How long does it take to buy a house? The buying a house timeline

How long does it take to buy a house? Read our step by step guide to buying a home.

If you’re fed up of living in a cramped rented flat or sticking to your mum and dad’s house rules then there’s probably only one question on your mind.

How long does it take to buy a house?

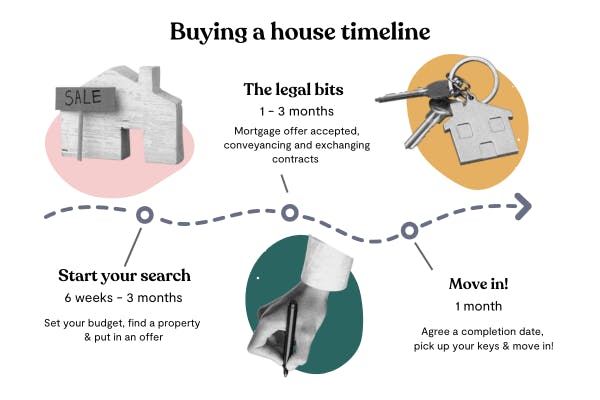

From start to finish it can take between 3-8 months to buy a house. It's worth keeping in mind though, that every home purchase is unique with a huge number of factors that can impact how long it'll take for you to buy a home.

Below, we've broken down each stage in the buying a house timeline, so you’ll know what to expect and how to plan when buying a property.

If you need help boosting your buying budget to buy your first home, we can help. At Tembo, we specialise in helping buyers, movers and remortgagers boost their mortgage affordability through a range of specialist schemes. In fact, on average our buyers boost their budgets by £88,000! To see how much you could afford with our help, create a free Tembo plan to get started.

What's the stages of buying a house?

There are three key stages in the buying a house timeline:

- Finding a property and getting a mortgage offer

- Offer acceptance, conveyancing & exchange of contracts

- Completion

Buying a house? You deserve a Tembonus

Mortgages can feel like a maze of paperwork and decisions. With HomeSaver, there'll be a reward waiting for you at the finish line, whether you're buying your first place, your next, or remortgaging.

Buying a house timeline:

1. Finding a property and getting a mortgage offer

Timeline: 6 weeks - 3 months

Step 1: Set your house budget

Timescale: 1 day

How much you can spend on your first home will depend on your deposit size, any financial support you’re receiving from family or friends and the size of the mortgage you can borrow. A Lifetime ISA can also help you save up for a house quicker, and a take home pay calculator can help you work out what you could put away each month into your house fund. It's also worth having a play around with a Mortgage Affordability Calculator to get an idea of what you could afford with a traditional repayment mortgage or with help from loved ones.

If you find a standard mortgage isn't enough to get the home you want, or your house deposit is too small, explore alternative ways to get on the ladder like guarantor mortgages, no deposit mortgages and enhanced borrowing schemes like 5.5x Income, Professional and Key Worker mortgages.

By creating a free Tembo plan, you can get a personalised recommendation of all the budget-boosting schemes you could be eligible for and how much you could afford with each - in a matter of seconds.

Boost your deposit by up to £1,000 every year

Open the Tembo Cash Lifetime ISA to get our market-leading 3.8% interest rate and the 25% government bonus. Over 5 years, that's hundreds more vs saving with the closest competitor.

Step 2: Find out your options

Timescale: 1 week

Once you've got an idea of what you can afford and the types of mortgage schemes you could be eligible for, it's time to talk over your options with a mortgage expert. A mortgage broker that specialises in affordability will be able to help you work out the best ways for you to get on the ladder, including options you might not have heard of. They will also talk through your options, answer any questions you might have about mortgages, and kickstart your mortgage application with your chosen lender.

You might also like ou guides on:

See how much you could afford today - for free!

When you create a free Tembo plan, our smart decisioning technology will compare your eligibility to thousands of mortgage products - in seconds - to give you a personalised recommendation of the best ways for you get on the ladder.

Step 3: Get an Agreement In Principle

Timescale: 1 day

Once you've chosen a mortgage lender and product to go with, it's time to get an Agreement in Principle (AIP) from your chosen lender. Also called a Decision In Principle (DIP), this is a certificate which shows the maximum amount the lender is prepared to offer you for a mortgage. You usually get the results back within 24 hours of requesting an Agreement In Principle from a lender.

It's worth noting, an Agreement in Principle is not legally-binding and is not a promise of what you will be offered. Instead, it's used to show to estate agents when you start house hunting to prove you are a serious buyer. In fact, some sellers won't take a property off the market unless you have an AIP already.

An Agreement In Principle is normally valid for 30 to 90 days - so once you have your AIP it's time to arrange house viewings!

Read more: Agreement In Principle, what can go wrong?

Step 4: Find a home to buy

Timescale: 10-12 weeks

By far the most fun part of buying your first home is viewing houses, although house hunting can be time-consuming and tiring. The average first-time buyer spends 10 to 12 weeks searching for a home. To speed this up, narrow your search by deciding where you want to live as well as your non-negotiables like how many bedrooms you need, if you need schools nearby or commuter transport links. Unless you’re awash with cash, be prepared to compromise. Think about the non-negotiable features of your first home that you can't bend on and those you’re willing to sacrifice.

