What is my personal savings allowance?

Most people can earn a certain amount of interest without paying tax on it, thanks to something called the Personal Savings Allowance (PSA). But how does it work, how much is it, and are you eligible?

In this guide

- What is the Personal Savings Allowance?

- How much is my Personal Savings Allowance?

- What happens if I exceed my Personal Savings Allowance?

- Has the Personal Savings Allowance changed?

- Does savings interest count towards my Personal Savings Allowance?

- Does ISA savings interest count towards my Personal Savings Allowance?

Tax treatment depends on individual circumstances and may be subject to change in the future.

What is the Personal Savings Allowance?

The Personal Savings Allowance (PSA) is a tax-free allowance that lets you earn interest on savings held outside of an ISA without paying any tax. It was introduced in April 2016 to encourage saving and simplify how interest is taxed. Before the Personal Savings Allowance, interest earned outside of an ISA was taxed before it even reached savers’ accounts. Now, your bank or building society will pay your interest in full.

However, if you go over your Personal Savings allowance, any interest you earn on your savings above your threshold will be taxed. But you can protect your savings from the taxman by using ISA savings accounts.

You can save (or invest) up to £20,000 each tax year across different ISA accounts, without hitting your Personal Savings Allowance at all.

Learn more: What is an ISA and how do they work?

Save faster with our easy access Cash ISA

Save up to £20,000, tax-free every year with a Tembo Cash ISA, where you'll have access to our competitive interest rate of 3.8% AER (variable), unlimited withdrawals, fee-free mortgage advice, and monthly paid interest. Open with as little as £10 today!

How much is my Personal Savings Allowance?

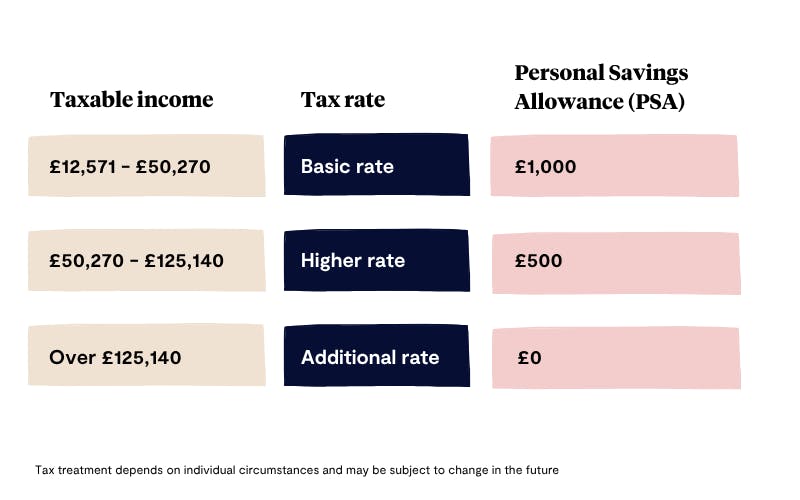

Your Personal Savings Allowance depends on your income tax band. If you’re a basic rate taxpayer, your Personal Savings Allowance is £1,000, meaning you can earn up to £1,000 in interest before your interest is taxed. If you’re a higher rate taxpayer, your Personal Savings Allowance is £500, and if you’re an additional rate taxpayer, your Personal Savings Allowance is £0.

For example, if you have a taxable income of £32,000 a year, this means you’re a basic-rate taxpayer and you’ll be able to earn up to £1,000 in interest each year (outside an ISA) without paying tax on your interest.

If you have a taxable income of £52,000 a year, you’ll be a higher rate taxpayer and you’ll be able to earn up to £500 in interest each year (outside an ISA) without paying tax on your interest.

If your taxable income is more than £125,140, you’re an additional rate taxpayer and won't get a PSA, but you can still use your annual ISA allowance to save up to £20,000 a year tax-free. You will need to pay tax at the applicable rate for anything over your PSA that isn't held in an ISA.

Learn more: Should I get an ISA?

What happens if I exceed my Personal Savings Allowance?

If you exceed your Personal Savings Allowance, any interest above your allowance will be taxed at your usual income tax rate. If you’re employed or you get a pension, HMRC will usually change your tax code so you pay the tax automatically. To decide your tax code, HMRC will estimate how much interest you’ll get in the current year by looking at how much you got the previous year.

If you’re self-employed and complete a Self Assessment tax return, you’ll need to report any interest earned on savings as part of your return.

If you’re not employed, don’t get a pension or you don’t complete a Self Assessment, your bank or building society will tell HMRC how much interest you received at the end of the year. HMRC will tell you if you need to pay tax on it and how to pay it.

Learn more: When does the ISA year start?

Explore our competitive ISAs

Save faster towards your life goals and protect your hard-earned money from tax with one of our competitive ISA accounts.

Has the Personal Savings Allowance changed?

No, the PSA hasn’t changed since it was introduced in 2016. This tax year 2.64 million people are expected to pay tax on their savings interest, due to rising interest rates and frozen tax thresholds. So, if you think you’ll earn interest above your Personal Savings Allowance, or you’re an additional rate taxpayer and therefore have no PSA at all, it’s more important than ever to make the most of your £20,000 ISA allowance!

There are a few different types of ISAs to choose from, including Cash ISAs, Stocks & Shares ISAs, Fixed Rate ISAs, and Lifetime ISAs.

You can save up to £20,000 into one or more ISAs each tax year, but the Lifetime ISA comes with a lower annual allowance of £4,000 a year. If you invest in a Stocks & Shares ISA, Stocks & Shares Lifetime ISA, or Innovative Finance ISA, your capital is at risk and you may get back less than you put in.

Learn more: Can I have a Cash ISA and a Lifetime ISA?

Withdrawals from a Lifetime ISA for any purpose other than buying a first home (up to a value of £450,000) or for retirement incur a 25% government penalty, meaning you may get back less than you paid in.

Does savings interest count towards my Personal Savings Allowance?

Yes, the interest you earn on your savings will count towards your PSA, whether you’re saving in a current account or a traditional savings account, unless your money is saved in an ISA, which places your funds in a tax-free wrapper.

You might also pay tax on interest earned through the following:

- Bank and building society accounts

- Savings and credit union accounts

- Unit trusts, investment trusts and open-ended investment companies

- Peer-to-peer lending

- Trust funds

- Payment protection insurance (PPI)

- Government or company bonds

- Life annuity payments

- Some life insurance contracts

Does ISA savings interest count towards my Personal Savings Allowance?

No, your ISA savings interest won’t count towards your Personal Savings Allowance and it won’t be taxed. This makes ISA accounts a great tool to save towards long-term goals, like a house deposit, a wedding or just more financial stability, without worrying about your savings interest being cut by tax.

Earn 2.7x more interest than the Big 4 banks with our competitive, easy access Cash ISA

Save up to £20,000, tax-free every year with a Tembo Cash ISA, and benefit from our 3.8% AER (variable) interest rate. That's almost £400 more in interest over 5 years than if you were to save with the Big 4 banks*! Plus, unlimited withdrawals, fee-free mortgage advice, and monthly paid interest. Open with as little as £10.

Tax treatment depends on individual circumstances and may be subject to change in the future. Tembo does not provide tax advice. Please consult a professional tax adviser for advice tailored to your situation.

Learn more

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 3.80% would have £390.68 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate December 2025.

Save your deposit sooner with a Tembo Lifetime ISA

Open a Lifetime ISA in minutes with as little as £1 and you’ll be able to buy your first home in 12 months or more. Get a £1 bonus for every £4 you save, up to £1,000 each tax year, and earn a market-leading 4.3% AER interest (variable).