Guide to Stamp Duty in Wales

If you buy a house or flat in Wales, you may need to pay a tax on your property purchase called Land Transaction Tax (LTT). This is the Welsh equivalent of Stamp Duty. Find out how much Land Transaction Tax you’ll need to pay for your property purchase in this guide.

On average, we boost budgets by £88,000!

Voted the UK's Best Mortgage Broker four years running, we're specialists when it comes to helping home buyers disover their true buying budget.

Tax treatment depends on individual circumstances and may be subject to change in the future

Do you have to pay Stamp Duty in Wales?

While Stamp Duty applies in England and Northern Ireland, you may need to pay the Welsh equivalent of Stamp Duty, which is Land Transaction Tax (LTT). Land Transaction Tax works in a similar way to Stamp Duty, but the rules and rates are set by the Welsh Government, not the UK government.

How much is Stamp Duty in Wales?

The amount of Land Transaction Tax (LTT) buyers pay depends on the price of their chosen property and whether you’re buying a main residence (home that you’ll live in) or an additional property.

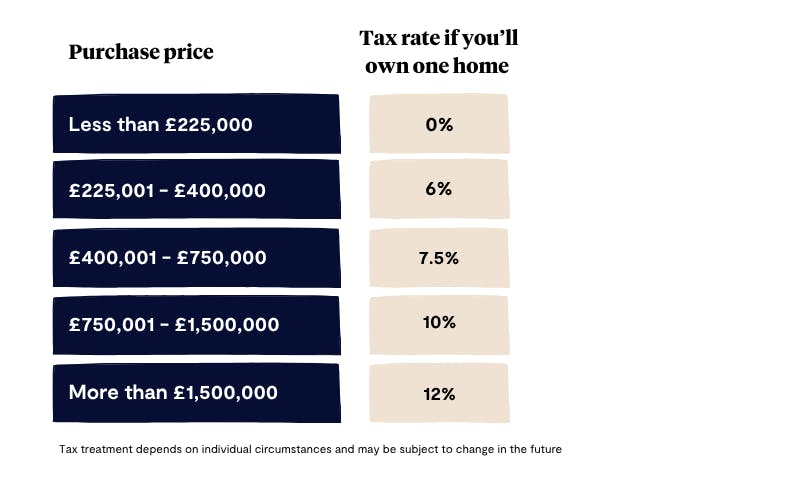

If you’re purchasing a home to live in, you’ll pay no Land Transaction Tax on any portion of the property up to £225,000. Here are the main 2025 Land Transaction Tax rates for a main residence; you can also use our Stamp Duty Calculator to see what you’ll pay.

- Up to £225,000: 0%

- £225,001 to £400,000: 6%

- £400,001 to £750,000: 7.5%

- £750,001 to £1.5 million: 10%

- Above £1.5 million: 12%

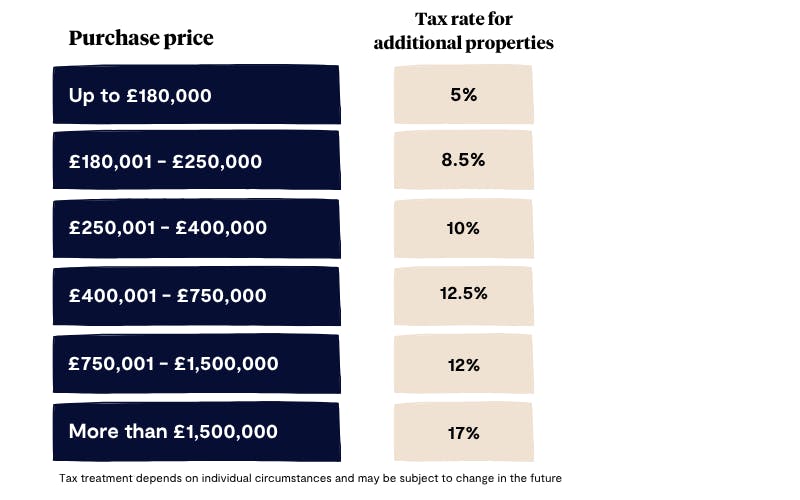

When buying an additional property, such as a holiday home or buy-to-let, you’ll face a bigger Land Transaction Tax bill than you would if buying your first home or selling your current property and moving to a bigger one.

The tables below illustrate the different rates you’ll pay at different price points.

One of the main things that sets Land Transaction Tax apart from England and Northern Ireland’s Stamp Duty Land Tax is that there are no exemptions for first-time buyers. In England and Northern Ireland, first-time buyers pay no Stamp Duty on the first £300,000 of their property purchase. In Scotland, first-time buyers pay no tax on the first £175,000 of the property purchase.

In Wales, a first-time buyer will pay the same amount of Land Transaction Tax as someone moving their way up the property ladder, assuming they’re buying a home for the same price.

The good news is that there are thousands of homes in Wales that are priced below the £225,000 threshold! In fact, the average property in Wales is £238,483.

Are Stamp Duty rates changing in Wales?

Land Transaction Tax may change in Wales in 2026, but it’s likely that any changes will only apply to those purchasing an additional property. In 2024, the Welsh Government announced an increase in rates as part of its budget for 2025 - 2026, but the most significant changes have already been introduced.

In December 2024, Land Transaction Tax rates increased for people buying a residential property worth £40,000 or more who already own one or multiple properties. However, first-time buyers and home movers haven’t seen an increase in LTT rates.

No changes have been announced for main-residence purchases, but rates can change in future budgets.

Learn more: Tembo’s guide to negotiating house prices

You might also like: How to reduce your Stamp Duty liability

Good to know

If you’re trying to decide whether to buy in Wales or England, avoid making a decision based on tax alone. Homes are, on average, cheaper in Wales compared to England. So you may get more value for money in Wales, despite the bigger tax bill.

Want to see how you could buy sooner?

See how you can boost your mortgage affordability by creating a free Tembo plan today. We'll compare your eligibility to thousands of mortgage products and budget-boosting schemes, with no credit check!