Next, register your requirements with property portals like Zoopla, Rightmove or Purple Bricks or visit local estate agents to tell them what you’re looking for. You’ll receive emailed lists of suitable homes and can get notifications to your phone. Estate agents will often call you before the house is even listed for sale.

Take a look at our location guides for some ideas of where to buy in different parts of the UK, or read our blog on Where should I buy a house? for guidance on choosing the perfect location.

Read more: What to look for when viewing a house?

Step 5: Make an offer on the property

Timescale: 1-3 days

When you make an offer on a property, don’t be too hasty to rush in and offer the asking price. An asking price is simply what the seller would like to sell it for. Haggling over the price is common when buying a home, so it’s important to play to your strengths and not get over-excited when making a higher offer. Your offer can be under, equal to or more than the asking price.

Here are some tips for negotiating on house price:

- Find out how long the house has been on the market. The longer the better, as you’re more likely to have a lower offer accepted. You can ask the estate agent or turn detective and Google the address to search for previous property listings. You can also check what similar homes in the area have sold for on the government’s Land Registry website, Zoopla, Rightmove and Mouseprice.com to gauge whether the asking price is reasonable.

- Make it known to the seller that you're a first-time buyer, so you’re in a strong position because you’re chain free. If you’re in a property chain, you are reliant on someone else buying your property so you can move. As the person selling their home to you is also likely to be buying, long chains of buyers can develop - if one transaction fails, for example your buyer pulls out, the chain will collapse and lots of time and money is wasted. In 2020, more than 300,000 chains collapsed.

- Don’t let the agent know you’ve fallen in love a property. They’ll advise the seller to hold firm on their asking price. Remember, the agent acts for the seller and the higher the price, the higher their commission.

- Have a maximum offer in mind and stick to it. When negotiating on house price, only edge up in small amounts of 5% or 10%. The seller will come back with a higher counteroffer. If you know the property has been up for sale for a while, stand firm and let it be known you’re looking at other properties. If this is the maximum you can afford to spend let the agent know. Always remember that if your offer is too far over the asking price it can cause problems arranging your mortgage.

You may be asked for your ‘best and final’ offer. This means making your last and highest offer if you are bidding against multiple other buyers. In times of high demand you could also become a victim of gazumping, when a seller accepts a higher offer after already accepting yours. Without showing your Agreement in Principle, the seller is unlikely to remove the house from the market, which increases the chances of gazumping.

When you do make an offer, put it to the agent in writing (email is fine) and they will inform the seller of your bid. The seller can take as long as they want to decide, but a typical time frame is two days to accept or decline. If they decline, the negotiations on house price begin.

2. Offer acceptance, conveyancing & exchange of contracts

Timeline: 1-3 months

Step 6: Mortgage application

Timescale: 2-4 weeks

Time to get your mortgage application underway and get a solicitor appointed. It takes around four to six weeks to receive a formal mortgage offer from your lender, but a lot depends on your circumstances, how organised you are and how busy the lender is. To speed things up, work with a mortgage broker and get your paperwork ready while you’re looking for a home. You need a valid passport and your latest three months’ payslips or two years’ accounts as standard, as well as other documentation.

A mortgage underwriter will then review your documents and the lender will also instruct a valuation on the property. This is to help the mortgage lender check the property's value to ensure it's sufficient to secure the mortgage loan against.

Following this, once you have your mortgage offer and your offer on the home you want to buy has been accepted you can start on the legal elements. When picking a solicitor, ask what time scales they are working to. A period of eight to twelve weeks is common, running concurrently to the mortgage offer period.

Then, when it comes to choosing a conveyancer - cheapest is not always the best. Ask your friends and family for a recommendation of an efficient and reliable conveyancer. We can also help you find a trusted, professional conveyancer from those that we work with.

If you have saved your house deposit using a Lifetime ISA, your conveyancer will also be the one who will withdraw your LISA funds on your behalf. You can find out more here in our guide on When Can I Withdraw Money From A Lifetime ISA?

Step 7: Exchange of contracts

Timescale: 4 weeks

With the legal work complete, the next step in buying a home is the exchange of contracts. It can take up to four weeks to get to point of exchanging contracts. Contracts that are signed by you and the seller are exchanged, which is when the property transaction becomes legally binding.

Important to know: Backing out now comes at a hefty price!

3. Completion

Timeline: 1 month

Step 8: Agree a completion date

Timescale: 1-2 weeks

Your completion date is the day your purchase money is transferred to the seller’s solicitor and you can pick up the keys to your new home. How soon you complete after contracts are exchanged is down to you and the home seller. One to two weeks is normal, giving you both time to pack and get ready to move. If you’re tied into a rental contract, you may need longer.

You might also like our guide on What is a mortgage deed?

Step 9: Move into your new home!

Timescale: 1-3 days

You’ve made it! You’re officially a homeowner. It’s time to pick up your keys from the estate agents and celebrate. Rope your family and friends in to help you move and don’t give yourself too much to do on moving day!

Ready to make your first move? Get in touch

Make a free Tembo plan to start your journey to homeownership. It takes 10 minutes to complete, and there's no credit check involved. Then, you can book a free call with one of our award winning team to make your first steps onto the ladder.

Why Tembo

We help buyers, movers and homeowners discover how they could boost their affordability in 3 simple steps. It’s why we’re the UK’s Best Mortgage Broker.