Tracker or fixed rate mortgage: Which one should I choose?

If you’re applying for a mortgage soon or you’re looking for ways to get a lower interest rate, one of the key choices you’ll need to make is deciding between a tracker or fixed rate mortgage. But which one should you choose?

What’s the difference between fixed rate and tracker mortgage?

The key difference between fixed rate and tracker mortgages is what happens to your interest rate over the course of your mortgage deal. With a fixed rate mortgage, your interest rate (and therefore your monthly repayments) are fixed for a set period of time - usually 2, 3, 5 or 10 years.

With a tracker mortgage, your interest rate usually tracks the Bank of England’s base rate, so your interest rate and monthly costs will rise and fall month to month in line with the base rate, which changes up to 8 times a year.

The amount of interest you’ll actually pay on a tracker mortgage is usually a little higher than the base rate, because lenders usually add an additional percentage for themselves. For example, if the base rate stands at 5.25% and your lender charges a 0.75% margin, you’ll pay 6% interest. If your lender charges a 1% margin, your interest rate would be 6.25% as long as the base rate stays in its current position.

Learn more: What happens when my fixed-rate mortgage ends?

You might like: The inside scoop on rising interest rates

Is a fixed rate or tracker mortgage better?

Whether a fixed rate or tracker mortgage is better depends on your individual circumstances. Some people are better off choosing a fixed-rate mortgage deal while other people would be well suited to a tracker mortgage. The right mortgage type for you will depend on your finances, goals and outlook on money and risk.

Fixed-rate mortgages can offer you protection from future interest rate rises because no matter what happens to the Bank of England’s base rate, the amount you’ll pay during the term will stay the same. A fixed rate deal can also give you peace of mind if you prefer knowing exactly how much you’ll be paying each month, regardless of what’s going on in the mortgage market.

However, once your fixed period ends, you’ll be moved onto your lender’s standard variable rate (SVR). The SVR will vary from one lender to another, but it’ll usually be influenced by the base rate, and is often higher than the rates offered on fixed rate or tracker rate mortgages. If the base rate goes up, lenders tend to increase their SVR to reflect the increased cost of borrowing. These increases aren’t always in line with the BoE’s rise, though.

Plus, if interest rates drop during your fixed rate term, you could be paying a higher rate than what’s currently offered on the market. However, leaving your fixed rate deal early could see you paying fees such as an Early Repayment Charge (ERC), so switching early to benefit from lower rates could be costly.

In comparison, with a tracker rate mortgage you won’t have the certainty of knowing exactly what your monthly costs will be. If interest rates rise, your repayments will do. This could mean that your mortgage repayments become too high for you to afford.

However, if rates drop, those on a tracker rate mortgage will see their monthly costs fall, while those on fixed rate deals won’t benefit from the reduced rates.

The rate of interest on tracker rate mortgages are also often lower than those offered on fixed rate deals. So while it can feel unnerving not knowing how much your monthly costs will be month-to-month, a tracker mortgage could help you access lower rates during times of higher borrowing costs.

Learn more: What to do if you can’t afford to remortgage

See what you could be offered

To work out whether a fixed-rate or tracker mortgage is best for you, it’s best to speak to an expert. Get started by creating a free Tembo plan today. We’ll send you a personalised recommendation, showing you how much you could borrow and what mortgage rates you can expect.

Pros and cons of fixed rate mortgages

Pros

Protection from future interest rate rises

Easier to budget and plan ahead

Peace of mind

Cons

Fixed-mortgage rates are often a little higher than tracker rates

If interest rates fall, you’ll be tied into a more expensive deal

If you want to switch to a new deal early, you’ll usually have fees to pay

Pros and cons of tracker rate mortgages

Pros

Your rate will likely only change if the Bank of England changes the base rate

Tracker mortgage rates are usually lower than fixed rates

Cons

If the base rate rises, your repayments will too

Your mortgage payments could become unaffordable if rates rise significantly

Should I get a fixed rate or tracker mortgage?

Whether you should get a fixed rate or tracker mortgage depends on your own personal circumstances and goals. You also need to take into account what’s going on in the mortgage market and economy to make an informed decision. This is why it’s beneficial to get expert advice from an experienced and trusted mortgage broker, who can advise you on the best course of action for you.

The Bank of England has increased the base rate 14 times in a row, bringing it from 0.10% in December 2021 to 5.25% today. This has resulted in interest rates climbing, although more recently some lenders have begun to reduce their rates. If the base rate rises further in a bid to tackle inflation, mortgage rates could follow, but no one can say for certain what will happen in the future.

