7 things you didn’t know about the generational wealth gap

Millennials spend too much money and boomers are to blame for the housing crisis. That’s what some people believe, anyway. The boomer vs millennial battle has been raging for a long time, with members of each generation pointing the finger and insisting the others are to blame for society’s biggest issues.

But how much truth is there to all this? Are younger generations really worse off than older generations and what’s the solution? Drawing from our First-Time Buyer Report, here are 7 things you didn’t know about the generational wealth gap.

1. If you save £200 a month, it’d take 24 years to save the average deposit

Why can’t millennials afford houses? Well, when you combine high living costs and property prices with low salaries, it’s harder than ever for young people to save a deposit. So it’s no surprise that a deposit is the biggest barrier standing between younger generations and their first home.

Across the UK, the average first-time buyer needs a £61,000 deposit. If they were to save £200 a month, it’d take 24 years and 7 months to save this amount.

The average first time buyer in London needs a whopping £132,685 deposit to buy a home in the capital. If they were to save £200 a month, it’d take 54 years and 10 months to get the money together! By which time house prices would likely have increased even more, pricing them out once again.

Clearly it’ll take more than quitting coffee, Netflix and nights out to save a deposit.

Save with the market-leading ✨ Cash Lifetime ISA ✨

With the Tembo Cash Lifetime ISA, you'll earn 3.8% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

2. The pandemic hit younger generations the hardest

The pandemic caused the gap between the rich and the poor to widen, which is unusual because it’s rare for wealth to increase during recessions.

Repeated pandemic lockdowns helped homeowners increase their wealth, thanks to reduced spending and rising house prices. Meanwhile, millennials and gen z didn’t come out quite as strong, largely due to having few assets of their own.

Under 40s are more likely than older people to have lost work, drawn on savings, fallen into debt and been forced to stop pension contributions, according to Professor Bobby Duffy in his book ‘Generations’.

It sometimes feels as though young people just can’t catch a break!

3. 31% of 18-24-year-olds expect to delay big life events because they want to own a property first

The UK birth rate is at a record low. The reasons for this are complex and include greater gender equality, improved education, and easier access to contraception.

Money is a significant factor too. It used to be possible for a couple to buy a home with just one person’s income. The father would go out to work while the mother would stay at home with the children. But as property prices have risen over time, this is no longer achievable for many families. Now, it can be a challenge to buy a house on two incomes, let alone one!

And when you consider the cost of childcare on top of the cost of housing, it’s no surprise that so many young people are putting such big life milestones on hold. Our research suggests 31% of 18-24-year olds expect to delay having children until they own a home.

Climate change concerns are another obstacle to parenthood. 13% of 25 to 34-year-olds say they’re likely to not have children due to climate change.

Concerns have been raised that this could lead to a ‘baby shortage’. The Social Market Foundation project found that by 2050 a quarter of Britons will be over the age of 65. This means fewer people in employment, and a higher share of older people who need economic support from the state.

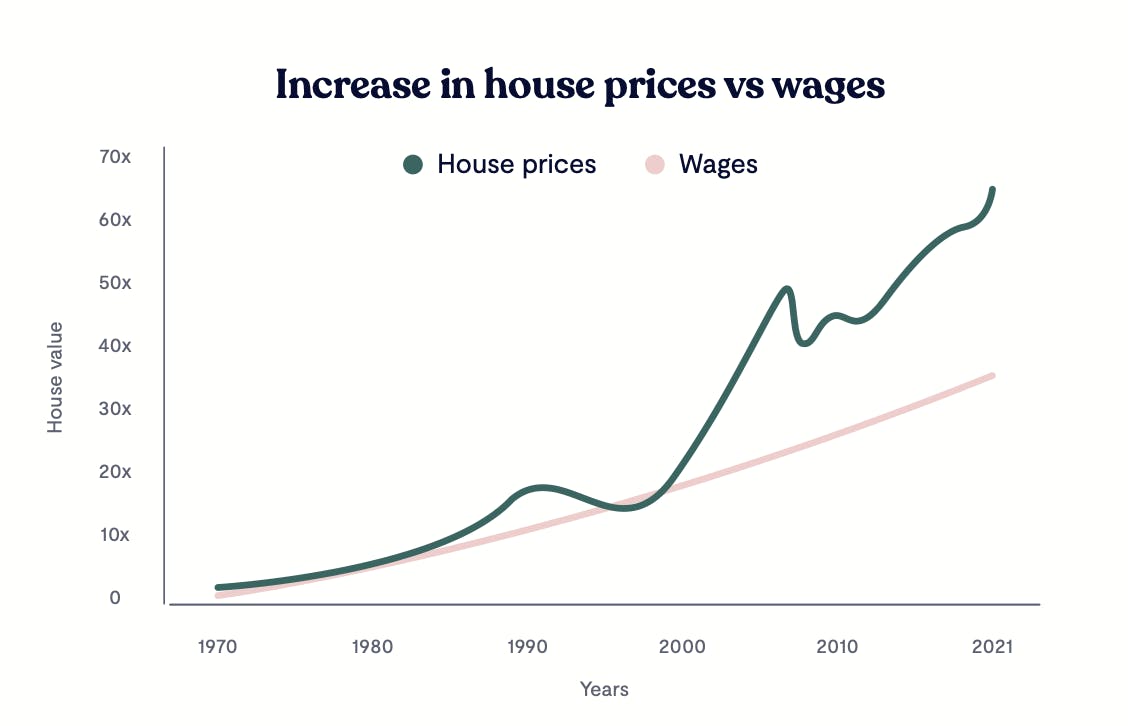

4. Houses prices are 65 times higher than the early 1970s — but wages are only 35 times higher

How much cheaper were houses for boomers? Well, the average UK property costs a whopping 65 times more than the average UK home in January 1970 — while wages are only 35.8 times higher compared to 52 years ago.

