How home buyers can navigate a volatile mortgage market

The mortgage market has had a turbulent time over the last year - over 2023 we gained a new monarch, another new prime minister, and saw unprecedented change in the economy. In 2024, we've already seen mortgage rates fall, rise and fall again, alongside stagnant economic growth - not to mention an election on the horizon. These economic changes have a huge impact on the property market. To try and bring some calm to the chaos, we've put together the comprehensive answers to our most commonly asked questions about how to charter a changing mortgage market.

What is the mortgage market?

First things first, what do we mean when we say 'mortgage market'. The mortgage market is simply the structure where borrowers can get a mortgage loan from a primary lender, such as a bank or building society.

Did you know?

At Tembo, we advise on over 100 mortgage lenders including high-street banks and building societies, as well as new providers you might not have heard of.

What is happening in the mortgage market?

Thanks to higher mortgage rates, higher living costs and elevated house prices, it's estimated that in 2024 there will be 21% fewer first-time buyers than in 2022, the lowest figure since 2013. Although there are signs of market activity increasing, property prices are being kept in check by increasing supply and mortgage affordability challenges faced by many buyers.

But despite this, first-time buyers are still determined to overcome these challenges to get a place of their own. So if you're feeling conflicted about whether it’s the right time to buy a property, remortgage or move up the ladder - knowledge is power. Let’s take a deep breath, and dive into it.

You might also like our more in-depth guide on Is now a good time to buy?

How to navigate a volatile mortgage market:

1. Remember that timing the market is a tricky game

Understandably, buyers often become fixated on trying to buy at the "perfect" moment, but in practice, this is a very difficult strategy to land.

There’s an old adage: ‘Time in the market trumps timing the market’. Within a property context, this means that time spent on the property ladder is better than trying to time the exact moment to buy or sell a home.

That’s because owning a home is a long-term investment - it requires a long-term mindset. In fact, data shows that the average Brit lives in their home for an average of 12 years. Over the past decade, we’ve seen rises and falls in house prices that at the time felt (and sometimes were) historic. But what’s important is that when you take a step back, the long-term trend is undeniably upward.

