Tembo Market Watch: November 2025

Whether you're a first-time buyer, a homeowner, or just keeping an eye on the market, here’s what you need to know - from the UK's Best Mortgage Broker.

TLDR:

- Base rate steady: Bank of England votes to hold base rate at 4%, but only by a slim margin

- Mortgage relief: Mortgage rates have been falling in recent weeks. See what rate you could get here.

- Warning issued for ISA savers: Cash ISA annual allowance could be halved. Make sure you're on a competitive rate.

- Slower house price growth: Annual house price growth has cooled to 3%, driven by affordability pressures and uncertainty around the Autumn Budget.

- Government's housing target deemed "unrealistic" by industry experts

Bank of England holds base rate at 4.0%

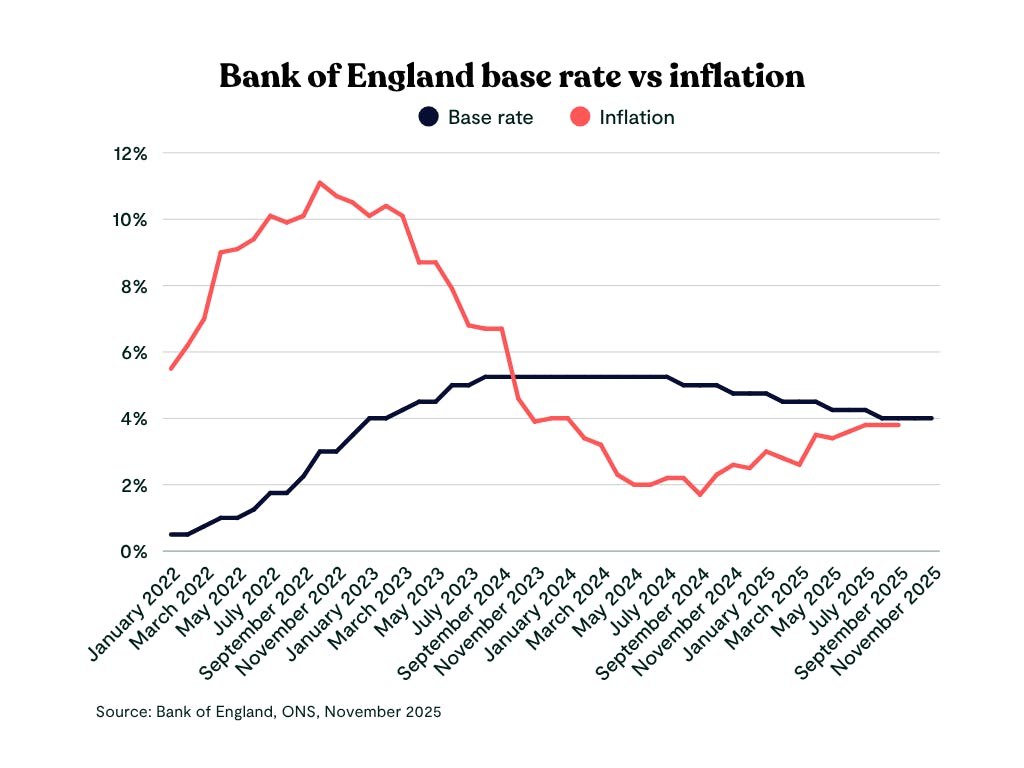

At their meeting on 6th November 2025, the Bank of England's Monetary Policy Committee (MPC) voted to keep the base rate at 4.0%. This marks the third month the rate has been held at this level, following reductions from 4.25% back in August.

Why? Well, the Bank is trying to manage inflation, which has been hovering at 3.8% for the last few months, and stabilise the economy.

By holding the base rate steady, the Bank aims to keep borrowing costs stable, influencing how much people spend and save. This balancing act is designed to bring inflation down without putting excessive pressure on households and businesses.

However, there were some who were hoping for a base rate cut today. A reduction in the base rate could lead to mortgage rates dropping further, which would be welcome news for many aspiring home buyers and homeowners with upcoming remortgages.

