What is mortgage affordability?

Mortgage affordability is when you can comfortably repay your mortgage each month. Keep reading to find out how affordability works and how lenders use mortgage affordability tests to determine how much you can borrow.

Before your bank hands over thousands of pounds for you to get on the property ladder, you must prove you can afford to pay it back. Your monthly mortgage payments are likely to be your biggest financial commitment, and the one which carries the most severe consequences should you fall behind on repayments. That’s why banks and building societies rigorously check your mortgage affordability and ask for proof of your earnings and outgoings when you apply for a mortgage.

What is mortgage affordability?

What is mortgage affordability?

Mortgage affordability is being able to comfortably repay your mortgage repayments each month, alongside any other debts you already have, your household bills and living expenses. It means your home loan is affordable.

‘Comfortably’ is key. After all your outgoings have been added up and subtracted from the money you earn, you still need to have cash left over to act as a buffer in case unexpected bills arise.

Mortgage affordability is important for two reasons. If you fall behind on your mortgage payments, it will be recorded on your credit report and linger for six years. This will drastically reduce your credit score affecting your chances of getting a mortgage, loan or even phone contract in the future. If you can’t meet your minimum contractual payment, or stick to an arrangement your lender has put in place to help you, ultimately your home will be repossessed and sold to repay your debt.

It sounds scary, but in reality repossession is rare. Banks and building societies have a duty to lend responsibly, under rules put in place by watchdog the Financial Conduct Authority. This means you’re protected from taking out too much mortgage finance by what’s known as an affordability check.

What is a mortgage affordability test?

A mortgage affordability test is used by mortgage lenders to check what you can afford to borrow for a mortgage. This is to determine how much they could lean to you, as well as if they could accept your mortgage application.

A mortgage affordability test actually involves a couple of checks, these include:

Income multiples

To work out the maximum mortgage a lender will offer you, banks and building societies use what’s called income multiples.

Let’s say you earn £30,000 a year before tax. A lender using an income multiple of 3.5 would multiply your £30,000 salary by 3.5 to get £105,000. Obviously, if you’re buying with someone else you add your salaries together and then apply the lender’s multiplier.

A common income multiplier for first-time buyers is 4.5 times earnings. So a single person on a salary of £30,000 could get a maximum mortgage offer of £135,000, while a couple with a joint income of £60,000 would be offered £270,000.

Most of the high street lenders will agree to a mortgage that is 5.5 times a borrower’s salary if they have a deposit of between 15% to 25% and earn at least £75,000. But with a 5.5x Income Mortgage, first-time buyers who earn £37,000 or more only require a 5% deposit and an excellent credit history to qualify for a mortgage 5.5x times their salary.

People who work in professional roles such as accountants, solicitors or blue light, NHS or key worker jobs can also apply for Professional Mortgages which allow you to borrow 5.5 or even 6.5 times your income.

You can also get a bigger mortgage through family support. There are loads of different ways your loved ones can support your purchase without needing cash in the bank. Check out the range of guarantor mortgages we advise on to find out more.

Income and outgoings assessment

Once the maximum value of your mortgage has been worked out, the lender will check you can afford to pay it from your monthly earnings (after tax) after you’ve paid all your other bills and deducted daily living expenses.

Commonly accepted types of income include:

- Basic employed and self-employed earnings

- Benefits such as child and working tax credit

- Pension income

- Rent from a buy-to-let property

When adding up your outgoings you’ll need to include; all your regular bills such as council tax, utilities and phone contracts, any monthly debt repayments, transport costs, childcare, school fees, food shopping and money spent on socialising, holidays and hobbies.

Once you’ve subtracted all your outgoings from your income, you need to have enough left over to afford your mortgage payment with a buffer. This is to ensure you can still afford your repayments if interest rates rise.

Read more: How to access lower mortgage interest rates

What about bonuses or overtime?

Although you can boost your earnings by using bonus pay, overtime and commission, because this income can go up and down lenders often restrict the amount you can use.

On average, our customers boost their budget by £88,000

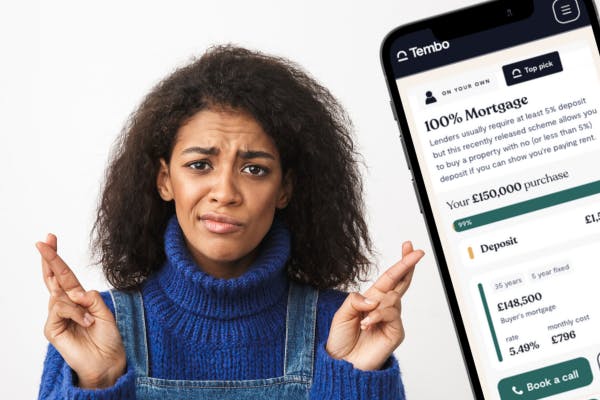

Whether it's through a guarantor mortgage, specialist buying scheme or traditional mortgage, there are loads of ways to get on the ladder. See what you could be eligible for with your own Tembo recommedation.

Stress testing

A mortgage lender’s stress test is not a test to see how well you cope under pressure. It’s a test to see if you could afford to repay your mortgage if interest rates rose by 3%. When you’ve completed your income and outgoings assessment, the spare cash you have left over must be enough to pay for a mortgage that has an interest rate 3% higher than your lender’s standard variable rate (SVR).

The average standard variable rate is currently 7.32% which means you must be able to afford an interest rate of 10.81% to be approved. Sounds steep, but it means there’s plenty of room in your budget should interest rates rise in the future. One way to avoid the harsh stress test is to opt for a fixed rate mortgage deal. Some lenders do not stress test to such a high level if you fix your rate for five years or longer, as it is seen to reduce the risk for the borrower.

Read more: How long should I fix my mortgage for?

Interest rates accurate as of October 2025.

Debt versus income

Okay, you’ve got your maximum mortgage offer, and you’ve worked out that you have enough money left over after your bills and expenses have been paid to afford a rate of around 11%. You have just one more hurdle to clear - achieving a low Debt to Income ratio.

Working out your Debt to Income (DTI) ratio is easy. Take the total debt you have on credit cards, divide that by your annual salary and multiply by 100.

But what does this mean? Well, as a rule of thumb to be accepted by almost all lenders, you would need to have a DTI of 30% or less. Up to 40% and you may not be offered the highest income multipliers available. With a DTI of 50% or more, lenders consider you to be a high-risk borrower. You would have a limited choice of lenders offering mortgage deals at high interest rates and your credit score and history would need to be tip-top.

Lenders will also take into account the level of monthly debt payments as part of their affordability checks

Boost your buying budget

If you're finding that your mortgage affordability isn't enough to get the mortgage size you need, talk to Tembo. We specialise in helping buyers, movers and remortgagers boost their mortgage affordability through a range of specialist schemes. In fact, on average our customers boost their buying budget by £88,000!

Discover how much you could boost your budget with Tembo

We've helped thousands of homebuyers discover how they could afford their dream home. To see what you could afford, create a free recommendation today to see all the ways you could get on the ladder.