Why is it hard for first-time buyers?

You might have heard people say that it’s harder for first-time buyers to get onto the property ladder today in comparison to previous generations. But why is it so difficult for first-time buyers to buy homes, and what can you do to finally make home happen? Find out in this guide.

Why is it so hard for first-time buyers?

Today, first-time buyers are facing a two-sided problem. House prices have risen substantially over the last few decades, outpacing wage growth. At the same time, first-time buyers are also having to contend with high living costs, even on a good salary. This is making it harder to save enough money for the down payment on a home, as well as borrow enough for a mortgage when house prices are 10x incomes.

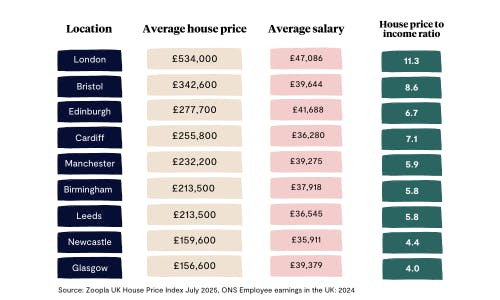

Currently, the average UK house price is just under £270,000, meaning that a first-time buyer wishing to put down a 10% deposit would need to save almost £27,000. But for some first-time buyers, they’ll need to save substantially more than this. First-time buyers in London hoping to put down 10% will need £53,400, based on the average home costing £534,000.

While in Newcastle, one of the most affordable locations in the UK, the average home is £158,000, making a 10% deposit £158000. But even this is no small fund to save up, and is impacted by how much aspiring first-time buyers in that area can save. In Newcastle, the average salary is £35,911, making the average house price equivalent to 4.4x incomes.

Here’s a table which illustrates the difference between the average salary and average house price in different parts of the UK:

This isn’t helped by the cost of living, which has disproportionately impacted younger generations. High rental costs, rising bills and groceries are just some of the expenses which eat into the ability for someone to put money aside each month. Plus, unlike previous generations where substantially fewer people went to university, around 40% of millennials graduated from university and now pay student debt monthly alongside other living costs. This is why millennials today are worse off than their parents at the same stage of life. It’s no wonder it takes 10 years on average to save up a deposit, and the average first-time buyer is now aged 34!

But saving a deposit is only half the battle, with many first-time buyers struggling to borrow enough due to strict affordability criteria and high property prices. When you apply for a mortgage, the lender will carry out a series of checks to make sure you can comfortably afford your mortgage payments. The last thing anyone wants is for you to get into financial trouble and be unable to pay your loan.

Affordability criteria can vary from one lender to another, but your lender will usually want to see proof of income (in the form of pay slips or tax returns) and proof of your typical expenditure (bank statements).

Many lenders also use something known as ‘income multipliers’ to determine exactly how much to lend you. Most will multiply your income by 4 or 4.5 to get your total loan amount, meaning you may be eligible for a £200,000 to £300,000 mortgage if you have an income of £50,000. You may be able to borrow more than this if you qualify for a Professional mortgage or a 5x or 6x Income mortgage.

If you’re unable to get a mortgage big enough for the home you want or you’ve been rejected completely, here are a few ways to boost your affordability, which we cover below.

Learn more: Why are banks tightening their lending standards?

Why are house prices so high in the UK?

Since the 1970s, house prices in the UK have risen by 318%, significantly outpacing wages, which have only grown by 94% over the same time period. This has been helped by a lack of new housing supply being added to the market. It’s estimated that there’s 4.3 million homes missing from the UK housing market. This means that over time, the homes that are on the market have gone up in value quicker than wages, making getting on the ladder more and more unaffordable. In fact, the average first-time buyer mortgage payment has increased by 61% in 5 years, rising from £667 in 2019 to £1,075 in 2024.

What solutions are there for first-time buyers?

Saving a deposit can be really challenging, no matter where you live. Thankfully, there are a few things you can do to boost your deposit and even reduce the amount you need to begin with.

1. Open a Lifetime ISA

If you’re saving for your first home, a Cash Lifetime ISA (LISA) can help you boost your deposit by up to £1,000 each tax year for free - and you’ll earn interest on top. Keep in mind that you can only use your Lifetime ISA funds for your first house deposit for a home worth no more than £450,000, or for retirement. If you buy a more expensive home or make a withdrawal before the age of 60 for anything other than an eligible property, you’ll pay a 25% withdrawal penalty.

You can save up to £4,000 in your LISA each tax year and get a 25% bonus from the government on any funds deposited. So if you can’t deposit the full £4,000, you don’t worry as you’ll still earn 25% on top of whatever you save. You can open a Tembo LISA today with as little as £1!

