Best Lifetime ISA providers in the UK

Lucy Wilmott

Lucy WilmottIf you’re a first-time buyer, opening a Lifetime ISA could help you reach your savings goals faster. You can save up to £4,000 a year and the government will top it up for free by 25%. That’s a bonus of up to £1,000 per tax year! You’ll also earn interest or investment growth on top, depending on whether you go for a Cash Lifetime ISA or Stocks and Shares Lifetime ISA.

It may seem like a no-brainer to open a Lifetime ISA if you’re saving for your first home in the UK. But many first-time buyers miss out - we found that only 1 in 6 first-time buyers used a Lifetime ISA to purchase their first home, despite using one, helping buyers to get on the property ladder four years earlier!

Reading this, you’re obviously thinking of opening a Lifetime ISA, or already have one and are considering transferring to the best provider on the market. This makes you stand out amongst today’s first-time buyers as a savvy saver! But which provider do you choose to go with? Keep reading to find out the best Lifetime ISA providers in the UK below.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in. Tax treatment depends on individual circumstances and may be subject to change in the future. Capital at risk when investing, past performance is not a reliable indicator of future results.

Open our market-leading Lifetime ISA today

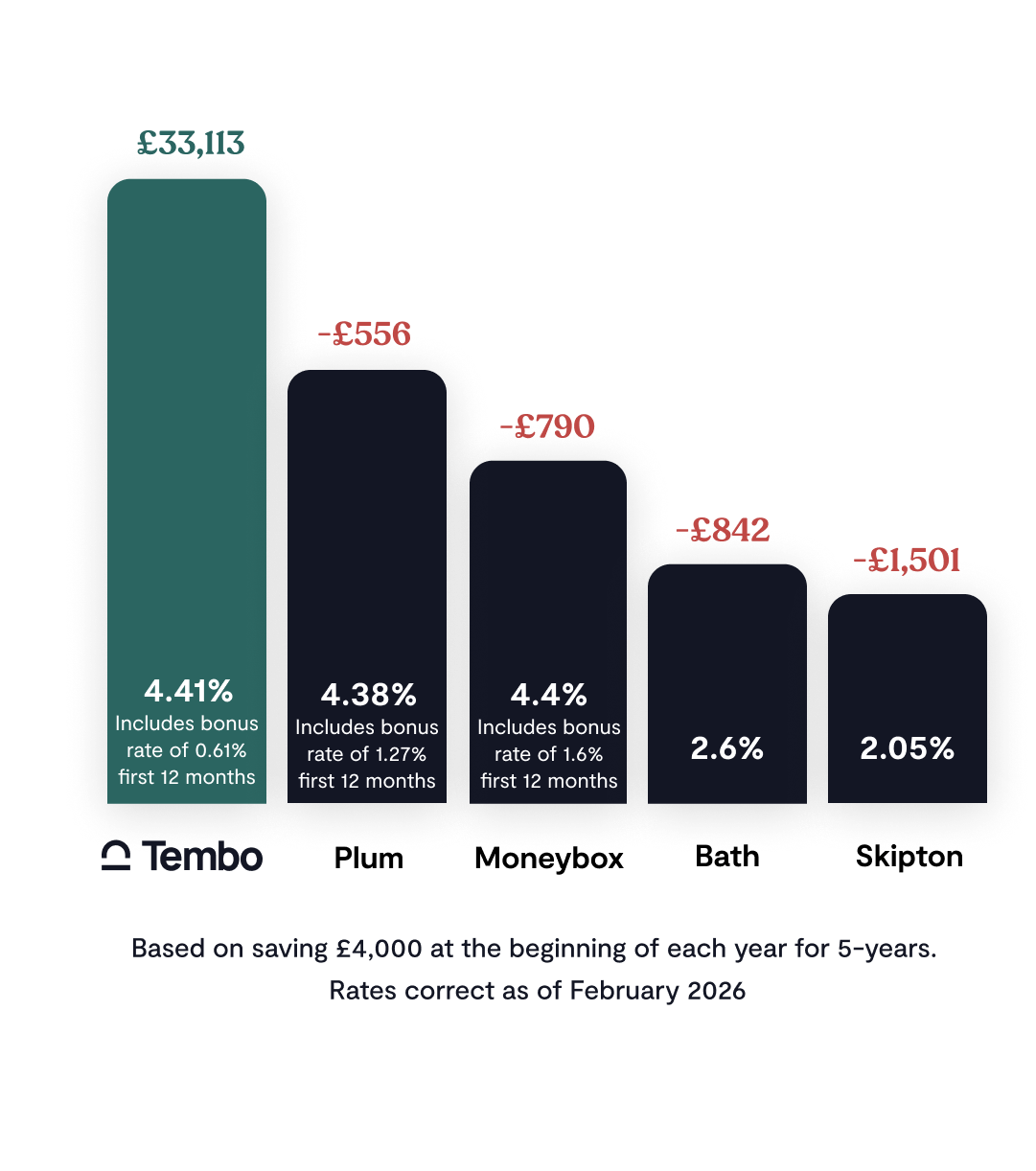

With the Tembo Cash Lifetime ISA, you'll earn 4.41% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

What is a Lifetime ISA?

A Lifetime ISA is a special type of ISA savings account available to those aged 18-39 that lets you save up to £4,000 each tax year towards your first home or retirement. Each tax year you save into the account, the government will boost your contributions by 25% for free, up to £1,000. You can choose a Cash Lifetime ISA, where your savings will benefit from interest growth, or a Stocks and Shares Lifetime ISA, where your funds will be invested in the stock market.

How does a Lifetime ISA work?

For every £4 you save into a Lifetime ISA, you get a free £1 from the government, up to £1,000 each tax year! The bonus is paid every year you pay into your Lifetime ISA, and is paid monthly (although it can take 4-6 weeks to land in your account).

The money in your LISA must be used for your deposit for your first home purchase, or to fund your retirement. Any withdrawals for other purposes will incur a 25% withdrawal charge, which means you could get back less than you put in.

