8 Facts You Might Not Know About House Deposits

I bet you thought there wasn’t much to know about saving up for your first house. ‘How much deposit do I need to buy a house?’, is the biggest question by far. But there’s plenty more to it than that. From the relationship between interest rates and deposit sizes to the difference between your mortgage and exchange deposit, we’ve compiled a handy list of eight things you might not know about house deposits.

In this guide

- 1. The average deposit is now over £50,000

- 2. The bigger your deposit, the cheaper your interest rate

- 3. You can get free money towards your house fund

- 4. It was actually easier "back in my day"

- 5. It takes 10 years on average to save up a deposit

- 6. You could still buy, even with a small deposit

- 7. Buying a new build? You could get an extra bump to your deposit

- 8. Your deposit is not the only factor

1. The average deposit is now over £50,000

Thanks to rising house prices, the cost of the average house deposit in the UK rose by 23% between 2019 and 2020, according to Halifax. Now, the average house deposit put down by a first-time buyer is £56,700.

But remember that the deposit you need depends significantly on where you are buying. Most banks prefer at least a 10% deposit (although you can find 5% deposit schemes). In London, the average property costs £534,000, so a 10% deposit would be roughly £53,400. But for Newcastle, one of the most affordable locations in England, the average property costs £159,100, so a 10% deposit would be £15,900 - almost £40,000 less.

2. The bigger your deposit, the cheaper your interest rate

The bigger your deposit in relation to your mortgage, the cheaper your interest rate will be. That’s because the more equity you have in your home, rather than debt, the lower the risk you pose to the lender if they need to repossess your property.

Mortgage interest rates are sliced up into what’s known as Loan to Value (LTV) bands that correspond with the size of the mortgage you need. If you’ve got a deposit that represents 40% of the purchase price, you’ll need a mortgage that’s 60% of the price.

Borrowers with a 40% deposit/60% mortgage have a 60% LTV and will be offered the lowest mortgage interest rates on the market. Those with a 5% deposit/95% mortgage - so a 95% LTV - will be offered the highest rates.

Have a look at today's interest rates and filter by your deposit size to see what interest rates are currently available for your Loan-to-Value. Or to see personalised rates, complete your details online today with Tembo. We'll check your eligibility for over 20,000 mortgage products from across the market in seconds.

3. You can get free money towards your house fund

By opening a Lifetime ISA you are entitled to a free 25% government bonus on all your savings. You must be aged 18 or over but under 40 years old to be eligible, and you can use the funds to purchase your first house or fund retirement. Each tax year, you can deposit up to £4,000 until your 50th birthday, and the government will give you a 25% boost on top.

You'll choose between a Cash Lifetime ISA, where your savings will also earn interest, or a Stocks & Shares Lifetime ISA, where your money will be invested in the stock market.

With the Tembo Cash Lifetime ISA, you'll get our market-leading 4.3% AER (variable) interest rate. Over 5 years, that would increase your deposit by hundreds versus the next best available rate on the market.

Boost your deposit by up to £1,000 every year

Open the Tembo Cash Lifetime ISA to get our market-leading 4.3% interest rate and the 25% government bonus. Over 5 years, that's hundreds more vs saving with the closest competitor.

4. It was actually easier "back in my day"

You've probably been told at one point that if you stopped buying takeaway coffees, avocados and paying for Netflix, you'd have a house by now. In the same breath, you might even have been told about how back in November 1979 rates reached the highest ever interest rate at 17%.

While this is true, and for many getting on the ladder in the '70s, '80s or '90s affordability was still stretched, the reality is millennials are the first generation for 136 years to be worse off than their parents

