Can a parent help with a mortgage?

Ruth Henson

Ruth HensonHow can parents help their children buy a house? This guide explores all available options for parent-supported mortgages. If you want expert advice on the options open to you, you're in the right place. At Tembo, we specialise in guarantor mortgages.

In this guide

- How can my parents help me get a mortgage or buy a house?

- Can a parent be a guarantor for a mortgage?

- Can my parents pay my mortgage?

- Can I get a joint mortgage with my parent?

- Do parents help pay for a house?

- Why do so many first-time buyers need help buying a house?

- Should I accept help from my parents to buy a house?

- The legal bits

- Where to get advice

Key takeaways

- Income boosting: Parents could add their income to your application to increase your borrowing power without gifting cash.

- Deposit support: Options include "Deposit Boost" (unlocking equity from a home) or "Savings as Security" (using savings as a temporary guarantee).

- Common Practice: Over 50% of first-time buyers under 35 now rely on family support to enter the property market.

- Legal Requirements: Gifted deposits require a "gift letter" and proof of funds to satisfy mortgage lenders.

- Protection: Using a "Deed of Trust" can protect family contributions if the homeowners split up in the future.

Discover the ways you could boost your budget with family support

With a number of options available to borrowers, find out how your family could help you get on the property ladder with our online fact find.

How can my parents help me get a mortgage or buy a house?

There are various ways your parents could help you buy a house, normally through a guarantor mortgage. There are even ways they could help, even if they don't have spare cash!

- Income Boost: Add part of or all of your parents' income to your mortgage application as a guarantor through an Income Boost. This increases the total income on which your mortgage affordability will be based. Find out more here.

- Deposit Boost: Unlocks equity from a parent's property to fund your down payment. Find out more here.

- Savings as Security: A parent puts cash savings, typically 10% of the property value, into a locked savings account with the lender for a set period, allowing you to buy with a 0% deposit. Find out more here.

What is a guarantor mortgage and how do they work?

Can a parent be a guarantor for a mortgage?

Yes, a parent can be a guarantor for a mortgage. Adding your parent to your mortgage application as a guarantor is a great way to increase your mortgage affordability so you can borrow more. These types of mortgages are often Joint Borrower Sole Proprietor mortgages.

At Tembo, we call this type of parent-support mortgage an Income Boost, which is much easier to say! An Income Boost can be a great solution for those who are struggling to get the mortgage they need on their own, for example, those who are self-employed, on parental leave, are a single parent or are buying solo.

Other types of family-supported mortgages are often called guarantor mortgages, because your loved one is supporting your home purchase in some way, even if they are not guaranteeing your mortgage loan.

Important! Your guarantor is liable for the mortgage debt

In becoming your guarantor on an Income Boost mortgage, your parent will be agreeing to be liable for the mortgage debt, which means they'll be required to step in if you are unable to make the mortgage repayments.

Can my parents pay my mortgage?

If you're struggling to pay your monthly repayments, your parents or another family member can help you pay your mortgage. They could gift you a lump sum of cash to be used to reduce your mortgage loan, which will make your monthly repayments more affordable. Or, if they want to contribute to the ongoing monthly payments, they can also be added to your mortgage.

Can I get a joint mortgage with my parent?

It is possible to get a joint mortgage with your parent to become co-owners, or for them to contribute to the mortgage. There are a few ways to do this. If you use a traditional joint mortgage, you and your parent will both be liable for the mortgage debt and will own 50% of the equity in the home each.

Or you can use a tenants in common style mortgage, which allows you to add your parents to your mortgage application as co-owners, but instead of splitting the equity evenly, you will each have an individual share in the property. This way, each co-owner’s share is separate and reflects what they have contributed to the house deposit and repayments over the years.

See how your parents could help you buy today

Complete your details to see all the ways your parents could boost your mortgage affordability and help you buy sooner. It's completely free, and there's no credit check involved!

Do parents help pay for a house?

