Are rates going down?

There’s been a lot of talk about mortgage interest rates over the last few months - it’s been almost impossible to watch the news without there being some mention of mortgages, inflation or the Bank of England’s base rate. With so much noise, it can be difficult to know what exactly is going on, and which way interest rates are going. Are rates going down? How long will interest rates stay high? To set the record straight, we’ve answered all your burning questions in this helpful guide.

Will interest rates go down?

Yes, it’s likely that interest rates will go down - in fact, some mortgage lenders have already cut rates and with the most recent data showing inflation has declined slightly, we could continue to see rate reductions over the rest of 2025. However, as the economy goes through periods of high and low inflation, interest rates will inevitably change. If inflation stays at a level that the Bank of England deems appropriate, it will continue to lower its base rate. This will have a further knock-on impact on the interest rates charged by other lenders, and should in theory result in interest rates going down even more. But if inflation remains stubborn, this could result in the base rate staying higher for longer, impacting mortgage rates.

When will rates go down?

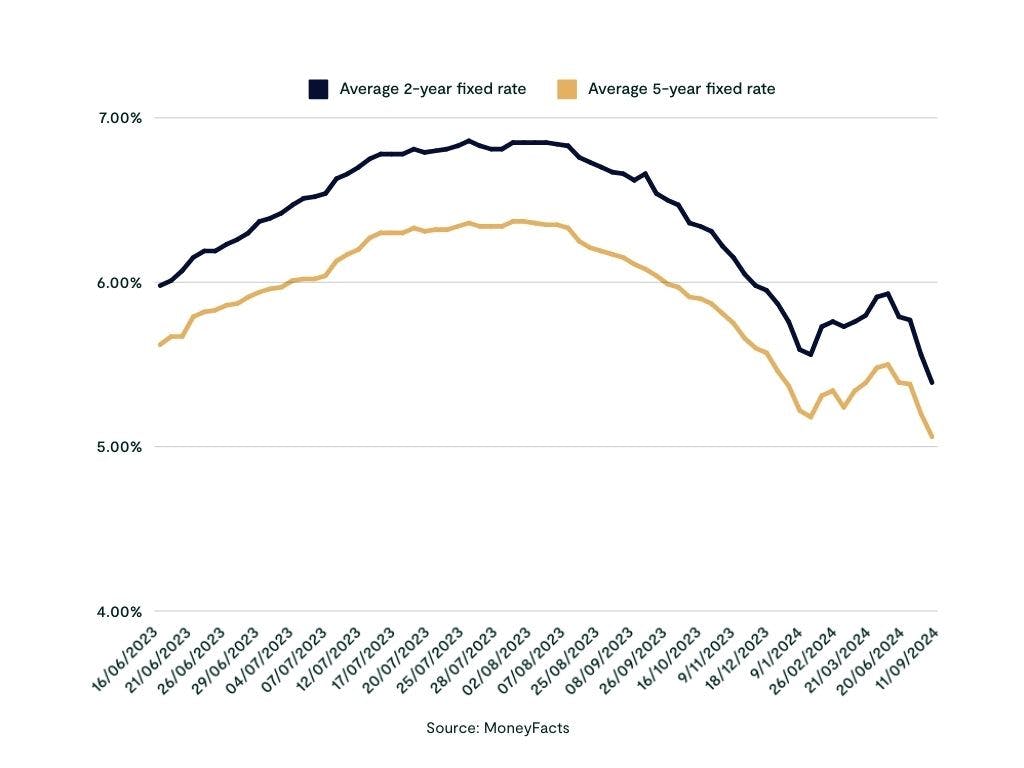

Interest rates have already peaked, and are likely to come down further in the next couple of months. The average 2-year fixed mortgage rate is now 5.48%, while the average 5-year fixed rate is 5.26%. It's likely interest rates will reduce further over the coming months, as the Bank of England is likely to lower its base rate again.

Interest rates are accurate as of January 2025.

How long will interest rates stay high?

How long interest rates will stay high depends on how the economy performs. The Bank of England consecutively increased the cost of borrowing through repeated base rate rises over 2023, which has caused lenders to raise their own interest rates. Currently, the base rate is 4.75%, and interest rates are averaging 5.48% for 2 year fixed rate deals and 5.26% for 5 year fixed rate deals. But, the base rate is expected to come down gradually over the next couple of months. So while interest rates could stay high this year, they should continue to gradually move downward in response to the base rate decreasing.

However, it’s important to keep in mind that the ultra-low rates seen over the last few years are unusual. When you look at the last 30 years, interest rates between 4-5% are the norm, while periods of sub-4% are rare. Although interest rates are currently above 5%, once we reach levels of below 5% again then interest rates can be considered back to a “normal” level.

If you are holding onto hope that rates will go back to the 1-3% deals seen during the pandemic before buying a home, you might be waiting a long time. Instead, consider ways to make your mortgage repayments more affordable through things like a longer mortgage term, bigger deposit, or boosting your mortgage affordability to get access to lower rates.

Working out the best way for you to get on the ladder or remortgage to a new deal can be a minefield if you’re trying to suss it out yourself. That’s why it’s always best to get expert advice to find the best option for you. We’ve helped thousands of buyers and remortgagers discover how they could boost their mortgage affordability to buy sooner or remortgage onto a new deal.

Interest rates are accurate as of October 2024.

See what you could afford today

Discover how much you could afford to borrow, or how you could remortgage through creating a free Tembo recommendation. Our smart tech will generate a free, personalised recommendation from over 20,000 mortgage products and 17 budget-boosting schemes - in seconds. You can then book in a free, no-obligation call with one of our award-winning advisors to talk through your options.