Save faster with the market-leading Lifetime ISA

Save up to £4,000 per tax year in our Cash Lifetime ISA and earn a market-leading interest rate (variable). Plus, get a 25% government bonus of up to £1,000 per tax year to boost your first home deposit or retirement pot. Download our app and start by adding just £1.

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in. Tax treatment depends on individual circumstances and may be subject to change in the future.

2. Consider a Shared Ownership scheme

Another option is Shared Ownership, which you can use whether you have a Lifetime ISA or not. Shared Ownership is a part buy, part rent buying scheme that lets you buy a percentage of a property and pay rent on the rest. As you’re not buying the property ‘in full’, you’ll need a much smaller deposit and mortgage than you usually would. You can then increase your share of the property over time, making it easier to transition from renter to homeowner without having to save a 10% deposit for the full property price upfront.

Perfect for you: What is shared ownership and how does it work?

3. Boost your deposit with family support

If a homeowning friend or family member wants to help you buy a home of your own, a Deposit Boost could be the answer. It typically involves remortgaging their home to release money tied up in their property, the proceeds of which you can then put towards your house deposit. If you have savings of your own, you can include them too in your deposit, or put them towards other homebuying costs such as conveyancing fees or Stamp Duty, if applicable.

Plus, by putting down a bigger deposit, you can often access better interest rates by lowering your Loan to Value (LTV), which could lower your mortgage payments, making them more affordable.

A Deposit Boost is just one of many low-deposit mortgage options. Create a free Tembo plan today to find out which first-time buyer schemes are most suitable for you from across the market without applying.

4. Add a loved one’s income to your mortgage

If you’re struggling to borrow enough for the home you want, an Income Boost could be the answer. Officially known as a ‘Joint Borrower Sole Proprietor’ mortgage (you can probably see why we don’t call it that), an Income Boost lets you add some or all of a loved one’s income to your mortgage application. This helps to boost your affordability by increasing the total income lenders will then use to work out how much to lend you. This is how an Income Boost can help you get a bigger mortgage.

Let’s imagine you’re a single homebuyer with a salary of £30,000 a year and you’ve been offered a mortgage worth 4.5x your income, giving you a maximum loan amount of £135,000. This might not be enough to buy your own home, especially if you have a small deposit or you want to buy in an expensive location.

Now let’s imagine your Mum earns £50,000 a year and wants to help you get on the ladder, without gifting you a hefty deposit. By adding her name and income to the mortgage, you could potentially boost your mortgage amount to £360,000. That’s your combined income of £80,000, multiplied by 4.5.

Although your ‘Booster’ will be added to the mortgage, they won’t be named on the property itself. They also won’t need to contribute to your monthly repayments automatically. But if you’re unable to keep up with your mortgage yourself, they will be required to help.

5. Look at higher lending schemes

For some borrowers, they may be able to increase what they can borrow for a mortgage through higher lending schemes, helping them to borrow 5 or even 6 times their income. These schemes include Professional Mortgages for roles such as accountants and solicitors, Key Worker and NHS Mortgages, as well as 5x Mortgages and 6x Mortgages for borrowers who meet certain criteria, such as earning a certain income.

When you create a free Tembo plan, we compare your eligibility to schemes like these, as well as thousands of mortgages from across the market. Make your free plan here.

6. Make your mortgage more affordable

Lenders have a responsibility to only offer mortgages to those who can afford to pay them back, but even so, some borrowers find that their mortgages become less affordable over time. This can be due to rising interest rates, a change in their income, or a breakup/divorce, for example. There are a few ways to protect yourself, for example you could lengthen your mortgage term, or switch to an interest-only mortgage.

Back in the day, most mortgages came with a 25-year term, but as property prices have risen (and wages have failed to keep up), terms of 30, 35 and even 40 year mortgage terms have become a lot more common. Spreading your mortgage over a longer term will help to reduce your monthly repayments and could increase your affordability, but be aware that by doing this, you’ll also spend more on interest in the long run.

Switching to an interest-only mortgage can be a way to make your mortgage payments more affordable in the short term. Instead of paying off some of your mortgage loan and interest to your lender each month, you’ll only pay back the interest. This can significantly reduce your monthly costs each month. But remember that unless you switch back to repaying your mortgage debt and interest, at the end of the mortgage term, you will have the full mortgage loan, which will still need to be repaid. This is why interest-only mortgages should be viewed as a short-term solution when you’re struggling financially.

See what you could afford today without applying

Find out all the ways you could buy through our unique online Fact Find. At the end, you‘ll get a personalised mortgage recommendation, showing you all the ways you could make home happen, plus indicative interest rates and monthly costs. Plus, it’s totally free!