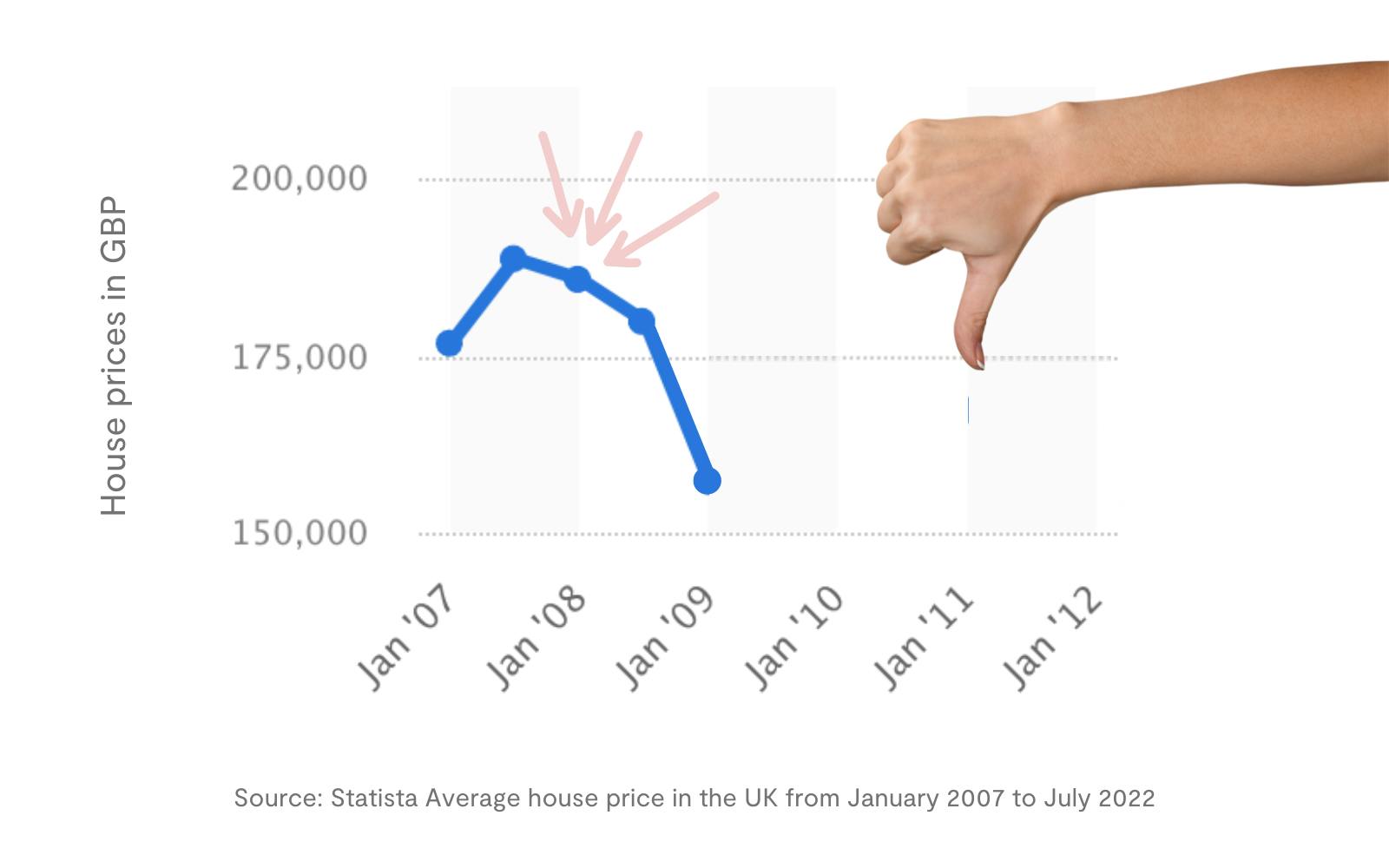

A first-time buyer who bought at the peak of the market in 2008, might have initially felt incredibly unlucky due to the crash in house prices that followed.

Line chart showing average house prices in the UK from 2007 to 2009. Pink arrows highlight the peak: Jan '08, and show falling house prices afterwards