But if we take inflation into account, house prices in the UK have increased 227% since the 1970s. Back then the average house cost just £4,057. This figure shot up to £20,268 in 1980.

In 1990, it more than doubled to £58,153 and in 2000 it reached £89,597. It almost doubled again in 2010 to £170,365. In 2020, the average UK property was valued at £249,633 before bringing us to £271,613 in June 2022.

Although it’s certainly a lot harder to buy a house now than it was in the 70s, 80s and 90s, this doesn’t mean our parents and grandparents found it easy to get onto the property ladder.

House prices in the 1980s probably felt extortionate compared to the decade before. High interest rates of up to 16% will have made many people’s mortgage payments unaffordable.

Buying a house following the 2007/2008 global financial crisis will have been a struggle too. It wasn’t long before prices were almost double what they were at the turn of the century.

5. 83% of homeowners believe first-time buyers face more difficulty than they did

If you spend any amount of time on social media, you’re likely to have seen comments from older people who believe younger generations are nothing but lazy snowflakes. If only young people worked harder and spent less money, they’d be able to buy a house, right?

But the internet has a way of bringing out the worst in people. Our research suggests that most homeowners acknowledge how hard it is to buy a house nowadays. 83% of homeowners across all age groups feel that first-time buyers face more difficulty than they did.

We even found that 53% of higher earning homeowners felt guilty about the generational wealth gap. However, we noticed that the older the homeowner was, the less likely they were to feel guilt.

38% of homeowners who responded to our survey agreed with this statement: “While I was able to buy a house on my own (or with my spouse), I believe young people have more difficult circumstances today and families should financially help young people to buy a house if they can.”

However, 35% agreed with this statement: “I had to save and buy a house on my own (or with my spouse). Young people today should have to do the same and not rely on family/loved ones.” Older age groups were more likely to take this stance.

6. One in six boomers own a second property

So, how many boomers own a home? Well, half of baby boomers became a homeowner by the age of 30. And one in six 55 to 64-year-olds have been able to buy a second property, according to the Institute for Fiscal Studies. Many are renting out their second homes to boost their incomes and provide for retirement.

While this can be a smart financial move for those who can afford it, it does make it harder for first-time buyers by limiting the number of houses available to buy.

It’s important to note, however, that second homes aren’t solely responsible for the housing crisis and rising property prices.

7. Almost half of first-time buyers get help from family to buy their home

Almost half of first-time buyers get help from family members when buying their first home. Of those first-time buyers, 50% said they wouldn’t have been able to afford to buy without their parents’ help.

If this sounds surprising, money secrecy might be partly responsible. Many people find it hard to talk about money, so when a first-time buyer receives help from their parents, they may be tempted to keep it a secret. Some people feel embarrassed about receiving help from their family. They may even feel guilty because other people don’t have the same support.

However, while 54% of respondents to our study said they wouldn’t be getting any help from their parents, 92% said they’d accept money from their family if it was offered. 41% would accept it as a gift, a third would accept it as a loan, 7% would accept it as inheritance, and 11% would only take the money if no one else knew about it.

Rising property prices teamed with low wages are clearly a huge cause for concern, particularly among younger generations. Our research showed that 70% of younger generations feel jealous of older people - and who can honestly blame them?

Although buying a house is certainly more difficult than it was 30, 40 or 50 years ago, that doesn’t mean that older people had it easy. And when we put ourselves in their shoes, it’s easier to see why they might be defensive.

Boomers didn’t have the workplace flexibility that many of us enjoy today. It was common for women to be financially dependent on their husbands. Job hopping was unheard of and workers had fewer rights. Many boomers will have experienced racism, sexism and other types of discrimination in ways that might shock some young people today, although these issues do still exist.

Boomers and millennials/Gen Z are often pitted against each other, but we believe we’re stronger when we work together.

While some boomers are wondering how they’ll fund their retirement and cover the cost of care, many have managed to build financially comfortable lives for themselves. Wealthy boomers might be planning their estates and looking for tax-efficient ways to pass their assets on when they die. By using their money wisely, they can help the next generation to get onto the property ladder while they’re still around to enjoy the experience.

Here at Tembo, we’re helping boomers, millennials and Gen Z to close the generational wealth and property gap. To find out how we can help your family, get in touch with our team today.

We've helped thousands discover their true buying budget

We work with over 100 lenders to advise buyers on the best home buying scheme for them. From family support mortgages, to schemes to help you buy on your own. Create a plan for free today to get a personalised recommendation.