Are house prices still rising?

Anya Gair, Head of Organic

Anya Gair, Head of OrganicAccording to recent data, house prices are still rising but only slightly. But property asking prices and mortgage rates remain high, which can make it challenging for many buyers to step onto the property ladder.

In this guide

- Are UK house prices still rising?

- Why have UK house prices been rising?

- Why are UK house prices so high?

- Do house prices rise with inflation?

- How much do house prices rise per year?

- Will UK house prices fall if interest rates rise?

- Should buyers purchase a house now or wait for prices to fall?

- Will UK house prices rise in 2025?

Are UK house prices still rising?

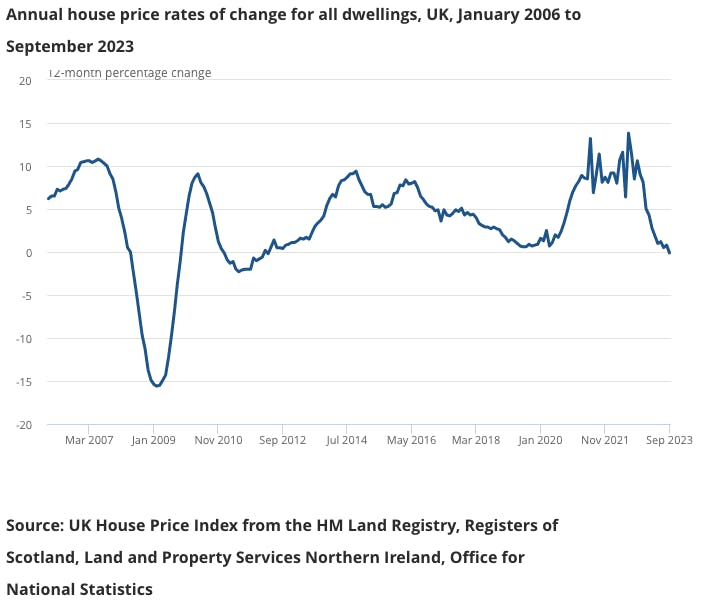

As of November 2025, UK house prices have remained broadly flat over the past year, with minor declines in some regions and slight increases in others. According to the latest data, house price inflation has stayed steady at +1.3%, remains flat in southern England, but is rising by more than 2% elsewhere. This is being helped by falling buyer demand - down 8% - and 7% more homes for sale.

It's likely that house prices will continue to increase gradually in 2026, somewhere around the 1-5% mark. The Office For Budget Responsibility has predicted that property prices growth will end 2025 at around 2.8% and be 2.5% on average in 2026, broadly in line with the growth in earnings.

Looking more long-term, if the government is able to meet its pledge to build more homes, the OBR predicts that the number of homes for sale will increase by 0.5%, which should reduce the average house price by around 0.8% by 2029.

For first-time buyers this may sound reassuring, but it's best to keep in mind that there's no guarantee that these drops in property prices will happen. If you can get on the ladder now, it's better to buy when you can instead of waiting for the "perfect" moment which may not come.

If this is you, Tembo can help.

Tembo’s award-winning team are experts at boosting borrowing power, helping buyers to get on the ladder sooner, or afford a larger property. To get started, create a plan on our homebuyer platform today. It’s free, takes 10 minutes to complete, and there’s no credit check involved.

See today's best mortgage rates

Compare the best mortgage deals from across the market, including familiar high-street banks & specialist lenders.

The interest rates shown are an indication only and are not guaranteed. Current rates may have changed by the time you come to apply.

Why have UK house prices been rising?

For the last couple of years, house prices in the UK have been rising off the back of pent up demand during the pandemic, low mortgage rates and the stamp duty holiday, which ended in October 2021.

Recently, property price growth has slowed. The cost of living crisis and higher mortgage interest rates are key reasons. When mortgage rates go up, borrowing money becomes more expensive. As a result, fewer home buyers can afford mortgages. At the same time, rising living costs make it harder to save for a house deposit.

Normally, house prices are determined by a number of factors, including:

- Supply and demand: More desirable locations tend to have higher prices due to competition among buyers, which pushes prices up.

- Economic conditions: Property prices often fall during a recession because fewer people are able to buy or move. The government may introduce incentives, such as a stamp duty holiday (a temporary cut to the tax paid when buying a home), to encourage activity.

- Mortgage interest rates: When rates are low, mortgages are more affordable, boosting buyer confidence and house prices. When rates rise, borrowing becomes more expensive, reducing demand and potentially lowering prices.

Why are UK house prices so high?

In the UK, we've had decades of property price growth, which has pushed the cost of houses up. The cost of an average house in 2021 was 65 times higher than in 1970, while earnings have only gone up 35 times. Today, the average house price sits at £270,000, 6.9 times higher than the average salary. This gap between salaries and house prices makes it harder to afford to buy a home using a traditional mortgage.

Plus, since the late 50s, there has been a significant reduction in the number of new homes being built, reducing the housing supply. This has helped to increase the price of homes that are on sale. At the same time, renting is becoming increasingly expensive, making it harder to save up a house deposit.

Do house prices rise with inflation?

Yes, when inflation rises, property prices often rise too. This might sound like a good thing for homeowners, but they may find it harder to move when the price of goods and services is increasing too. If homeowners decide to stay where they are, this can limit the supply of houses and make it even harder for first-time buyers to get on the ladder.

However, inflation can also have the opposite effect. If inflation causes a mortgage interest rate increase, many buyers find it harder to get the loans they want because monthly repayments are more expensive. This leads to a decrease in demand for properties and consequently a fall in house prices.

You might like: How to get lower mortgage rates

How much do house prices rise per year?

Between 2025-2030, UK house prices are expected to grow by roughly 2.5% each year. However, annual growth can vary significantly due to economic factors, making it important for buyers to research market conditions before making a decision - or seeking advice from an expert mortgage broker like Tembo.

Will UK house prices fall if interest rates rise?

Often, when interest rates rise this can cause house prices to fall, especially when mortgage rates increase as this makes getting a mortgage more expensive, which can push down demand. When there is less demand for houses, this can cause house prices to drop. However, there’s no guarantee that this will happen.

Read more: Are mortgage interest rates going down?

Should buyers purchase a house now or wait for prices to fall?

Whether house buyers should purchase a house now or wait for prices to fall depends on their individual financial circumstances and goals. Even if the market sees a short-term dip, long-term affordability and stability are often more important considerations. Your own income, savings, and goals are far more important than the ups and downs of the property market. This’ll probably be the biggest purchase you’ll ever make — it’s worth getting it right.

Getting expert advice can be invaluable when deciding if now is the right time for you. Even if you're far off buying your first home, our award-winning team can help. Create a free Tembo plan to get started.

You might like our guides Should I buy a house? and Is now a good time to buy a house?

Will UK house prices rise in 2025?

Most experts predict only a small increase. The Office for Budget Responsibility expects prices to grow by around 2.8% during 2025, while Savills forecasts roughly 1%. Wage growth and any cut in the Bank of England’s base rate may lift demand, but mortgage rates staying higher are likely to keep price rises modest.

Create a free Tembo plan today to get started

Get a personalised recommendation on how you could boost your buying budget by using a specialist buying scheme. To get started, simply create a free plan.