Lifetime ISAs in the spotlight: What the Treasury Committee report means for you

A Lifetime ISA is a special ISA savings account designed to help first-time homebuyers and retirement savers save up for a first house deposit or retirement faster. But this financial tool has come under some criticism in the last few days following the Treasury Committee's latest report. Here’s what you need to know about the Treasury Committee's recent report, our take on the findings, and how it all impacts you.

Save with the market-leading Cash Lifetime ISA

Save up to £4,000 each tax year and get a free 25% bonus on top of your savings, up to £1,000. Plus, with the Tembo Cash Lifetime ISA, you'll earn 4.52% AER (variable) on your savings - that's hundreds more in interest towards your house fund vs saving with the closest competitor!

The Treasury Committee recently raised some questions about how Lifetime ISAs work – particularly around things like withdrawal charges and whether the product is working as well as it could for first-time buyers.

It’s important to know: your savings and government bonus are still safe. There are no changes to the Lifetime ISA rules right now, and if anything does change in future, we’ll let you know well in advance and help you understand what it means for your goals.

We believe the LISA is still one of the most powerful tools for first-time buyers – and we’re keeping a close eye on the conversation to make sure your voice is heard. For now, let’s cover what the report covered and what this means for you.

By saving into a LISA instead of enrolling in or contributing to a pension, you may lose out on contributions by an employer (if any), and it may affect your entitlement to means-tested benefits. Tax treatment depends on individual circumstances and may be subject to change in the future.

The Lifetime ISA has proven that it helps first time buyers to get a foot on the property ladder, in what is a very challenging market. The government has ambitions to build 1.5m homes, so it is critical that they also provide ways for people to finance them, particularly those on lower incomes whom the Lifetime ISA has been particularly effective at helping to date.

Richard Dana

CEO of Tembo

Lifetime ISAs' dual purpose causing confusion

The Treasury Committee’s report suggested that the Lifetime ISA’s dual purpose - saving for your first home or for retirement - might be causing some confusion for savers. While flexibility is a big plus of Lifetime ISAs, some people aren’t always sure how to make the most of it. MPs noted that this can sometimes lead to uncertainty around how to use the product, or which savings or investment approach is right for them.

Cash Lifetime ISAs are a great way for aspiring home buyers to save in the short term, getting a free 25% boost every year they save. But for those using a Lifetime ISA as a way to save for retirement, they could potentially miss out on higher returns from investment avenues such as bonds and equities over the long term. However, the report did acknowledge how the Lifetime ISA is a useful option to save for retirement for the self-employed.

Our take? There’s an opportunity for the government to explore how the Lifetime ISA could be made even clearer and more effective for savers. That might include offering more tailored guidance or flexible options depending on whether someone’s saving for a first home or for later life. Clearer rules and more choice could help savers feel more confident and in control - especially those using a LISA for long-term investing.

Read more: A guide to mortgages for the self-employed

A Lifetime ISA must be open for at least 12 months before being used to buy a home. Withdrawals for any purpose other than buying a first home (up to a value of £450,000) or for retirement incur a 25% government penalty, meaning you may get back less than you paid in.

Withdrawal penalty defended as "necessary"

One of the most contentious features of the LISA is its early withdrawal penalty. If account holders withdraw funds for anything other than an eligible first-time home purchase or retirement, they face a 25% penalty. While this is designed to deter misuse, the fine not only removes the government’s 25% bonus but also cuts into the saver’s own contributions, effectively a 6.25% penalty on personal savings.

So far, the Treasury Committee has defended the withdrawal penalty as a necessary deterrent against misuse. In the words of Economic Secretary to the Treasury Emma Reynolds, the withdrawal charge aligns with penalties in other long-term savings products like pensions.

Our take? The penalty is overly harsh, especially for those facing emergencies or those purchasing their first homes in more expensive areas. At Tembo, we are on a mission to help the next generation reach their life milestones, like getting on the property ladder. We believe that savers, especially the younger generation who are already facing significant financial hurdles, shouldn't lose their own money if they need to dip into their LISA in the face of major life changes such as job loss.

Changing the withdrawal penalty so savers only lose the 25% bonus - and not their own money - could be the solution. That way, there is still a deterrent to misusing LISAs, without savers losing their own hard-earned cash.

Read more: What is an emergency fund and why do you need one?

