Should I overpay my mortgage?

Overpaying a mortgage can be a smart way to improve your financial situation. By paying some of the balance early, borrowers could reduce their overall interest bill and potentially become debt-free sooner.

Expert advice from the UK's Best Mortgage Broker

Voted the Best Mortgage Broker by our customers four years running, we specialise in finding the best mortgage options for you from over 100 lenders. Discover your options by creating a free Tembo plan today.

Overpaying can be a powerful way to reduce long-term interest costs.

Andy Shead

Senior Mortgage Adviser at Tembo

Key takeaways

- Overpaying on a mortgage can reduce overall interest costs.

- Borrowers should check for any fees or charges before proceeding.

- Make sure you reserve some cash in an emergency fund for unforeseen costs

Is it a good idea to overpay your mortgage?

Yes, overpaying your mortgage can be a good idea. It could save you thousands of pounds in interest and help you become debt-free sooner. This is because the amount of interest you pay is worked out as a percentage of your outstanding mortgage loan. By reducing your mortgage debt through overpaying, you’ll reduce the amount of interest you pay overall. However, in some cases, you may be better off saving or investing your spare cash instead.

Learn more: Steps to getting your first mortgage

How much can I overpay on my mortgage?

The amount you can overpay on your mortgage will depend on your mortgage agreement. Typically, you can overpay 10% of your total outstanding mortgage balance penalty-free if you have a fixed-rate mortgage deal. Although some lenders will let you overpay up to 20%.

If you are on your lender’s standard variable rate (SVR), there is usually no limit to the amount you can overpay without charges. If you’re on a tracker rate mortgage deal, you can usually overpay. But be mindful that if you’re in your introductory period, you might have to pay an early repayment charge.

To be on the safe side, regardless of the type of mortgage you have, check with your lender before making any overpayments.

Learn more: How long does a mortgage in principle last?

Is it better to overpay monthly or with a lump sum?

If you can afford to overpay a large lump sum in the near future, this can save you more in interest than monthly overpayments might, but you should keep enough cash for short-term needs. If you choose monthly, you should also be able to pause your overpayments at any time, which can give you peace of mind if your circumstances change.

