a popular option for single people looking to buy a home with their parents’ help, but couples can use it to reduce their stamp duty bill without getting another family member involved.

The second-time buyer will act as the first-time buyer’s booster or guarantor instead of buying it together as joint owners. Something to keep in mind with an Income Boost is that although the booster will be named on the mortgage, they won't be named on the property deeds.

This is because the booster wouldn't contribute to the monthly payments or the house deposit, except if the owner needed help covering their mortgage payments. This might not suit everyone, however, because the booster won't be classed as a co-owner in the property or have an equity stake in the home. But it's worth considering if you're concerned about a hefty Stamp Duty bill.

For those wanting expert advice on the best mortgage option to reduce stamp duty, speak to our team of award-winning mortgage brokers. They can talk you through the options available to you, to help you come to a decision. To get started, create a free Tembo plan.

Learn more: First-time buyer buying with a homeowner: What are the restrictions?

What if I can’t reduce my Stamp Duty?

Unfortunately, Stamp Duty is often unavoidable — especially when buying an expensive property. While you may not be able to avoid a hefty Stamp Duty bill, there are plenty of other ways to reduce costs, such as negotiating on the property price and paying for additional elements separately.

On average, we boost budgets by £88,000!

Create a free personalised mortgage recommendation today in less than 10 minutes. You'll see all of the ways you could make home happen, including indicative interest rates and monthly costs

Can stamp duty be offset against other taxes?

Stamp Duty generally cannot be offset directly against Income Tax or Corporation Tax. However, for landlords, SDLT paid on an investment property is usually treated as part of the acquisition cost when calculating Capital Gains Tax (CGT) on a future sale. Tax rules can vary by situation, so professional advice is recommended.

When does stamp duty need to be paid?

In England and Northern Ireland, an SDLT return is usually filed and any SDLT due is paid within 14 days of completion. A solicitor or conveyancer commonly submits the return and arranges payment, but the buyer remains responsible for meeting the deadline and avoiding penalties and interest.