The real reason you're not on the property ladder yet (It’s not avocado toast)

Have you ever been told that you could afford to buy a house if you just worked harder and stopped spending so much money? It’s something that Millennials and Gen Z hear all the time!

There may be a few things you can do to boost your deposit and your chances of getting a mortgage, but it’s probably not your fault that you don’t own a house yet - even if you don’t have a side hustle, you love going out for brunch, and you’re paying for multiple streaming services at once.

Here’s why it’s actually so hard to get on the property ladder in the UK, and why it’s got nothing to do with avocado toast…

1. The cost of living is rising

It’s easy to blame holidays, clothes, or takeaways for young people’s inability to get on the property ladder. Still, many non-essentials have become cheaper and more accessible over time, while the essentials (such as food and rent) have risen dramatically.

You can fly from London to Malaga for £40, but you’ll pay 54 times that on a month’s rent in London. You can buy a new outfit for less than £20, but food prices have risen 4.5% over the last 12 months - that’s the fastest rate since February last year.

The real problem standing between renters and homeownership isn’t the discretionary treats – it’s the costs we can’t opt out of. Even those who rarely splurge are left with little spare cash at the end of the month. That’s why skipping brunch won’t fix the problem!

Make your money work harder with a Tembo ISA

Whether you want easy access to your money, or to lock away long-term funds, with our range of ISA accounts you’ll earn competitive interest rates, as well as fee-free, award-winning mortgage advice.

You can save or invest up to £20,000 into one or more ISAs each tax year.

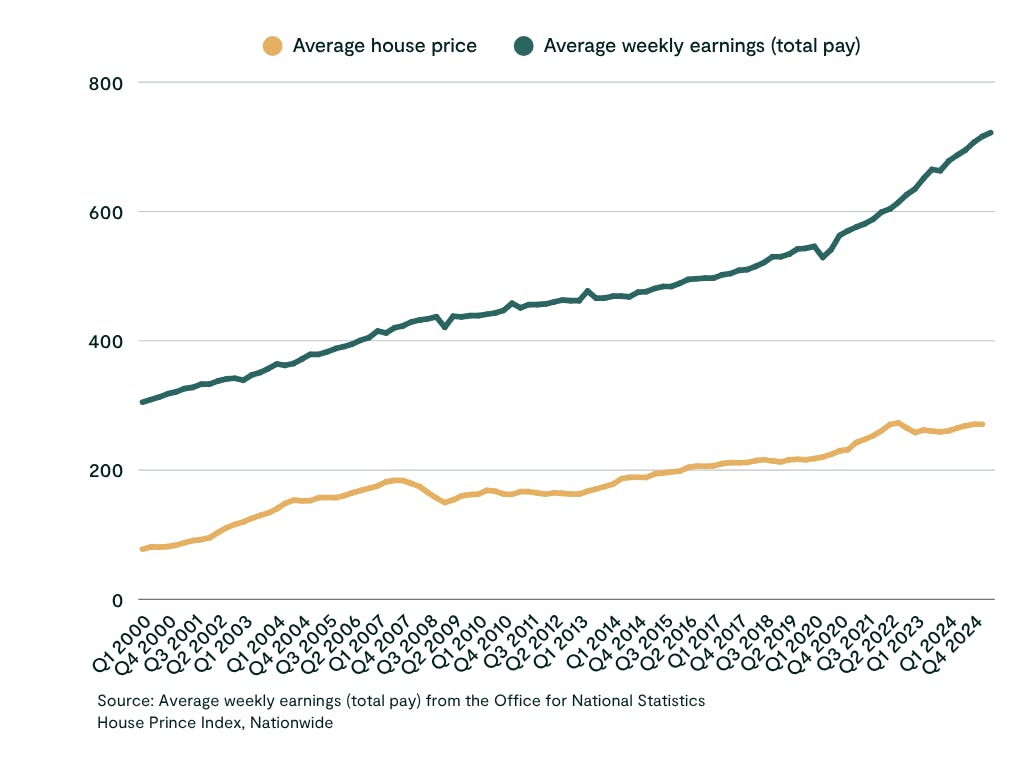

2. House prices have risen faster than wages

The average house price has risen from £10,388 in 1975 to £272,751 in 2025. Even looking at a smaller timeframe, the rise in house prices has outpaced earnings. In the 1990s, the average home cost around four times the average earnings. By 2022, it had risen to eight or nine times - and even higher in places like London and the South East. The last time house prices were this expensive relative to average earnings was in 1876. So if you’re struggling to save a 10% deposit, it would be silly for anyone to blame avocado toast!