Parental help with buying a home is more common than many people realise, and it's not limited to any particular income bracket. The "Bank of Mum and Dad" is often used to describe any financial help parents give their children, including support to get on the housing ladder.

While some people feel hesitant about accepting family support, the reality is that it's become a practical solution for many aspiring homeowners facing today's housing market challenges.

The reality is that a large number of parents help their children buy a house. In fact, over half of first-time buyers are reliant on family support to buy their first home. If you are aged under 35 years, more than half (56%) of your friends are likely to have been given a leg up onto the property ladder by a financial gift or loan from their parents. In fact, 71% said they couldn't have bought without that financial support, or they would have had to delay buying by an average of 4 years.

Accepting family support is a practical response to today's challenging housing market, which we'll explore in more detail below.

Why do so many first-time buyers need help buying a house?

With house prices rising by as much as 5-10% a year and the average home now costing £269,800, many younger homebuyers are finding they need additional support to achieve their homeownership goals. Often, the problem is not that they can’t afford the repayments, but that they struggle to save the deposit in the first place or get a mortgage big enough to buy what they need.

In most cities, for first-time buyers who are able to put down a 10-15% deposit, monthly repayments will be cheaper than renting. But if you’re at an early stage of your career and earning power, building a big enough deposit is especially hard if you have to pay high rent while you save.

There are other factors which have also placed homeownership further out of reach for first-time buyers in comparison to previous generations.

House building by local authorities, which tends to be significantly more affordable than private developments, has declined substantially across the UK since your parents and grandparents bought their first home.

Younger generations are also now trying to save for a house alongside student loan repayments - the forecasted average debt among students who started their course in 2021/2022 once they have finished their course is £45,800! Any monthly payments you make to your student loan is money that previous generations could have put towards saving for a home.

Additionally, people under 30 were more likely to experience income reductions during the pandemic (15%) compared to those over 60 (5%).

Not only are the younger generation finding saving more and more difficult, but the older generations have benefited from property prices soaring. The average house in March 2021 cost more than 65 times the average UK home in January 1970, when the previous generation may have been buying. Over the same time, average weekly wages have risen only 35.8 times.

This means two things: one, the gap between wages and house prices has grown substantially over the last 50 years. Two, many parents who bought in their 20s and 30s now have a lot of wealth tied up in their properties. This means that through schemes like a Deposit Boost, this wealth can be gifted to the next generation to help them buy.

Read more: Are house prices still rising?

