What is shared ownership and how does it work?

If saving a big deposit or getting a big enough mortgage feels impossible, shared ownership could be your route onto the property ladder. It’s a home-buying scheme that lets you buy part of a property and pay rent on the rest, helping first-time buyers and home movers afford a home sooner.

In this guide, we’ll explain what shared ownership is, how it works, and whether it’s a good idea for you.

In this guide

- What Is Shared Ownership?

- How does Shared Ownership work?

- Who is eligible for shared ownership?

- Is shared ownership only for first-time buyers?

- Things to consider before you buy

- How much deposit do I need for shared ownership?

- Do you need a mortgage for shared ownership?

- Can you make a profit on shared ownership?

- Are shared ownership properties hard to sell?

- Is it a good idea to buy shared ownership?

What Is Shared Ownership?

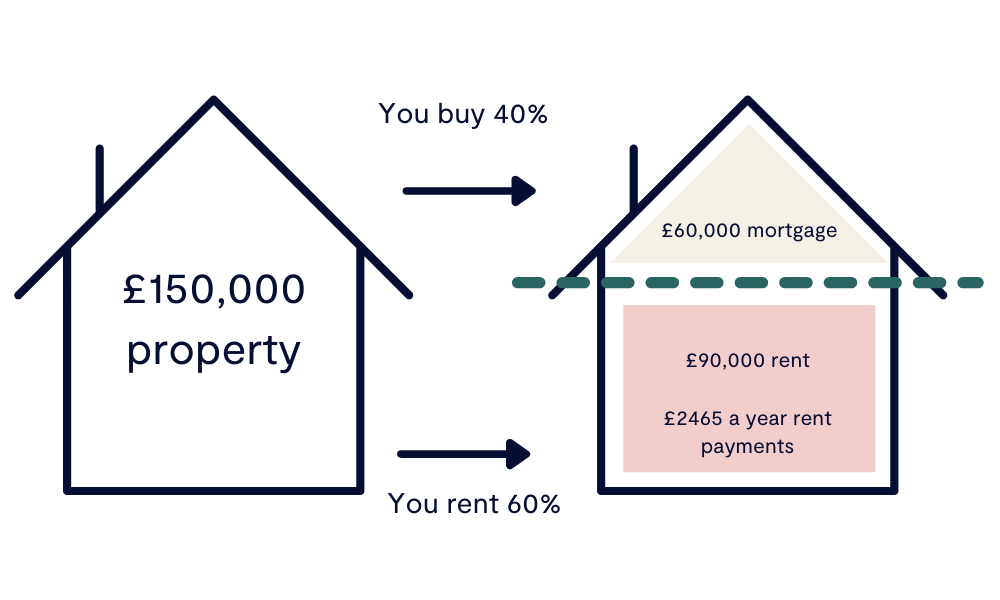

Shared ownership - sometimes called part buy, part rent - allows you to buy a share of a property, usually between 10% and 75%, while paying rent on the rest to a housing association or private landlord.

Because you’re only buying a share of the home, you’ll need a smaller deposit and lower mortgage than if you were buying the traditional way with a deposit and a mortgage. This makes shared ownership a more affordability option for people who are struggling to save a big enough deposit, or have been priced out of buying in expensive areas such as London and the South East. Plus, over time you can buy more shares in a process called "staircasing" until they own the property fully.

Learn more:How to buy a house with no deposit

What is shared ownership and how does it work?

How does Shared Ownership work?

The traditional way of buying a home involves putting down a deposit, normally equivalent to 10-20% of the total house value, then using a mortgage to cover the rest. When you buy through shared ownership, however, getting on the property ladder becomes much more affordable. Here’s how it works:

- You purchase a share of a property, typically between 25% and 75% (but there are schemes where you can purchase just a 10% share).

- Your share in the property will be made up of a deposit, and a mortgage for the share you are buying.

- You’ll then pay rent each month to the housing association on the portion of the property they own. The rent is often subsidised and below market value.

- You’ll also may be responsible for service charges, ground rent, and maintenance costs, even though you don't own the whole property. So be prepared to cover these costs too!

- Over time, you can buy more shares (either gradually or with a lump sum) until you own 100% of the property. If you staircase your way to full ownership, you’ll stop paying rent but you may still have a mortgage.

Here’s an example of how shared ownership might work:

- You buy a 40% share of a £200,000 flat (£80,000).

- You put down a 10% deposit for the share you’re buying (10% of £80,000 = £8,000)

- You take out a mortgage for the remainder of the share you buy (£80,000 - £8,000 = £72,000)

- You pay rent on the remaining 60% (worth £120,000) to the housing association.

See how Shared Ownership could help you buy sooner

Create a free Tembo recommendation to see what you could afford with Shared Ownership, as well as the other budget boosting schemes we advise on. It takes 10 minutes to complete and there's no credit check involved.

Who is eligible for shared ownership?

