Are interest rates going down, and what does it mean for you?

Anya Gair, Head of Organic

Anya Gair, Head of OrganicFind out what's happening with interest rates and if they are going up or down in this essential guide.

Are interest rates going down?

Interest rates have been falling in recent weeks, with the lowest 2-year fixed rate mortgage available from our panel of over 100 lenders now 3.51%*. After the Bank of England’s base rate was cut in December 2025, mortgage lenders started to lower some fixed mortgage rates.

We expect this rate-war to continue with mortgage rates drifting lower slowly through 2026 as further base rate cuts are anticipated later in the year. However, variable rates tied directly to the Bank of England base rate (like tracker mortgages) won’t change until the base rate itself is cut again.

Savings rates have already begun to fall as the base rate reduction feeds through the market. Ensuring your money is in a savings account with an inflation-beating interest rate is vital to preserving the purchasing power of your money over time.

What is inflation and how does it impact mortgage interest rates?

See today's best mortgage rates

Compare the latest mortgage interest rates from across the market, or create a free Tembo recommendation for a personalised rate.

The interest rates shown are an indication only and are not guaranteed. Current rates may have changed by the time you come to apply.

Why are interest rates high?

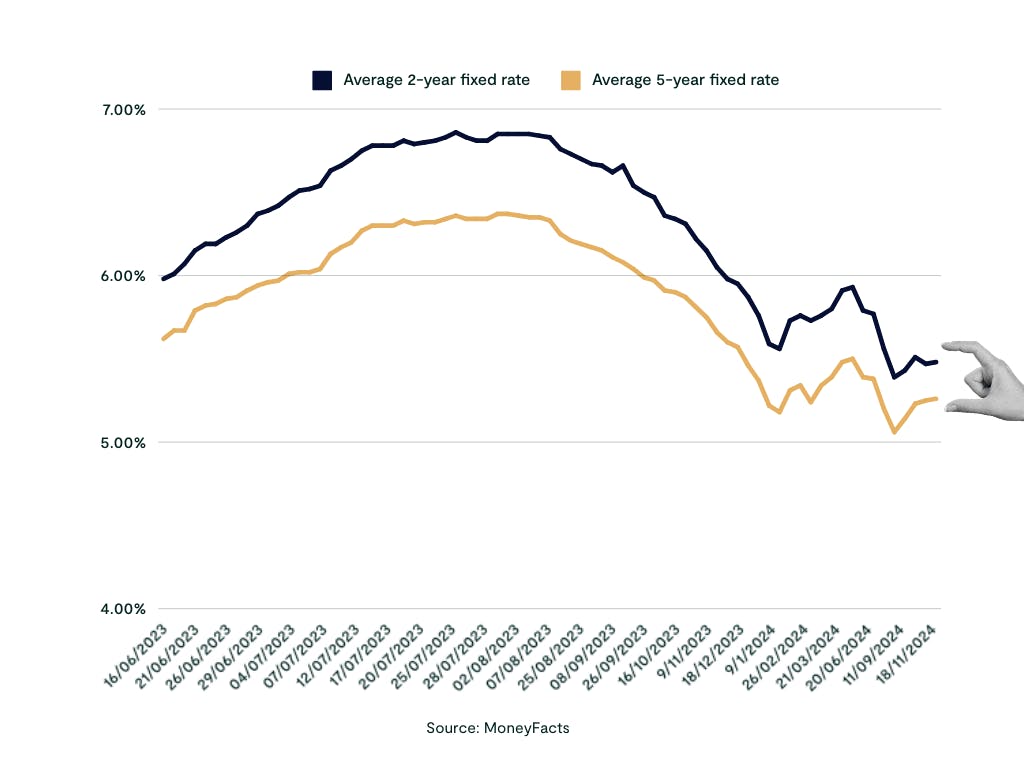

Interest rates are higher than they have been in recent years, but are not as high as they were last year. If you need to move onto a new mortgage rate soon, or are looking at buying, you might look at current rates and despair that they are higher than the 1-2% deals offered during the COVID-19 pandemic.

However, rates this low aren't common, and deals in the 3-4% range are much more normal. Right now, the lowest rate available from the 20,000 mortgages we advise on is 3.51%*. We could see mortgage rates drop even lower over 2026, but any declines are likely to be gradual. It's better to see what rates you could be offered now with a free Tembo plan, so you can understand your options without applying.

Why is the base rate high?

By keeping the base rate high, the Bank of England has been trying to slow down consumer activity, which means companies can’t increase their prices so quickly. So far, this has been working, reducing inflation from the 11.1% peak in October 2022 to 3.4%. But inflation has recently increased, so although the Bank of England cut the base rate to 3.75% in December 2025, the next cut might not come until spring.

How do falling interest rates impact first-time buyers?

When interest rates rise, this makes mortgages more affordable as it decreases the amount of interest you'd pay each month, alongside paying off your mortgage loan. If you're a first-time buyer, lower interest rates might mean that you can afford to borrow more as your repayments aren't as expensive. Just remember that you need to be able to afford your mortgage, even if rates rise!

If you're still saving towards your first home, falling interest rates make it even more important to save into an account with a competitive interest rate, so you can earn as much interest on your savings as possible.

If you're struggling to save for a house, don't worry. Set up a Cash Lifetime ISA with us today to benefit from our market-leading 3.8% AER (variable) interest rate, plus a free 25% bonus from the government. There are also ways to buy a home with a small deposit, as well as schemes that help you boost your deposit size.

Open an account with just £10 or transfer today

Open a Lifetime ISA with Tembo today to benefit from our market-leading 3.8% interest rate, helping you save hundreds more towards your deposit over a 5-year period versus the next best competitor on the market

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

How do falling interest rates impact homeowners?

If you already own a home, the falling interest rates will only impact you if you are coming to the end of your current fixed rate deal and are looking to remortgage, or you are on a variable rate. Of the 1.8 million households remortgaging in 2026, those coming off 2-year fixes taken in 2024 could see some improvement, while those leaving 5-year fixes when rates were at historic lows will likely still face higher repayments, even after recent mortgage rate cuts.

This is why finding the best deal possible for you is vital, as it can help mitigate the potential rise in mortgage costs.

The good news is, if you're struggling to remortgage, you're in the right place. At Tembo, we're experts in helping homeowners increase their affordability so they can access lower interest rates and stay in the home they love. To find out what remortgage rates you could get, create a free Tembo recommendation personalised to you.

Learn more about how interest rates work in our guide: What are mortgage interest rates?

Discover how you could boost your affordability

Whether you're a first time buyer trying to get on the ladder, or a homeowner struggling to remortgage. Our award-winning team and innovative smart tech will find you all the ways you can boost your affordability to buy sooner or access lower rates. Create your free, personalised Tembo recommendation to get started

Learn more

*Based on 60% LTV, with a 35-year mortgage term. Interest rates are accurate as of January 2026.