If you use your LISA for a home purchase, the property you're buying must be worth £450,000 or less, and be your first home anywhere (including if you've bought or part-owned a property abroad).

Who has the best Lifetime ISA?

When it comes to who has the best Lifetime ISA, it's a good idea to think long-term, as saving up for your first home or retirement can often take years. This is why at Tembo, we offer the market-leading 4.41% AER (variable) rate on our Cash Lifetime ISA to speed up your time to buy.

Who offers Lifetime ISAs?

There is a range of banks and savings providers that offer Lifetime ISAs, including Tembo, but not all banks and building societies offer it as a product. Instead of looking to see if your local high street bank offers a Lifetime ISA, look at who offers the best Lifetime ISA rate instead. This may be a digital bank or a newer savings provider as opposed to an older bank. Saving with a high interest rate can help your Lifetime ISA savings grow by hundreds compared to saving with another provider.

The below list is based on UK Lifetime ISA accounts providing the highest rate of interest or best service for first-time buyers or retirement savers.

Best Cash Lifetime ISA providers:

If you’re using the Lifetime ISA for a house purchase in the next few years, a Cash LISA is likely to be the best option. The government will top up your contributions by 25%, and you’ll also benefit from interest gains. This is why choosing a Lifetime ISA provider with the best interest rate can have a significant impact on your house fund value. For example, by saving with Tembo you'll benefit from hundreds more in interest vs saving with the closest competitor on the market over 5 years.

Here are the top Cash Lifetime ISA providers in the UK to choose from:

1. Tembo

The Tembo Cash Lifetime ISA offers the market-leading rate at 4.41% AER (variable). Over 5-years, that means hundreds more added to your savings pot if you save with us vs the best next rate on the market.

As well as our market-leading rate, you’ll get features and tools to help you on every step towards your first home. From a tailored homebuying plan that walks you through each step, to fee-free access* to our award-winning mortgage service backed by our Best Mortgage Deal guarantee and free rate checking service.

Not to mention your very own dedicated mortgage team who’ll help you find the best mortgage options for you from over 100 lenders - on average, our customers boost their mortgage affordability by £82,000!

What’s the interest rate? 4.41% AER (variable), made up of 3.8% AER (variable) + 0.61% AER (variable) for the first 12 months.