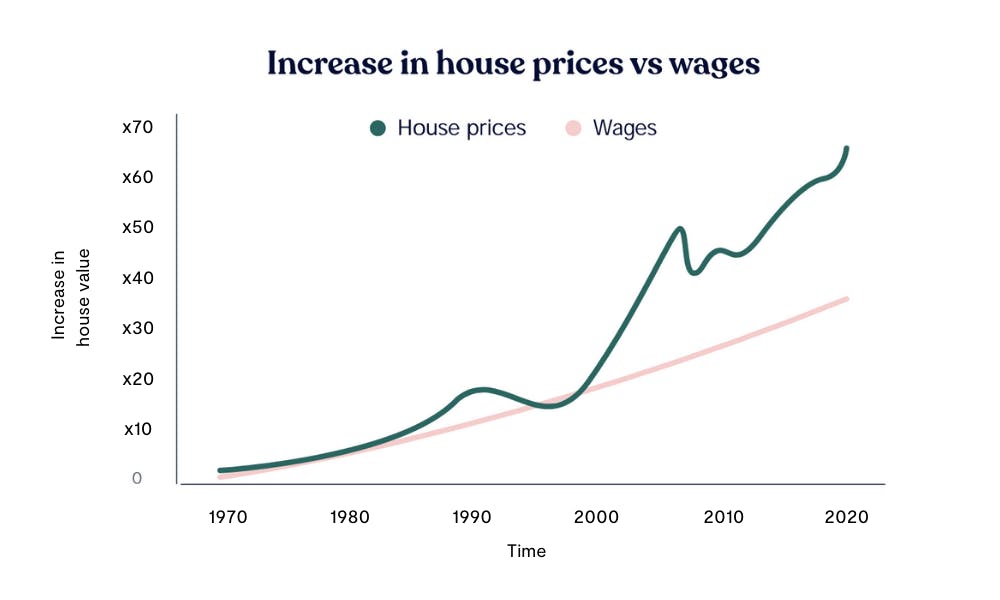

Since the 1990s, the average earnings-to-house-price ratio has more than doubled, which means first-time buyers are paying 191% more than their parents did to get on the ladder. And since the 1970s, house prices are 65x higher, while wages are only 36x higher. This means those who are already homeowners have benefited from decades of property price growth, while the next generation has seen the gap between house prices and earnings grow.

5. It takes 10 years on average to save up a deposit

With the current affordability gap between house prices and earnings, it's no wonder it takes first-time buyers a decade to save up for a home. While this may seem disheartening - there are ways to get there sooner. Using a Lifetime ISA, first-time buyers are able to buy a home four years earlier.

Plus, there are schemes and initiatives out there to help you boost your deposit, or buy with only a small amount saved up 👇

6. You could still buy, even with a small deposit

Did you know that there are ways to get on the ladder without any deposit saved up? While you will have a limited number of lenders to choose from, there are 0% deposit mortgages on the market such as Skipton's Track Record mortgage or family-supported options like a Savings as Security mortgage or Deposit Boost. Plus, there's now over 50 mortgage lenders who offer 5% deposit mortgage schemes

Why are there more low-deposit schemes now? Back in April 2021, the government launched the Mortgage Guarantee Scheme, offering lenders the financial guarantees they need to provide mortgages for 95% of the purchase price for homes worth up to £600,000. This led to more choice for borrowers with a 5% deposit and consequently much lower rates. Currently, for a 5% deposit you could get an average rate of 5.19% for a two-year fixed-rate deal from our panel of over 100 lenders.

See today's current rates here.

You might also like: Tracker vs fixed rate mortgage: What's the difference?

Based on 2-year fixed rate 95% LTV with a 35-year mortgage term. Interest rates accurate as of January 2025.

7. Buying a new build? You could get an extra bump to your deposit

If you're looking at buying a new build, you could be in luck. Some homebuilders offer deposit schemes like Builder's Gift, where they will match your deposit, normally up to 5% of the property price. There's also other schemes like Deposit Unlock, or Own New's Deposit Drop that lets you purchase a new build with just a 5% deposit saved up.

8. Your deposit is not the only factor

Your house deposit isn't the only thing that influences a lender’s decision of how much to lend to you, or whether to lend to you at all.

Your income is also a key deciding factor. Typically, mortgage lenders will let you borrow between 4-4.5x your household income for a standard mortgage. So if you and your partner earn £50,000 collectively, this means in theory you could borrow between £200,000-£225,000 for a mortgage. But some people are eligible for enhanced borrowing, such as NHS workers, professionals like accountants or doctors or those earning a high income.

Your credit score plays a vital role too. Your credit rating tells lenders how well you handle credit and debt. The higher your credit score, the less risk you pose to lenders when lending you money. Read our guide on credit scores to find out what a good credit score is and how to build up your score.

On average our customers boost their affordability by £82,000

See all the ways you could boost your buying budget. It's free, takes 10 minutes to fill out your details and there's no credit check involved. Plus, you can see personalised interest rates and indicative monthly repayments.