Calls to raise the outdated house price cap

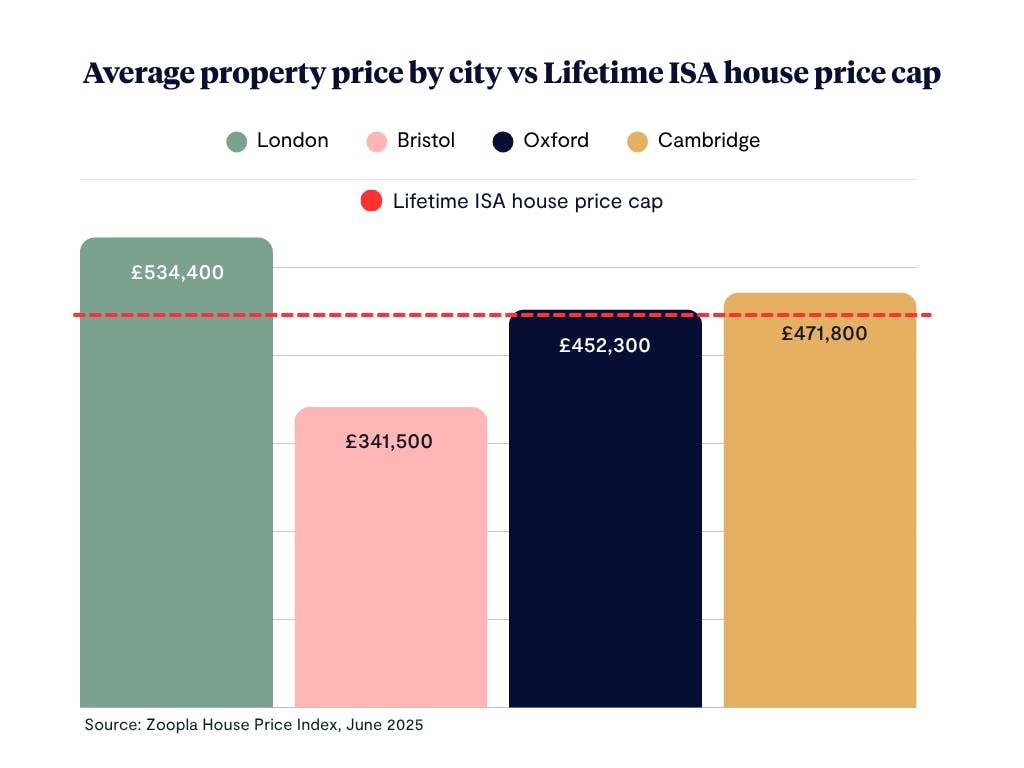

Since its introduction in 2017, the LISA’s property price cap for eligible homes - set at £450,000 - has remained unchanged. This is despite property prices, particularly in London and the South East, rising by 31%. That means that if the Lifetime ISA house price cap had kept pace with house prices, the cap would now be almost £590,000.

Instead, the current cap has remained, no longer reflecting the realities of today’s housing market. Figures show that the average first home in London now costs over £511,000, leaving many diligent savers unable to use their LISAs without incurring penalties.

Our take? There could be thousands of first-time buyers missing out on using a Lifetime ISA because of this outdated cap. From our own data, we know that first-time buyers using a Lifetime ISA purchase four years earlier than those who don't.

On average, it takes a decade to save up a house deposit, so cutting down this time by almost half is a significant helping hand for first-time buyers! But despite this, only 1 in 6 first-time buyers use a Lifetime ISA. Raising the cap to £500,000 or even £600,000 would better support those purchasing in more expensive areas.

You might also like: How to get a mortgage with only a small deposit

Impact on lower-income earners

The Treasury Committee’s report also raised concern that LISAs may disproportionately benefit higher earners while missing their mark for those most in need. The report highlighted issues such as the impact of a LISA on benefit eligibility (e.g. Universal Credit or Housing Benefit). This may mean savers may unknowingly compromise their future financial support by choosing a LISA over alternative savings instruments. This has led to calls for clearer labelling of LISAs as potentially unsuitable for individuals who could require public financial aid at any stage in their lives.

What does this mean for you?

Right now, there are no changes to the Lifetime ISA – this is simply a government review looking at how the product could work even better for savers. If you're using a LISA to save for your first home or for later life, it’s a great moment to check in on your goals and make sure your savings are working hard for you. Here's how to stay on track:

- Know the rules: If you’re using a LISA, particularly for home buying, keep the £450,000 cap in mind to avoid unexpected penalties. With house prices changing in some areas, it’s smart to factor this into your budget early.

- Explore your options: Your goals and timeline are unique - and while the LISA is a valuable part of the picture, other products like high-interest Cash ISAs, Fixed Rate ISAs, or workplace pensions might also support your plans, depending on what you're aiming for.

Read more: How much pension do I need?

Share and stay ahead

The Treasury Committee’s report has sparked a wider conversation about the future of savings in the UK. With reforms potentially on the horizon, it’s more crucial than ever to stay informed and updated. Share this post with your friends and family to help more people understand the implications of using a Lifetime ISA, and keep an eye out for updates from us on the government’s impending ISA reforms!

Want to start saving towards life's big milestones?

Download the award-winning Tembo app today to kickstart your savings journey. Whether you're looking to save for your first home or for your next big adventure, we're here to help you every step of the way.