How do you open an account? App

How do you manage your account? App

When is the interest paid? Monthly

Can you transfer from other ISAs? Only from existing LISAs, not ISAs

2. Moneybox

What’s the interest rate? 4.4% AER (variable) rate, but this rate drops to 2.80% after 12 months

How do you open an account? App

How do you manage your account? App

When is the interest paid? Monthly

Can you transfer from other ISAs? Yes but only other LISAs

3. Plum

What’s the interest rate? 4.38% AER (variable) rate, but this includes a bonus rate of 1.14% AER (variable) for only the first year. The rate drops to 3.11% AER (variable) after 12 months

How do you open an account? App

How do you manage your account? App

When is the interest paid? Monthly

Can you transfer from other ISAs? Yes but only other LISAs

4. Paragon

What’s the interest rate? 3.51% gross/AER variable rate

How do you open an account? Online

How do you manage your account? Online, by post or phone.

When is the interest paid? Annually

Can you transfer from other ISAs? Yes but only other LISAs

5. Bath Building Society

What’s the interest rate? 2.60% AER (variable)

How do you open an account? Online or branch

How do you manage your account? Online or branch

When is the interest paid? Annually

Can you transfer from other ISAs? No

Perfect for you: Should I buy a house?

Worried your LISA savings aren't enough?

Our award-winning team are experts at helping first-time buyers discover their true buying budget. Working with over 100 mortgage lenders and specialist schemes we can recommend the best options for your situation to boost your mortgage affordability.

Using a Lifetime ISA for retirement?

By saving into a Lifetime ISA instead of enrolling in or contributing to a pension, you may lose out on contributions by an employer (if any), and it may affect your entitlement to means-tested benefits.

Best Stocks & Shares Lifetime ISA providers

If you’re using the Lifetime ISA for retirement, or you’re not planning to buy a home in the next few years, a Stocks and Shares LISA may be more suitable than a Cash LISA. Not only will the government top up your contributions by 25%, you’ll also benefit from investment growth — which historically has outperformed savings interest in the long term. However, the value of your investments can go down as well as up and you may get back less than you originally invested.

Here are some of the top Stocks and Shares Lifetime ISA providers in the UK at the moment:

1. Tembo

Unlike other Stocks and Shares Lifetime ISA providers, Tembo doesn’t charge a monthly fee. Instead, you’ll pay a 0.35% platform fee and a 0.17% fund provider fee.

Your money would also be invested in the Blackrock MyMap 5 Select ESG fund, which is an ESG fund - ESG stands for environmental, social and governance, meaning it's a collection of "ethical" investments designed to have a positive impact. While you might think the ESG funds might not perform as well as other funds, this isn't necessarily the case - the Blackrock MyMap 5 Select ESG fund delivered a total return of 11.4% in 2025!

Cost: 0.35%

Average annual fund cost: 0.17%. Additional fees charged by the fund provider BlackRock.

How to manage: App

Minimum investment: £25, but we recommend to save as much as you can. While low balances will still benefit from interest with a Cash LISA, Stocks and Shares LISAs are subject to an annual management fee, which is applied monthly.

2. AJ Bell

AJ Bell is one of the UK’s largest investment platforms, with over 540,000 customers. Its Lifetime ISA may be ideal if you’d like a wide choice of investment funds. But with a high initial investment of either a £500 lump sum or £25 a month, it might not be suitable if you only want to invest small amounts.

Cost: 0.25% custody charge (maximum £3.50 a month for shares)

Fees to buy/sell funds: £1.50

Fees to buy/sell shares: £5 (or £3.50 if you made 10 or more share deals in the previous month)

How to manage: Online/app

Minimum investment: £250 lump sum or £25 a month

3. Hargreaves Lansdown

Hargreaves Lansdown is a FTSE 100 company, managing more than £120 billion for 1.7 million clients. When you open a Hargreaves Lansdown LISA, you can choose your own investments or pick one from its ready-made portfolios. You can add money to your LISA with a monthly Direct Debit, making it easier to grow your savings without having to think about it. If you don’t know what to invest in, you can add cash to your LISA now, then decide where to invest later on.

Cost: This depends on whether you hold funds or shares. For shares, there’s a 0.25% annual management charge (capped at £45 a year). For funds, 0.25% on the first £1m, 0.1% for the value between £1m - £2m, and no charge on anything over £2m.

Fees to buy/sell funds: None

Fees to buy/sell shares: Between £5.95 and £11.95, depending on the number of deals per month

How to manage: Online/app

Minimum investment: £100 lump sum to open the account or £25 minimum for monthly payments.

4. Moneybox

With Moneybox, you can choose from three simple Starting Options, or customise your portfolio with top US stocks, funds, and ETFs.