Whether you’re eligible for shared ownership depends on the scheme you go for, as there are differences between providers. But as a general rule of thumb, you may be eligible for shared ownership if:

- You meet the minimum income requirements. These vary from scheme to scheme; it can be as low as a minimum household income of £24,000.

- You can afford the minimum deposit amount. Again, these vary by provider. Some allow you to put down just a 5% deposit on the share you’re purchasing, others it’s 25%.

- The property meets the provider’s requirements, such as not needing major renovation, not having a value of more than £600,000, and not a new build. Some providers also exclude flats and listed properties from their eligibility criteria.

- Some of these schemes (e.g. StrideUp, Wayhome, Your Home) are Sharīʿah-law compliant, offering a compliant alternative for buyers looking for Islamic-friendly homeownership.

To see which shared ownership schemes you’re eligible for without applying, create a free Tembo plan today. It takes minutes, is completely free, and there’s no credit check involved. Start here.

Is shared ownership only for first-time buyers?

No, you don’t need to be a first-time buyer to use shared ownership. You can take out a shared ownership mortgage even if you’re moving house or you’ve owned a home in the past. However, if you currently own a property, you must be in the process of selling it to be eligible for the scheme.

If you’re unsure whether you qualify, create a free Tembo recommendation today. We’ll check your eligibility and show you all the schemes that could help to bridge the affordability gap.

Read more: How to get a mortgage with adverse credit

Key benefits of shared ownership

If you’re wondering whether the scheme is right for you, here are just a few of the key benefits of shared ownership:

- Smaller deposit: You only need a deposit for the share you’re buying, not the full property value.

- Lower monthly payments: Both your mortgage and rent are based on smaller amounts.

- Flexibility: You can increase your ownership over time through staircasing.

- Access to better areas: It can make homes in high-demand or expensive regions more affordable.

- Potential for growth: You can benefit from rising property prices on your share.

Things to consider before you buy

Shared ownership can be a great stepping stone, but it isn’t the right fit for everyone. Here are some things to keep in mind:

- Most shared ownership homes are leasehold, meaning you’ll pay service charges and ground rent.

- Your rent will usually increase each year in line with inflation.

- Selling can take longer, as the new buyer must also qualify for shared ownership too.

- You may need permission to make structural changes or to sublet part of your home.

- Stamp Duty still applies (though you can choose to pay only on your share initially).

Is shared ownership the same as renting?

No, there are a number of differences between shared ownership and renting. When you rent, you’ll be able to live in the property, but you won’t own a share of it. With shared ownership, you’re both a tenant and a part-owner.

That means:

- You build equity in your share as property prices rise.

- You have more stability than a tenant, as you can’t be asked to leave if you keep up payments.

- You can buy more of your home over time to reduce your rent.

So with the help of shared ownership, you’re investing in your future, not just paying someone else’s mortgage.

How much deposit do I need for shared ownership?

It depends, because your deposit is based on the share you’re buying, not the full price of the home. For example, if you buy a 25% share of a £200,000 property (£50,000), a 5% deposit would be just £2,500, which is a fraction of what you’d need to buy the full home. This makes shared ownership particularly helpful for buyers on lower incomes or with limited savings.

Do you need a mortgage for shared ownership?

Yes, you’ll still need a shared ownership mortgage to cover the portion you’re buying. Lenders will assess your income, deposit, and credit history just as they would for a standard mortgage.

If you’re not sure how much you could borrow, you can get a free Mortgage in Principle from Tembo in minutes, with no credit check required.

Can you make a profit on shared ownership?

Yes, it’s definitely possible to make a profit on shared ownership, just like with any other home purchase. If the value of your home increases, the value of your share rises too. That means when you sell your share, or staircase (buy more of the property), you could make a return on the portion you own.

For example, if your 40% share was worth £80,000 when you bought and that share is now worth £100,000, you’ve gained £20,000 in equity.

You can sell your shared ownership home at any time, as long as you’re able to find a suitable buyer who also meets the shared ownership criteria.

Are shared ownership properties hard to sell?

It can sometimes take a bit longer to sell a shared ownership property, since the new buyer must also qualify for the scheme. However, demand for affordable homes is high (especially in major cities), so it might be easier to find a buyer than you think.

Is it a good idea to buy shared ownership?

Shared ownership can be a smart choice if:

- You can’t afford to buy outright right now

- You have a smaller deposit or moderate income

- You want to buy in a more expensive area

- You plan to stay put for several years and eventually buy more shares

It might not be right for you if:

- You want full flexibility over renovations or renting out your home

- You’re planning to move again soon

- You prefer to avoid leasehold fees or rent increases

If you’re unsure, it’s worth speaking to a mortgage expert. At Tembo, we can show you how shared ownership compares with other schemes and help you find the most affordable route onto the property ladder.

Start your journey to homeownership today

At Tembo, we’re on a mission to transform homeownership. Our award-winning team are specialists when it comes to alternative ways to get on the ladder. To see how you could get on the ladder sooner with Tembo’s help, create your free recommendation today.