Guide to Stamp Duty in Scotland

When you buy property in Scotland, you may need to pay Land and Buildings Transaction Tax. Like Stamp Duty in England and Northern Ireland (and Land Transaction Tax in Wales), it can significantly increase the cost of buying a property. So how does Scotland’s version of Stamp Duty work and how much tax will you pay?

Tax treatment depends on individual circumstances and may be subject to change in the future

Do you have to pay Stamp Duty in Scotland?

No, you technically won’t have to pay Stamp Duty when buying a house in Scotland, but you may have to pay the Scottish equivalent instead, which is called Land and Buildings Transaction Tax (LBTT). It shares some similarities to Stamp Duty, but the rules and rates are different and are set by the Scottish Government, rather than the UK government. How much Land and Buildings Transaction Tax in Scotland you’ll pay depends on the property’s value and whether you’re a first-time buyer, home mover, or buying a second home or investment property.

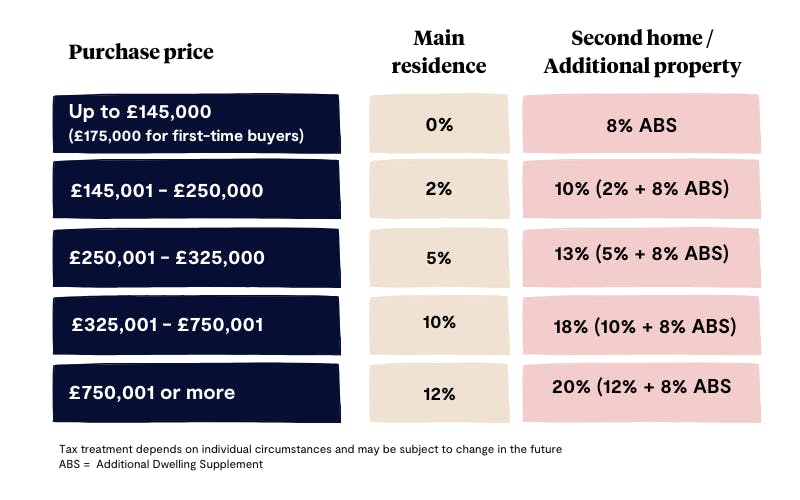

If you’re a first-time buyer, you’ll pay Land and Buildings Transaction Tax on any portion of a property worth over £175,000. For home movers, you’ll pay Land and Buildings Transaction Tax on any portion of a property worth over £145,000. If you’re purchasing a second home, or an additional property apart from your main residence, you’ll pay Land and Buildings Transaction Tax on any portion of a property worth over £145,000 but will pay a higher rate.

We’ve broken down the individual thresholds and rates in the table below:

Learn more: Tembo’s guide to negotiating house prices

The good news is that there are thousands of homes in Scotland that are priced below the £145,000 threshold! Currently, the average property in Scotland is £192,000, although there will be properties on the market for less than this.

Is Stamp Duty different in Scotland and England?

Yes, Stamp Duty is different in Scotland and England, meaning your tax bill may vary depending on your chosen location, even if the property price is the same. In England, if you’re buying a home to live in, you’ll pay Stamp Duty on any portion of the home worth over £125,000 (or £300,000 for first-time buyers). While in Scotland, you’ll pay Land and Buildings Transaction Tax on any portion of the property worth over £145,000 (£175,000 for first-time buyers).

This means, a first-time buyer purchasing a £300,000 home in Edinburgh would pay £2,500 in tax, but they’d pay no tax at all if they spent the same amount in Newcastle. Home movers, investors and those buying an additional property could also face a bigger tax threshold in Scotland.

Good to know

If you’re trying to decide whether to buy in Scotland or England, avoid making a decision based on tax alone. Homes are on average, cheaper in Scotland compared to England. So you may get more value for money in Scotland, despite the bigger tax bill.

Learn more: How to reduce your Stamp Duty liability

You might also like: How has Stamp Duty changed?

Want to see how you could buy sooner?

See how you can boost your mortgage affordability by creating a free Tembo plan today. We'll compare your eligibility to thousands of mortgage products and budget-boosting schemes, with no credit check!