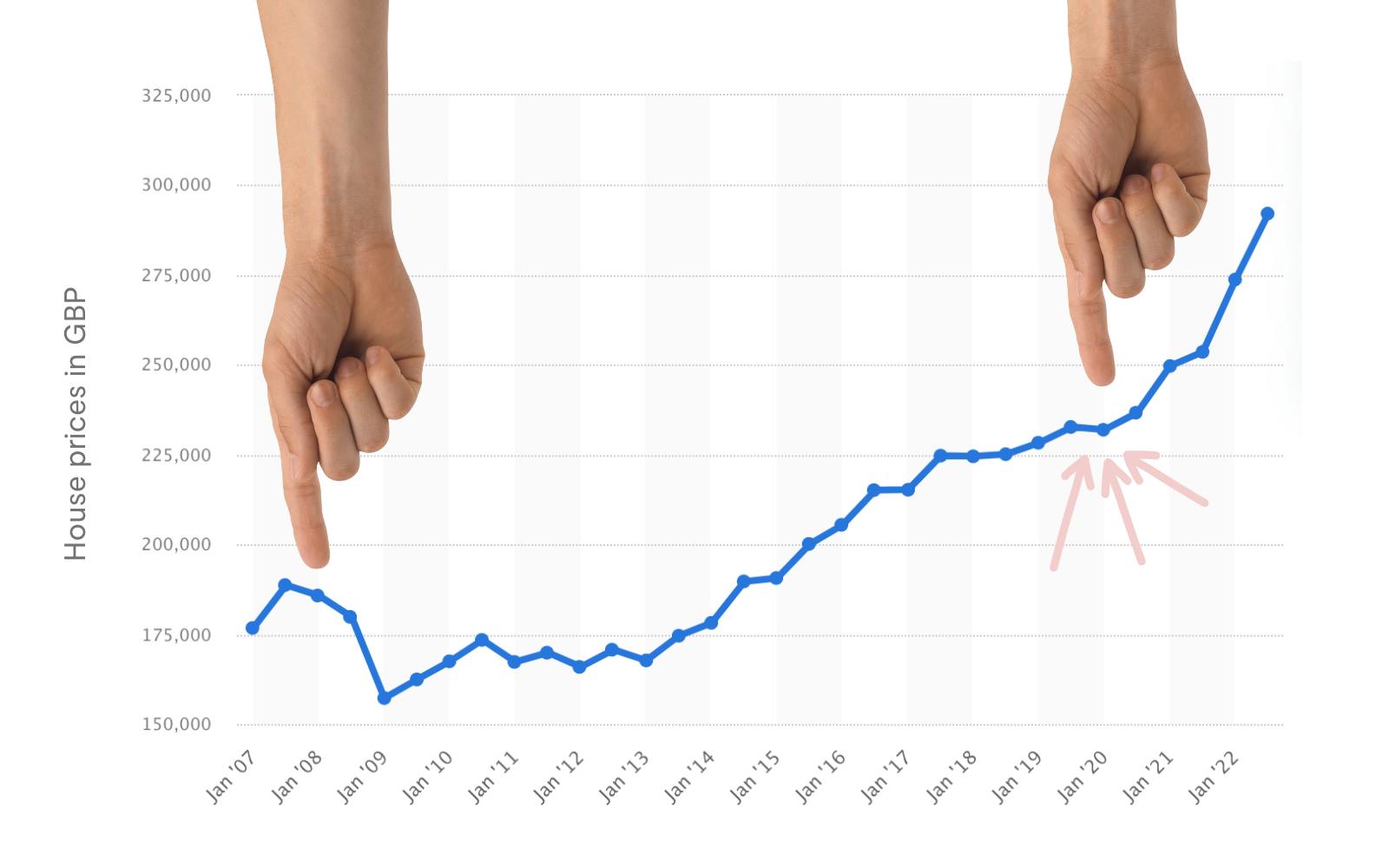

However, fast forward twelve years, and their property would have increased in value by 81% versus when they bought it.

Line chart showing average house prices from 2007 to 2022. Fingers highlight the peak before the financial crash in '08 and then the recovery in prices by 2020.

Now to the current day, where it's predicted that house price growth will stay modest over 2025. But take into account that prices rose to new heights during the pandemic's "race for space" and the stamp duty holiday. In just two and a half years between March 2020 and September 2022, the average property increased in value by 24%. When you take a step back, over time prices are moving in the right direction.

2. Compare the financial benefits of owning over renting

If you can afford to buy and maintain a property, owning is usually more financially beneficial than renting over the long-run. In fact, over 25 years someone who owns a property is £200,000 better off than someone who rents the same property.

That’s because you’re investing rather than spending when you pay your mortgage each month. If you’re renting, you’re paying into someone else’s investment: your rent is a sunk cost, and you won’t see returns on it further down the line.

When you own, providing the price of the property you buy stays the same or increases over the long-term, you can think of your home as a savings pot.

Let’s say you’re paying £500 each month for your mortgage repayments. £200 of that is interest that goes to the lender, and £300 is a capital repayment that pays off your mortgage. In 5 years, you would have £18,000 stored up in property equity, simply by paying your mortgage. And that's not even factoring in potential house price gains too! So if you can afford to buy now, it is often better to buy sooner rather than wait for the "perfect" moment.

