Mortgages for teachers: The complete guide

Andy Shead, Senior Mortgage Advisor

Andy Shead, Senior Mortgage AdvisorTeachers often have a lot on their plates with lesson planning, marking and endless admin. When buying a home, the last thing teachers need is more stress and paperwork! The good news is that you may be eligible for extra support when applying for a mortgage, thanks to a number of specialist schemes designed for teachers.

Whether newly qualified or a department head, this guide covers everything teachers need to know about mortgages.

Key Takeaways

- Enhanced Borrowing: Teachers can often borrow more than the standard 4.5x salary, with some professional schemes offering up to 5x income.

- Lenders often assess teachers based on future income potential and scheduled pay rises, rather than just current payslips.

- Supply teachers may be able to qualify for mortgages, typically requiring between 6 to 12 months of consistent work history.

- Newly qualified teachers (NQTs/ECTs) may be able to apply for mortgages using job offer letters before their first day of work.

Want to see what is possible?

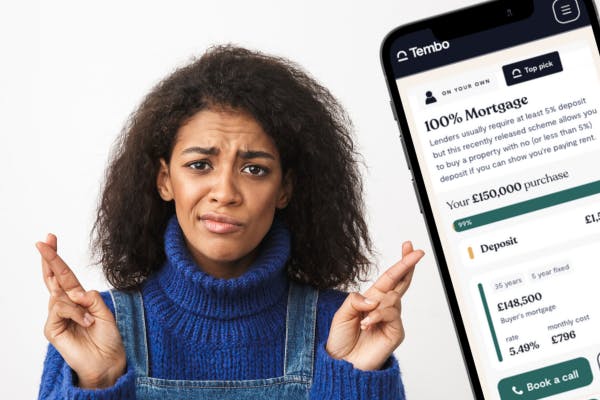

With a number of specialist schemes available for teachers, it is important to get advice from experts who can help you make the right decision. Tembo specialises in complex mortgages and can help you get the best deal for you to maximise your borrowing power.

Can teachers get a lower mortgage rate?

Sometimes, yes. Because teaching is seen as a stable, skilled profession, lenders may look more favourably on your application. This could mean better interest rates compared to applicants in other roles, particularly those that are less secure, but this isn’t guaranteed.

If you’re eligible for a key worker or professional mortgage, you might even be able to buy a home with a smaller deposit.

Are there special mortgage options for teachers?

While there isn't a mortgage product exclusively labelled as a 'teacher mortgage', you may have access to professional and key worker schemes that offer real advantages. The mortgages teachers are eligible for are often offered to mortgage applicants from other professions too. Some of these schemes offer benefits like enhanced borrowing or lower minimum deposit requirements.

The key difference between teachers and other applicants is that lenders will often consider your future income potential when assessing affordability, rather than focusing solely on your current income. This can be particularly beneficial if you’re at the start of your career or you have the potential to progress to a better paid position in future.

For example, a newly qualified teacher on an initial salary may still be assessed with expected pay rises in mind. That can mean you may be able borrow more than someone with the same income in a different field.

Can teachers borrow more than other applicants?

Yes, in some cases, teachers can borrow more for a mortgage than other borrowers. Most lenders cap borrowing at around 4.5x your salary, but teachers often qualify for higher limits through specialist schemes:

- Standard mortgage: Up to 4.5x income

- Professional mortgage: Up to 5.5x income

- Long-term fixed rate: Up to 5.5x income

Keep in mind that you’ll still need to pass the lender’s affordability checks, so make sure your credit record is in good shape and you’ve got all financial commitments under control before submitting your application.

To learn more about mortgage affordability, take a look at our guide: What is mortgage affordability and how do I increase it?

See what mortgage schemes you could apply for

Create a free Tembo plan today to find out not only how much you can borrow, but also what mortgage buying schemes you’re eligible for.

Can supply teachers get approved for a mortgage?

Yes, but it can be trickier. Supply teachers on temporary, fixed-term or zero-hour contracts are sometimes seen as higher risk, so not all lenders will accept your application. Some lenders take a more flexible approach to supply teachers. For example:

- A few accept just 6 months’ history of supply work.

- Others prefer at least 12 months, ideally with a record of consistent income.

This is where an expert broker can make a huge difference. If you apply for a mortgage through a bank directly and get rejected, this can leave a mark on your credit file, making it even harder to get approved for future mortgage applications. Thankfully, an experienced mortgage broker knows which banks lend to supply teachers and which don’t, so they can help you avoid rejection in the first place.

Learn more: What to do if your mortgage application is declined

What mortgage options are there for early-career teachers?

If you’re in your first few years of teaching, you may be eligible for an early career teacher (ECT) mortgage. Here, the lender will look at your estimated career progression rather than just today’s payslip.

That means newly qualified teachers (NQTs) might still qualify for higher borrowing limits than someone in another job with the same salary.

You might not have as much employment history or as many payslips as more experienced teachers, but by choosing a lender who understands how teaching careers work, you may be able to get a mortgage with the following documents:

- A job offer letter or employment contract, even before starting work.

- Career track record if you have trained or worked in education before qualifying.

- Evidence of future pay increases built into the role.

Start your journey to homeownership

Creating a free Tembo plan is your first step. Our technology compares your eligibility across thousands of mortgage products and budget-boosting schemes to provide you with a personalised recommendation quickly.

Only qualifying professionals get enhanced borrowing

If you’re buying with someone else and they don’t have a job that lenders consider “professional”, lenders will multiply your individual incomes by different figures, typically 4 to 4.5 times their salary.

Early career teacher mortgage options

If you’re in your first few years of teaching, you may be eligible for an early career teacher (ECT) mortgage. Here, the lender will look at your estimated career progression rather than just today’s payslip.

That means if you’ve just started as a newly qualified teacher (NQT), you might still qualify for higher borrowing limits than someone in another job with the same salary.

You might not have as much employment history or as many payslips as a more experienced teacher, but by choosing a lender who understands how teaching careers work, you may be able to get a mortgage with the following documents:

- Your job offer letter or employment contract, even before you’ve started work.

- Your career track record if you’ve trained or worked in education before qualifying.

- Evidence of future pay increases built into your role.

Create your free Tembo plan

We’ll assess your eligibility across 100+ lenders, including familiar high-street brands and specialist buying schemes, to uncover your best mortgage options.