Cost: £1 per month subscription fee & 0.45% platform fee (charged monthly)

Fees to buy/sell funds: None

Fees to buy/sell shares: None

How to manage: Online

Minimum investment: £1

So, where is the best place to get a Lifetime ISA?

When it comes to saving into a Cash Lifetime ISA, Tembo is the best bet - over 5 years our market-leading 4.41% AER (variable) interest rate will increase your LISA savings by hundreds in interest alone vs the closest rate on the market. When it comes to a Stocks and Shares Lifetime ISA, this really depends on how much flexibility you want in choosing where your money is invested.

Providers like AJ Bell and Hargreaves Landsdown are older names with a wide choice of investment funds, but they have higher required amounts to open accounts with them. If you want to choose a provider that chooses the fund for you, knowing you are investing ethically and have a lower minimum opening balance, our Stocks and Shares LISA could be a good option.

Is the Lifetime ISA being scrapped?

It’s been confirmed that the government is consulting on plans to create a new first-time buyer focussed savings product which could replace Lifetime ISAs. However, HMRC has confirmed that existing Lifetime ISA savers will be able to keep contributing indefinitely to their Lifetime ISAs, even after a new saving product is introduced.

So if you have a Lifetime ISA, don’t worry, you can keep adding to your account.

If you’re thinking of opening a Lifetime ISA, there’s still time to do so.

At Tembo, our position remains the same.

The reason for introducing a new product is that many Lifetime ISA savers lose some of their own money if they breach the withdrawal rules. The government wants to fix that in the new product. But it raises the question of why they don’t just fix it in the current Lifetime ISA instead…

Is it too late to open a Lifetime ISA?

If you're aged between 18-39, it's not too late to open a Lifetime ISA and use it to save up for your first home, or retirement. Remember that you must have the account open for 12 months before you use it to purchase your first home. If you want to use a LISA to save for retirement, make sure to open the account before the cut-off age. You can keep paying into your LISA until your 50th birthday, and your funds will continue to earn interest or investment growth until you take your savings out once you're 60 or over.

What are the disadvantages of a Lifetime ISA?

One of the main disadvantages of a Lifetime ISA is the age restrictions - you must be aged between 18 and 39 to open a LISA. You must have the account open for at least 12 months before using it to purchase your first home, and if you're saving for retirement you can't access your funds until you're at least 60.

The other main disadvantage of a Lifetime ISA is the withdrawal penalty - if you withdraw your money from your LISA for any reason apart from buying your first home or funding retirement, you'll incur a 25% withdrawal charge, which could mean you'll get back less than you put in. If you're using a LISA to purchase a property, the property you're buying must be worth £450,000 or less, be in the UK, and you must use a residential mortgage to purchase it.

If you want to save your money in an ISA but a Lifetime ISA isn't the right fit, consider a Cash ISA instead! You can save up to £20,000 each tax year tax-free and use the funds for anything (not just your first house or retirement, like with a Lifetime ISA). Plus, with a Tembo Cash ISA, you'll earn 2.7x more interest than if you were to save with one of the UK's Big Four banks!** You'll also benefit from unlimited withdrawals, and fee-free access to our award-winning mortgage service*. Get started here

Struggling to save up enough?

With costs of living going up and earnings remaining fairly flat, it’s unsurprising that one of the most common reasons we see for people being unable to get a mortgage is due to being unable to put money aside to save up a large enough deposit. Thankfully, we’re here to help.

At Tembo, we work with over 100 lenders and specialist buying schemes to help the next generation get on the property ladder. These include guarantor mortgage options such as a gifted Deposit Boost and family springboard mortgages.

And don’t worry if your family isn't in a position to help you. There are other options, including joint mortgages with friends or siblings, shared ownership and 5x Mortgages.

So whether you’re ready to buy or you’re wondering what your options could be, complete your details with us today. Our bespoke technology analyses your eligibility for specialist schemes from over 100 mortgage lenders in seconds.

You might also like: How to buy a home with a low deposit

Discover your true house buying budget today

We specialise in helping home buyers to bridge the mortgage affordability gap with our smart decisioning technology. To find out how much you could borrow with our help, complete your details today. It's free, takes 10 minutes to complete and there's no credit check involved.

Learn more

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 4.10% would have £448.69 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate October 2025.