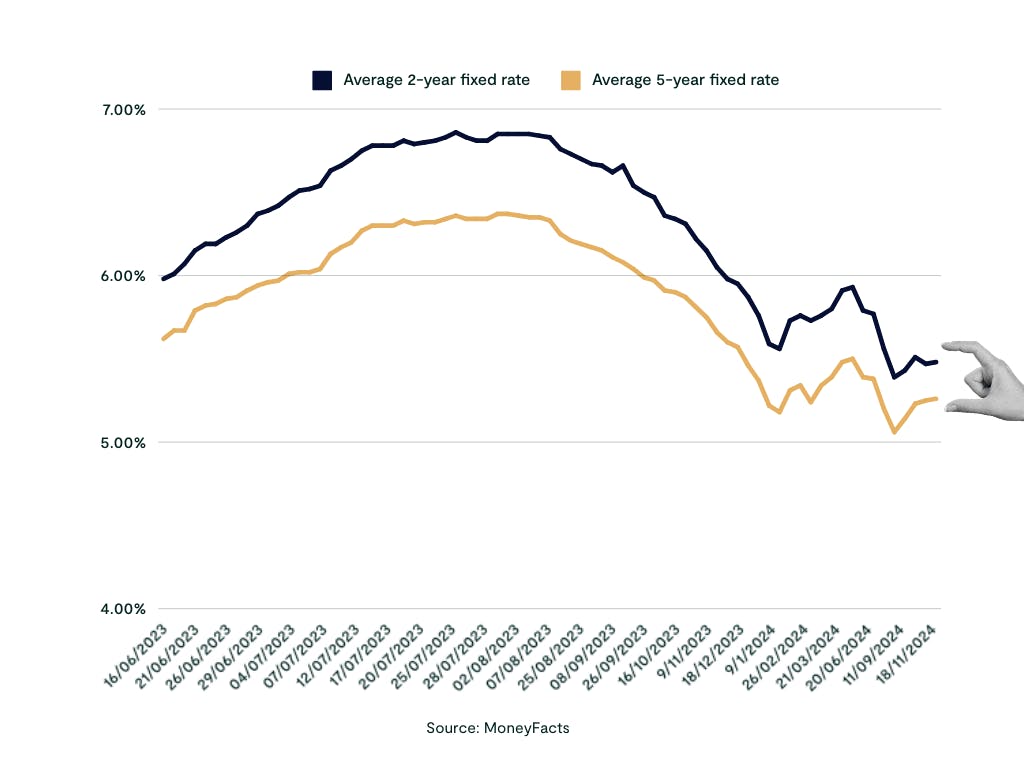

3. Interest rates are higher right now, they have been at historic lows

There’s no doubt that interest rates have been dominating headlines recently. Now, the average two-year fixed rate stands at 5.48% - a very substantial increase from the average 1.76% interest rate for two-year fixed deals back in 2020. While this may seem scary, take a minute to consider the wider picture. Firstly, these are not record-breaking rates: buyers in the 80s were faced with average interest rates of 16.63%! But more importantly, we should bear in mind that interest rates have been at historic lows since the pandemic, and the sub 2% mortgages we became used to in 2020-2021 are not ‘normal’.

Interest rates are accurate as of January 2025.

4. Understand what’s possible: know your mortgage affordability

Everyone’s circumstances are different, and it might be better for you to hold off on the house hunt and keep renting for a while. Or it might not. The key here is to understand what’s affordable for you.

Use a quick mortgage calculator to work out how your mortgage repayments would stack up vs what you pay in rent. If it’s similar, or even slightly more - ask yourself if the number is affordable for you. Remember that any mortgage calculator only gives you a general idea of your affordability. To truly understand what you could afford, as well as all the ways you could boost your budget, create a free mortgage recommendation online today.

Your credit history has never been more important

In tough times lenders tighten up their eligibility around what credit mishaps are acceptable. So be sure to review your credit file from one or all of the credit reference agencies (Equifax, Experian and TransUnion) before you apply.

Remember, short-term volatility should not put you off buying your first home. Consider the long-term benefits of homeownership, what the alternatives are for you and suss out what you can afford in order to make a reasoned decision.

