Inflation heats up, rising more than expected to 3.8%: What this means for mortgages and savings

If you've been waiting for the perfect moment to buy your first home, remortgage, or are watching your savings with growing concern, you may think July's inflation figures have thrown a curveball into your plans.

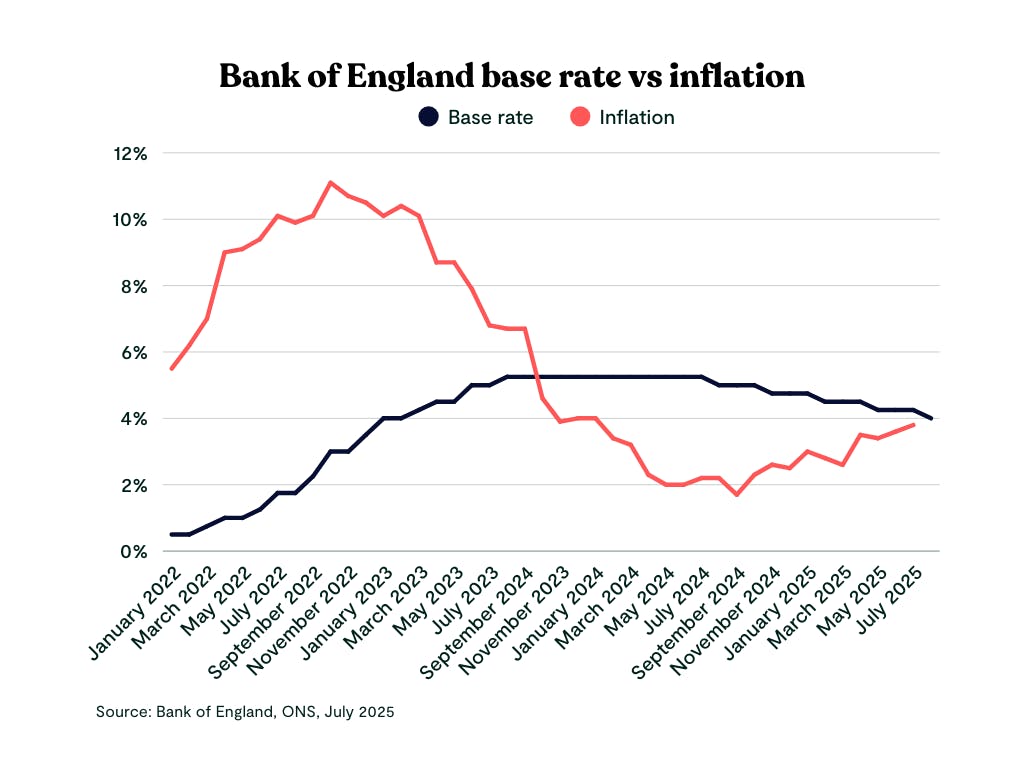

UK inflation jumped to 3.8% in July - nearly double the Bank of England's 2% target and the highest since January 2024. Let's break down what these numbers really mean for your money when it comes to mortgage rates and savings.

Why has inflation risen to 3.8%?

The Office for National Statistics' latest release showed that consumer price inflation rose to 3.8% in July, up from 3.6% in June. Not only was this higher than expected, but it also marks the highest inflation rate since January 2024 and is the highest among the G7. What drove this increase? Two main culprits stand out: soaring airfare costs and rising food prices.

Soaring airfare costs: Flight prices jumped by a staggering 30.2% between June and July – the biggest monthly increase since records began in 2001. While this might seem like a niche concern, travel costs affect everyone from business travellers to families planning summer holidays.

Rising food prices: Food inflation accelerated to 4.9%, continuing an upward trend that began at the end of 2024 when it stood at just 2%. The Bank of England expects food prices to climb above 5% by year-end.

These increases weren't isolated incidents. Services inflation – the measure most closely watched by the Bank of England's policymakers – rose to 5% from 4.7%.

What does this mean for mortgages?

Just two weeks ago, the Bank of England cut its main interest rate by 0.25 percentage points to 4%. However, the decision was far from unanimous – almost half of the monetary policy committee opposed the cut, signalling divisions about the appropriate response to inflation.

With inflation now sitting at nearly double the Bank's target, the prospect of further rate cuts this year looks increasingly unlikely, but some are still expecting a rate cut in November.