In the days leading up to the meeting, some market experts were predicting a cut to be on the cards.

With the Bank of England now expecting inflation to fall towards its 2% target over the coming months, a cut is looking more likely going forward. The next rate review is scheduled for Thursday 18th December 2025, so watch out for our next Market Watch to see what happens!

Need mortgage help? Talk to Tembo, the UK's Best Mortgage Broker four years running

Need to remortgage quickly? Want to find out your true buying budget without applying? Create a Tembo plan to discover all your mortgage options from across the market in minutes.

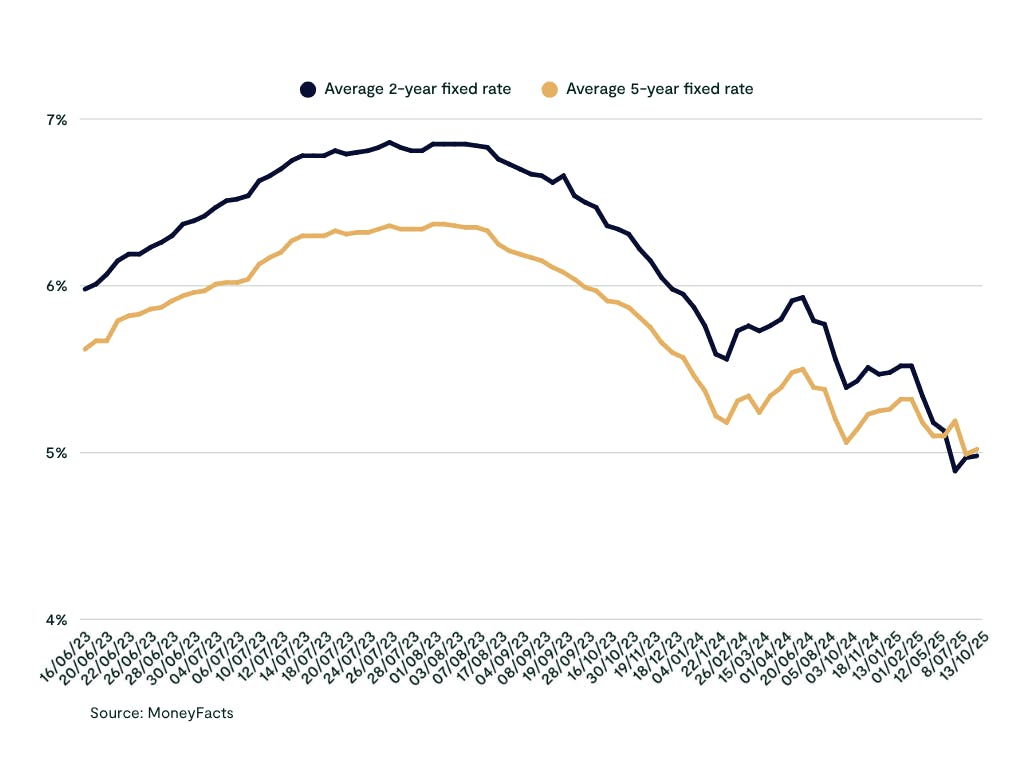

What does this mean for mortgage rates?

For anyone with a mortgage (or trying to get one), the base rate is a big deal. It directly influences the interest rates that lenders charge for their mortgage products. Here's what this month's base rate hold means for you:

- Tracker mortgages: If you have a tracker mortgage, your monthly payments will continue to follow the base rate, so you won't see any change for now.

- Variable rate mortgages: Those on Standard Variable Rates (SVRs) will also likely see their rates remain unchanged, although lenders can adjust these independently of the base rate.

- Fixed rate mortgages: For those looking for a new fixed rate deal, the news is cautiously optimistic. Lenders usually price in rate reductions before a base rate cut is announced. This is why mortgage rates have been falling in recent weeks, as low as 3.64%. However, getting a mortgage remains a challenge for many due to affordability hurdles. Which is why having an expert on your side can be a game-changer!

While the hold is a sign of stability, the market is still reacting to stretched affordability and speculation about the upcoming Autumn Budget on November 26th. Here's what to expect.