Example – monthly overpayments

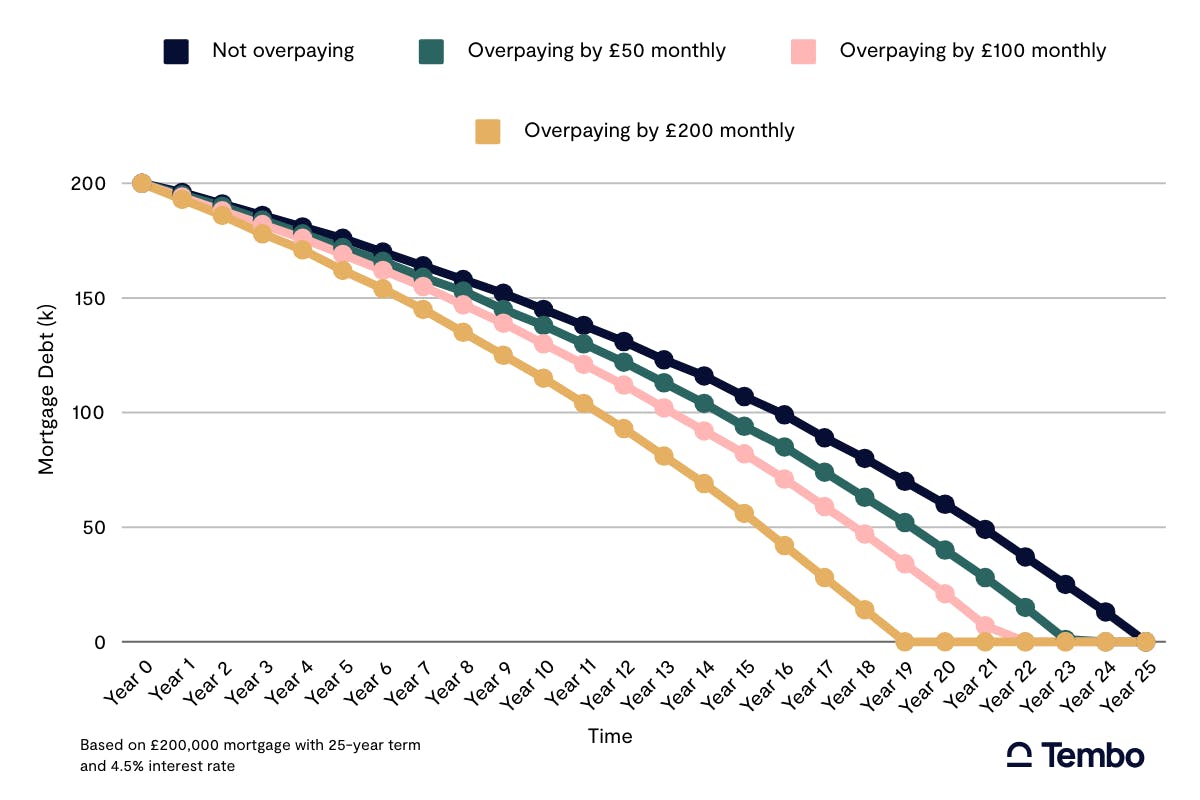

Sarah has received a small pay rise and wants to put some of her extra earnings towards her mortgage. Her mortgage is £200,000 with 25 years left to pay, and she currently has a 4.5% interest rate, so her monthly repayments are £1,112 a month.

If she overpays her mortgage by £100 a month, she’ll save £21,120 in interest and pay her debt off 3 years and 6 months sooner. And if she overpays by £500 a month, she’ll save £63,820 in interest and become mortgage-free after 13 years, instead of 25.

Example - overpaying in a lump sum

Alex and Tom have received an inheritance from Alex’s grandmother. They want to put £20,000 of it towards their mortgage. Like Sarah, they have £200,000 left on their mortgage, with 25 years remaining and a 4.5% interest rate.

If they make a £20,000 lump sum overpayment, they’ll save £35,730 in interest and pay their debt off 4 years and 2 months sooner.

Learn more: What to look for when viewing a house

Is it better to pay off a mortgage or save money?

Whether it’s better to pay off a mortgage or save money depends on your individual circumstances. If your mortgage rate is higher than the amount of interest you can earn on savings, it usually makes sense to overpay on your mortgage. If you can earn more interest on your savings than you pay on your mortgage, you’ll be better off keeping the cash.

Top Tip

Avoid dipping into your emergency fund to overpay your mortgage. You’ll still need money to hand for financial emergencies such as a broken boiler or unexpected car repair. Try to keep 3 to 6 months of living expenses in cash at all times.

Learn more: How much should I have in savings?

In the tables below, you can see some examples of overpaying monthly by different amounts on a £200,000 mortgage loan with a 4.5% rate, borrowed over a 25-year term.

Now let’s compare this to saving for the same period of time with three different savings rates:

As you can see, in these examples, saving for the same amount of time only puts you in a better financial position if you have a savings rate that is higher than the rate of interest on your mortgage.

Keep in mind that these are illustrative examples that make certain assumptions, such as your mortgage interest rate remaining constant throughout the entire term.

Learn more: What to do in the 6 months before buying a house

Will my mortgage payments go down if I pay extra?

Yes, your mortgage payments could go down if you pay extra, as you’ll potentially shave off a fair amount of interest. Interest is worked out as a percentage of your outstanding loan - with a smaller loan left, you’ll pay less.

Is it cheaper to overpay my mortgage or reduce the term?

Neither option is automatically cheaper; it depends on the interest rate, fees, and how long the borrower stays in the deal. Overpaying can reduce total interest, but shortening the term may force higher monthly payments. Each approach carries different pros and cons, so it’s crucial to seek expert advice from an experienced mortgage broker before deciding.

Whether it's cheaper to overpay on a mortgage or reduce the mortgage term depends as there's not a right or wrong answer. The cheaper option for you will depend on your interest rate, how much you can afford to overpay, and whether there are any early repayment charges or mortgage fees.

Switching to a new mortgage deal with a shorter term could give you access to a better interest rate and save you more money overall. But you’ll need to consider the cost of any early repayment fees or remortgage fees before making the commitment. You’ll also need to make sure that you can afford the new repayments.

If your circumstances change in future and you need to remortgage again, you may be placed on a higher interest rate than before and have fees to pay.

Learn more: Buying a house timeline

How to pay extra on your mortgage

- Check your mortgage agreement for limits or fees on extra payments.

- Decide whether to reduce your monthly payments or shorten the term.

- Contact your lender (usually via their website, app or phone) to arrange the overpayment

- Keep enough funds in reserve for emergencies and short-term expenses.

Thinking of switching to a new deal?

Create a free personalised mortgage recommendation with us today, and we’ll show you what moving to a new deal could look like including indicative monthly repayments and personalised rates. No credit checks, no obligations.