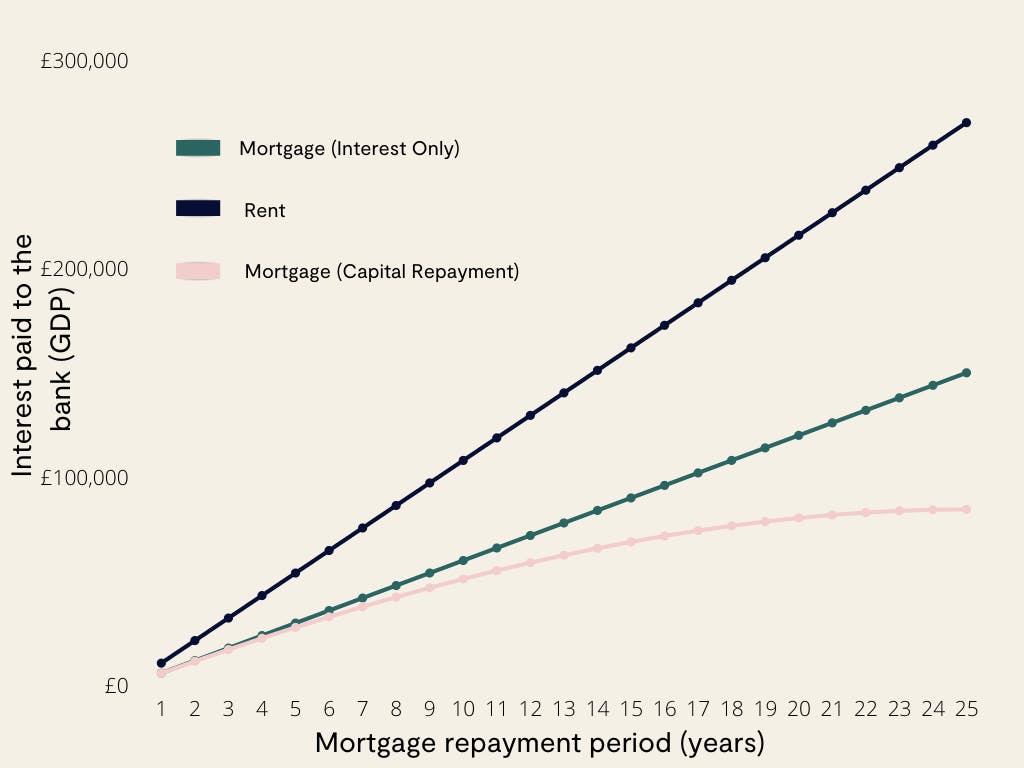

Owning a property will make you over £350,000 better off!

Getting on the ladder earlier with parental help will not only give you security against rent rises, it will also make you financially better off in the long term. In fact, owning a property makes you £352,500 better off than the average private renter over the next 30 years—even if house prices don’t rise.

Should I accept help from my parents to buy a house?

It's natural to have mixed feelings about accepting help from your parents to buy a house. Many people feel they should achieve homeownership independently, but the reality of today's market often makes family support a sensible option. You might also worry that your parents won’t have enough to live on by themselves if they offer you support, or it could create tensions between siblings or other family members. The important thing to remember is that accepting help from family to buy is normal and is nothing to be ashamed of.

If you're worried about how to broach the subject with your family, read our guide here on how to talk to your family about support, inheritance and more.

If my parents gift me money, can they choose which house I buy?

No, in law, once a gift is given, it is the receiver’s to do with as they wish. Parents may ask children who are giving a gift to sign a "letter of intent" explaining what they will do with the money, but this is not enforceable by law.

I’m not married, will my partner get half the gift if we split?

Drawing up a cohabitation agreement or Living Together Agreement (LTA) can avoid any problems with splitting the gift if the relationship breaks down.

This is a legal document common among unmarried couples. It lays out how any assets will be divided if the couple splits.

The legal bits

If your parents are helping you buy, there are a couple of requirements to keep in mind as you go through the home-buying process. You will need to take the following actions to ensure the lender can substantiate the gift:

- Proof of gift: a written letter confirming the money is a gift, not a loan.

- Anti-money laundering: parents must provide bank statements to show the source of funds.

- Equity protection: draft a ‘Deed of Trust' to protect the gift in case of a breakup.

- Legal advice: when using a guarantor mortgage, guarantors usually need Independent Legal Advice (ILA).

Where to get advice

At Tembo, we specialise in helping families work together to make home happen, so first things first - complete your details on our online fact find to see which schemes could work for you and your loved ones for free.

If your parents want to help you buy a house, it's important to get professional, independent legal and financial advice once they’ve decided which mortgage they want to use. That might mean talking to their regulated financial advisor, as Tembo customer Jo did:

A regulated financial advisor can advise your parents on:

- How to avoid falling foul of inheritance tax rules

- The best way to take money from a pension without paying extra tax

- Whether it is better to use non-pension assets instead to fund the gift

- How to rearrange your investments to avoid losing out due to the gift

Read more: Top 5 Financial Advisors

Additional guides are also available on What Is A Financial Advisor? and Do I Need A Financial Advisor?

Looking for ways your parents could help? Talk to the experts

At Tembo, we specialise in helping buyers boost their mortgage affordability to buy sooner. To see how your parents could help you buy a home, complete your details today. You can then book in a free, no-obligation call with our award-winning team to talk through your options.