What this means for you:

- First-time buyers: Mortgage rates are likely to remain elevated for longer than previously expected, but this doesn't mean you can't afford to get on the ladder now! Explore what mortgage deals you could get without applying by creating a free Tembo plan.

- Remortgagers: If your fixed-rate deal is ending soon, you may face higher rates than anticipated when switching to a new product. Getting expert advice on what you could be offered is crucial! Remember, you can lock in a rate up to 6 months before your current deal ends. Discover your options for free with a Tembo plan.

How else does inflation impact the housing market?

Higher inflation doesn't just affect mortgage rates – it impacts the entire housing ecosystem. Construction costs have been rising, which could have a knock-on impact on house prices for new builds. This could create a double squeeze for prospective buyers who face both borrowing costs staying higher for longer, and more expensive properties.

We boost budgets by £88,000 on average

At Tembo, we're experts at making home happen. We’ve helped thousands of first–time buyers and remortgagers discover their true borrowing potential with our smart tech and award-winning team. Discover your mortgage options by creating a free Tembo plan today.

What does this mean for my savings?

While mortgage holders grapple with rate uncertainty, savers face a different but equally pressing challenge: the erosion of purchasing power. With inflation at 3.8%, your money is losing its purchasing value over time unless it's earning at least that much in interest.

Unfortunately, the average savings account currently offers a rate well below this threshold, meaning that unless your savings are in a competitive account like one of Tembo's ISA accounts, your cash is effectively shrinking in real terms.

Consider this example: £10,000 in a savings account earning 2% annual interest would need to earn £380 just to maintain its purchasing power at current inflation levels. Anything less, and you're losing out!

Explore our competitive ISA savings accounts

See the full range of ISA savings accounts that we offer, including our Easy Access Cash ISA, Fixed Rate Cash ISA and our market-leading Lifetime ISA.

Tax treatment depends on individual circumstances and may be subject to change in the future. You must be 18 to open an ISA, and can save or invest up to £20,000 into one or more ISAs each tax year (up to £4,000 into a Lifetime ISA).

What can I do now?

Despite the challenging environment, there are practical steps you can take - whether you're a prospective home buyer, a homeowner with an upcoming remortgage, or a saver trying to make their money go further!

For aspiring homebuyers:

- Act strategically, not hastily: While mortgage rates may not fall as quickly as hoped, they're still well below the peaks reached in recent years. If you're financially ready, waiting for perfect conditions might mean missing opportunities. See what you could afford today without applying.

- If you're worried about rate fluctuations, consider fixing for longer: Given the uncertainty around future rate cuts, consider fixing your mortgage for a longer period if you want more stability and budget certainty. Read our guide on How long should I fix my mortgage for?

- Factor in the total cost: Look beyond the headline mortgage rate. Consider arrangement fees, early repayment charges, and the flexibility to overpay or port your mortgage. An expert broker can help you do this to take the admin of trawling through different mortgage deals off your plate! Here at Tembo, we compare your eligibility to over 20,000 mortgage products from across the market to find the best deal for your situation and budget.

For current homeowners

- Review your remortgage timeline: If your current deal expires in the next 6-12 months, start exploring options now. The mortgage market can change quickly, and early preparation gives you more choices.

- Consider overpaying: If your mortgage and budget allow it, making overpayments now could save significant interest over the loan term, especially if rates remain higher than expected.

- Assess your position: Calculate your current Loan to Value. If property values have risen since you bought, you might access better rates, even if the base rate doesn't fall.

For savers

- Seek inflation-beating interest rates: Look for savings accounts that offer returns above the current inflation rate. You can explore Tembo's range of competitive, inflation-beating savings accounts here.

- Diversify your approach: Don't put all your savings in just one account. Make the most of accounts such asLifetime ISAs if you're saving for your first home to get a free 25% boost to your house fund. Accounts likeFixed Rate Cash ISAs will also give you a fixed rate of return over a set period, regardless of what live interest rates are doing.

Save with the market-leading Lifetime ISA

Save up to £4,000 each year towards your first home or retirement, and get a free 25% government bonus of up to £1,000 each year. Plus, benefit from our market-leading interest rate. Over 5 years, you’ll earn hundreds more in interest vs the next rate on the market.

Lifetime ISA withdrawals for any purpose other than buying a first home (up to a value of £450,000) or for retirement (60+) incur a 25% government penalty, meaning you may get back less than you paid in.