Cash ISA annual allowance could be cut

There's been growing speculation over the past few months that Rachel Reeves will announce plans to cut the annual Cash ISA limit in the Autumn Budget. Right now, you can save up to £20,000 each tax year into a Cash ISA tax-free.

If the rumours are true, this could be halved to just £10,000, significantly impacting savers' ability to build up funds tax-free. This is despite many finance experts urging the Chancellor to keep the Cash ISA allowance at £20,000.

The Autumn Budget will be announced on the 26th November 2025. So if you haven't already, make the most of your Cash ISA allowance before any changes come into effect!

Earn over £400 more in interest than the Big 4 banks with Tembo's Easy Access Cash ISA

Plus, unlimited withdrawals, fee-free mortgage advice, and monthly paid interest. Open with as little as £10!

House prices show slow growth

‘Sluggish’ - that’s the word that many are using to describe the property market right now. House prices fell by 0.3% in September, and are only 1.3% higher than a year ago. This is a noticeable slowdown compared to the growth seen in 2024.

This indicates that buyers and sellers are showing caution, leading to a slowdown in activity. In fact, new buyer enquiries fell for the third straight month, according to the latest data from Rics Residential Market Survey.

This is largely driven by affordability pressures and uncertainty surrounding potential tax changes in the Autumn Budget.

But there could be good news. There's speculation that the government might introduce reforms to Stamp Duty Land Tax (SDLT).

This could potentially jump-start the market by lowering the upfront cash needed to buy a home. But for now, many are in a "wait and see" mode.

If this is you, why not explore your mortgage options with Tembo? Our free Tembo Mortgage plan could help you discover your true buying budget - and it might be more than you think! On average, our customers boost their budgets by £88,000. Get started here.

Housebuilders raise concerns over government housebuilding targets

Industry leaders argue that while the government's housebuilding goals are ambitious, they may not be realistic. The Government has pledged to build at least three new towns this parliament, as part of their wider promise to build 1.5 million homes in England by 2029.

But there are ongoing challenges, including supply chain disruptions, labour shortages, and regulatory hurdles. All of which are making the government's hefty targets a steep challenge without major reforms.

What should you do? Our top tips

- Savers: The Bank of England’s decision to hold the base rate means that interest rates for saving accounts are likely to remain steady in the short term. But if there's a base rate cut next month, we could see savings rates drop. It’s a good time to review your savings options to ensure your money is working as hard as possible (or lock in an interest rate with a Fixed Rate ISA before rates change!)

- First-time buyers: It'll take a while for any new homes built to come to market. But the current slower house price growth and potential Stamp Duty reforms could make it easier to get on the ladder. However, affordability remains a challenge, so exploring ways to boost your borrowing power, like with a Tembo plan, could be the key to making home happen.

- Home movers: With cautious market activity, selling your current home may take longer than expected. Pricing correctly is crucial! However, slower price growth might mean the gap between your current property and your dream home is smaller, too. See what you could afford.

- Remortgagers: Mortgage rates have been falling in recent weeks. While a potential base rate cut in December could cause rates to fall further, there's no guarantee of this. If you're 6 months or less away from your current deal ending, lock in a rate now with Tembo. Then use our free rate checking service to reapply if rates drop down the line.

What’s next for the market?

The outlook for the rest of 2025 and into early 2026 is one of cautious stability. The upcoming Autumn Budget will be a critical event. The Chancellor's decisions on property taxes, housing supply, and support for landlords could provide the catalyst the market needs. Until then, the market is likely to continue its slow and steady pace.

Often, navigating the housing market can feel like a moving target. With constant shifts in interest rates, house prices, and government policy, it’s a lot to keep track of.

Check back in our latest articles to keep informed on the latest movements. Or discover how you could save faster, or buy sooner, through our award-winning savings app and mortgage service.

Discover your true buying budget in minutes

Create a free Tembo plan to discover all the ways you could buy or remortgage from across 20,000 mortgages. It’s free and there’s no credit check involved!