Bank of England holds base rate at 4.25% amid uncertain economic landscape

Today (19th June 2025), the Bank of England’s Monetary Policy Committee (MPC) has voted to hold the base rate steady at 4.25%. After cutting the rate for the second time last month, today’s decision was widely expected by the market, with the committee voting for a hold.

See what rate you could get without applying

Create a free Tembo plan to discover your true buying budget, including indicative interest rates and monthly repayments - all without applying for a mortgage!

Why has the Bank of England voted to keep the base rate at 4.25%?

While this decision was anticipated, it comes against a backdrop of growing economic concerns. Geopolitical tensions, such as the Israel-Iran conflict and fluctuating US trade policy under Trump, are contributing to global instability. Closer to home, the UK economy contracted by 0.3% in April, reversing previous growth trends. Wage growth also slowed in the three months to April, and unemployment ticked higher. This is raising questions about the strength of the UK labour market, not to mention making it harder for households struggling with high living costs as inflation continues to creep up.

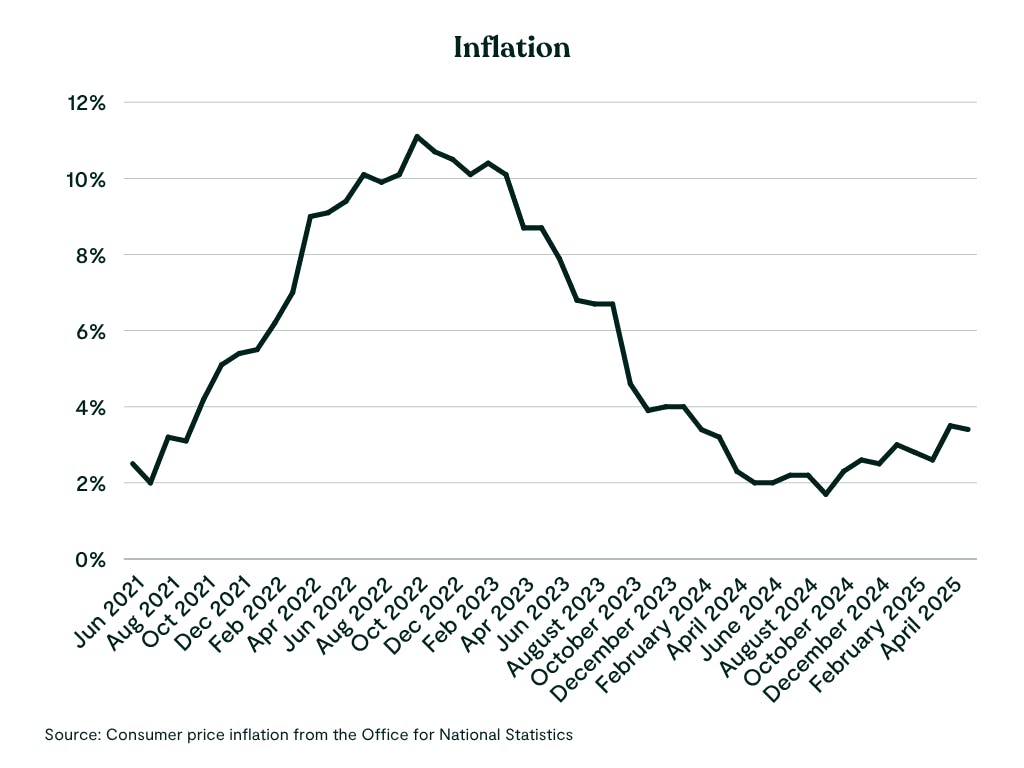

Right now, inflation is above the Bank's 2% target, with the latest data showing that it was at 3.4% in May. It's expected to hit a new high of 3.7% this summer, driven by rising energy and food prices.

In light of all this, it's not surprising the Bank of England's MPC voted to maintain its "gradual and careful approach" to easing the base rate, voting on holding it at 4.25% today. In fact, the base rate is now not expected to drop until August, and then again in November.

What does the base rate hold mean for mortgage rates?

It's been a fragmented landscape when it comes to mortgage rates lately. Some big names have been cutting rates, while others have been hiking their prices. Geopolitical tensions, a base rate cut predicted to not be on the cards until August, and rising swap rates are all contributing to lenders remaining cautious.

After today’s decision, if lenders do reduce their mortgage rates, they are likely to do so gradually. Keep in mind that future base rate cuts are usually factored into fixed-rate mortgage deals before a cut is announced. So, ahead of the predicted base rate cut in August, some lenders may reduce their rates. But the best-priced five-year fixed-rate mortgage from our panel of over 100 lenders is already just below 3.9%, instead of closer to the current base rate at 4.25%. So we might not see much movement, as we expect lenders to reduce rates cautiously, if at all.

What does this mean for home buyers?

If you’re a first-time home buyer or moving up the ladder, the best thing to do is to understand what your options are now, instead of holding out for rates to drop. It’s impossible to predict what mortgage rates will do over the next few months, and if you wait, you might find yourself being offered higher rates than if you were to buy sooner.

By creating a free Tembo plan, you can see what mortgage rates you could be offered without applying in minutes. Plus, if you lock in a mortgage deal with us now through our award-winning mortgage broker team, you can use our free rate-checking service if rates fall. Just contact your dedicated broker, and they'll reapply for you at no extra cost!

What does this mean for remortgages?

Homeowners nearing the end of their fixed-rate mortgage deals should start looking at what options are available to them, and if their remortgage date is 6 months away or less, consider locking in a deal now.

Many homeowners will be facing higher mortgage costs when they remortgage, including the almost half a million homeowners who secured mortgages at the height of the pandemic, who are now facing a £510 monthly rise as their fixed-rate deals come to an end.

But burying your head in the sand is not the answer, as you could see yourself moved onto your lender's Standard Variable Rate (SVR), which is averaging 7.74%.

If you’re worried about locking in a deal only for rates to drop, then you’ll love our free rate-checking service! If you lock in a deal with us now and rates drop, just contact your dedicated broker, and they'll reapply for you at no extra cost! If rates rise, you’ll be protected as you’ll have already locked in a deal. It’s a win-win!

On average, we boost budgets by £88,000!

Discover all the ways you could buy sooner, boost your budget or remortgage without applying. When you’re ready, you can then book a no-obligation call with our award-winning mortgage team.

What does this mean for savings?

The Bank of England's decision to keep the base rate at 4.25% likely means that interest rates will gradually decrease. When interest rates decrease, savings rates tend to follow the same trend. This means that the returns you earn on your savings accounts may be lower over time. This can make saving less rewarding, which is why it's even more important to ensure your money is earning the most competitive interest rate to maximise your money.

At Tembo, we always strive to deliver the best savings rates to our customers. That’s why the rates on both our easy access Cash ISA and market-leading Lifetime ISA are above the base rate, helping you to get even more from your savings.

Explore our competitive ISA savings accounts

See the full range of ISA savings accounts that we offer, including our easy access Cash ISA and market-leading Lifetime ISA.

Tax treatment depends on individual circumstances and may be subject to change in the future. You must be 18 to open an ISA, and can save or invest up to £20,000 into one or more ISAs each tax year (up to £4,000 into a Lifetime ISA).