During times of rising interest rates, some people opt for a fixed-rate mortgage to give them peace of mind. If you take out a fixed-rate deal, you’ll have protection from future rises. You’ll know exactly how much you’re paying each month and you won’t need to worry about your mortgage becoming affordable if the Bank of England increases the base rate again.

However, locking into a fixed-rate mortgage for a long period of time can work out more expensive if interest rates fall during the course of your mortgage term. You could find yourself paying more for your mortgage than you would have if you’d chosen a tracker and your repayments reflected positive changes in the economy.

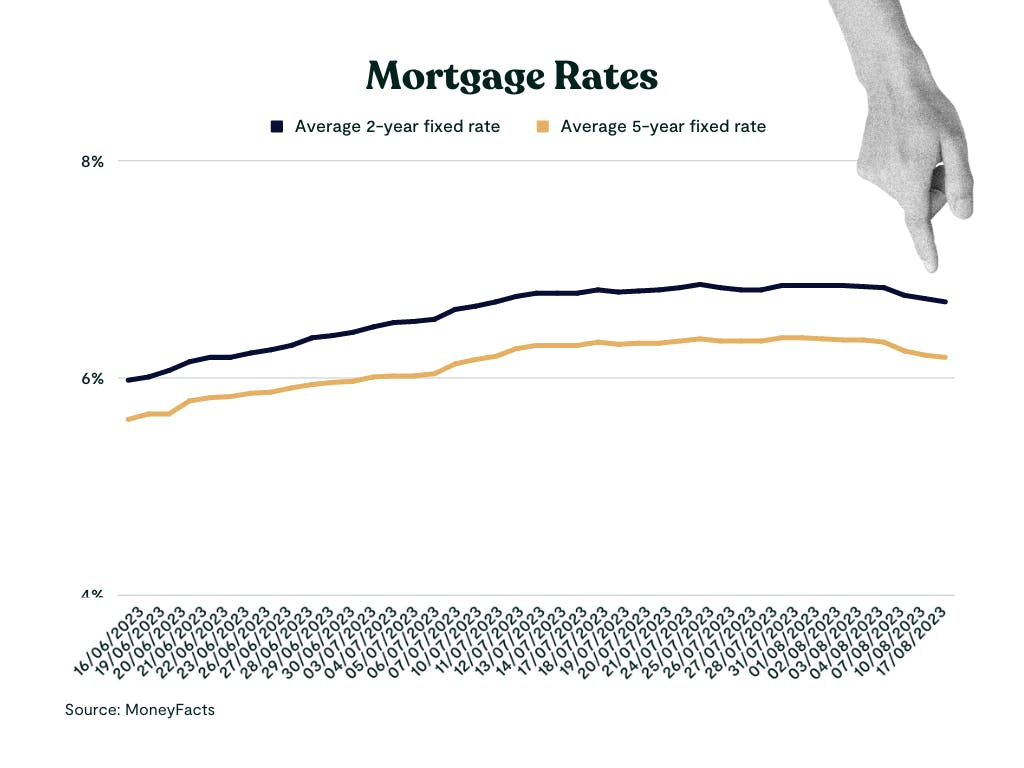

As the chart below shows, mortgage rates have been rising over the last couple of months, and although they could rise higher than they are today, there are some early signs that they might have peaked, and could start to come back down. If you locked in a fixed rate now, only for rates to fall, you could end up with a higher interest rate, making your monthly costs more expensive.

Learn more: What is the inflation rate and how does it affect your mortgage?

Should I switch my tracker mortgage to a fixed rate?

If you currently have a tracker mortgage and you’re worried about rising interest rates, switching to a fixed rate mortgage can give you certainty in the coming years. If you’re risk averse and fixed payments will help you sleep at night, a fixed-rate mortgage may suit you well. However, if rates go down, you could end up with a higher interest rate than what’s currently available. It’s always best to speak to an expert about your options to help you make the right decision for you.

Get expert advice from our award-winning team

It can be hard to work out whether to fix your mortgage and if so, how long to fix it for. That’s why it’s best to speak to a mortgage expert before making a decision. Here at Tembo, a member of our award-winning team can advise you on the best course of action for your personal circumstances.

Why Tembo?

We specalise in helping buyers, movers and remortgagers boost their mortgage affordability so they can buy sooner, or get access to a better mortgage deal. It's why we've been voted the UK's Best Mortgage Broker four years running.