On average, our customers boost their budgets by £88,000

Discover how you could make home happen today by creating a free mortgage recommendation. You'll see all the ways you could get on the ladder, plus personalised interest rates and indicative monthly repayments.

I’m a homeowner. What’s the best thing to do to protect myself?

Whether your current mortgage deal is expiring in the next few months, or not for another year, this is a time of anxiety for homeowners. Monthly costs are increasing significantly, particularly for those borrowers who secured ultra-low rates in 2020.

But, you’ll be glad to know that there are plenty of options out there:

1. Consider a variable or tracker mortgage

Traditionally, fixed-rate mortgages have been much more popular in the UK - in fact, they make up 74% of active mortgages in the UK. But with market uncertainty pushing up fixed-rate deals into the region of 4%-5%, variable rates offer a solution for those looking to keep their repayments low.

A variable mortgage rises and falls in line with an index - usually the base rate. So if the base rate increases, so does your mortgage interest rate. You don’t know exactly what you’ll be paying each month, so it is a riskier product for those who like certainty.

Plus, some lenders don’t charge early repayment fees. So if in a few months, fixed-rate mortgages are looking more attractive, you can exit your tracker mortgage and move on to something more predictable.

2. Hold a fixed-rate mortgage offer for six months

At Tembo, if you apply for a new remortgage deal up to 6 months before your current deal ends and rates go down in that time, simply get in touch with your advisor and we will re-apply for you. That way, if rates drop you can benefit from the more affordable deals, and if rates rise you've already locked in a new deal to remortgage onto.

Learn more: Are interest rates going down?

You might also like: What to do if you can't remortgage due to affordability

3. Remember mortgages are more flexible than you might think

If the cost of living crisis is biting and you’re struggling to pay your mortgage, keep in mind that mortgages are much more flexible than you might think, and repossession is a last resort for a lender.

We've listed out some of the options that might be open to you below:

Offset mortgage

If you want to reduce the amount of interest you pay on your mortgage, and you have savings, an offset mortgage could be a great option to keep monthly payments low.

An offset mortgage essentially links your mortgage with your savings account. The lender will take away the amount in your savings account from what you owe on your mortgage. You’ll only pay interest on what’s left.

Read more: What is an offset mortgage?

Mortgage payment holiday

You could approach your lender and ask for a temporary mortgage payment holiday. You might remember payment holidays being spoken about a lot during the COVID pandemic. It is an arrangement between you and your lender that allows you to stop or reduce your mortgage repayments for an agreed period of time.

Note that your lender doesn’t have to agree to your request, and it’s not automatic, so never stop paying without speaking to your lender first.

Mortgage porting

If you’re concerned about the long-term impact of rising interest rates, you could also look to port your mortgage to a new property and downsize. This would provide you the opportunity to reduce your borrowing, or make use of some of the equity you’ve built up in your old home, say, to put it into your savings account.

Check the terms and conditions of your mortgage, and also do some research into your lender to get a feel for whether this could be a possibility for you.

Read more: What is porting a mortgage?

You might also like: What help are mortgage lenders giving to struggling borrowers and homeowners?

What would you do if you were in my situation?

At the end of the day, the decision is yours to make. Regardless of what’s happening in the market, you need somewhere to live. But whether that’s through homeownership or renting is a decision for you to make after considering the pros and cons of both.

So, we can’t make the choice for you. But we can help you on your way; the best piece of advice, whether you’re a first-time buyer or a seasoned homeowner, is to seek expert advice. The mortgage market has never been more volatile or unpredictable, but an entire industry of experts exists solely to ensure that you can get the best possible deal.

Many mortgage brokers (including Tembo) don’t charge a fee for their service until you get a mortgage offer from a lender. So, try not to rush into a decision, and get all the free advice you can from a professional first.

Need help getting on the ladder?

Don't go it alone. Speak to a mortgage expert today so you can make an informed decision. Create a free Tembo plan to get your own personalised mortgage recommendation and be able to book in a call with one of our award-winning team.