Learn more: What is a 95% mortgage and can I get one?

3. It’s hard to get a big enough mortgage

Not only do rising house prices make it harder to save a deposit, they can make it harder to get a mortgage too - or at least a mortgage big enough for the home you actually want.

Most lenders will offer mortgages of around 4.5x a borrower’s income. So, if you earn £40,000 a year, you can usually expect to borrow around £180,000 towards your first home, as long as you pass the lender’s other affordability criteria. If you wanted to buy a home for £300,000, you’d need to save a deposit of £120,000 to bridge the gap between your mortgage amount and the property price.

Saving a deposit of this size isn’t possible for most people, but we do bring good news!

Some lenders are willing to offer bigger mortgages of 5.5x your income, particularly if you have a ‘professional’ job with a good salary and regular pay increases. It might even be possible to borrow 6x your income, bringing your total mortgage on a £40,000 salary to £240,000.

If that’s still not enough for a property in your area, you may be able to boost your mortgage even further by using a guarantor or by clubbing together with a group of friends and living in the property together.

There are more options available than you might think — and none of them require giving up your social life or living off microwave noodles.

Learn more: How much can a first-time buyer borrow?

On average, we boost their budgets by £88,000!

We’ve helped thousands of first-time buyers discover how they could afford their first home with the help of affordability-boosting schemes. Create a free plan to see what you could afford.

4. We’re not building enough homes

In the 1940s and 50s, the UK treated housebuilding as a national priority. Not only did the government at the time build over a million homes as part of its ‘Homes for All’ policy, but roughly 80% of them were council houses. After this, the pace of house building slowed down, and the number of council homes sold off through the Right to Buy scheme increased.

Fast forward to today, and annual building levels rarely hit 200,000, even though the population is much larger than it used to be. And with demand outstripping supply, rents and house prices have risen dramatically.

This means that many first-time buyers are being squeezed from all sides, as not only has the price tag on their first home gone up, but it’s much harder to save a deposit for it due to the cost of renting.

Learn more: How to rent like a pro while saving for your first home

5. There’s not enough social housing

When Margaret Thatcher introduced the Right to Buy scheme in 1980, it was initially quite popular. The scheme allowed council tenants to buy their home at a big discount. Over the last 45 years more than 1.8 million council tenants have been able to turn their homeownership dreams into a reality - something they might not have been able to do without the scheme’s help.

But this also meant a big drop in the number of council houses available. Today, around 40% of former council properties sold under Right to Buy are owned by private landlords, often rented out at much higher rates.

So even if you’re not relying on social housing yourself, a shortage of council homes affects you too: with fewer affordable options, more people compete for the same homes to buy or rent, pushing prices higher for everyone.

6. The planning system is too complicated

So why don’t developers just build more properties? Well, according to the Federation of Master Builders’ 2024 House Builders’ Survey, 76% of small, local house builders rated the planning system as the top barrier holding back new homes. It’s slow, underfunded, and frustratingly complex, making it harder to get permission to build, especially for small sites. In fact, 71% of builders said opportunities for smaller developments are actually decreasing.

This means there aren’t enough new homes on the market, which pushes up prices and makes it even harder for first-time buyers to get on the ladder.

7. Buy-to-let added to the problem

Landlords have existed for centuries, but it wasn’t until 1996 that lenders first began offering Buy to Let mortgages. Before that, landlords who couldn’t afford to pay in cash might’ve used a commercial mortgage, or another form of lending, such as a personal loan.

Buy to Let mortgages made it easier for ordinary people to invest in property because lenders began including expected rental income when deciding how big a loan to offer, rather than limiting it to what the borrower earned themselves.

This shift helped to transform homes from places to live into investments, allowing aspiring landlords to buy up available housing stock which could have been bought by first-time buyers.

Make home happen with the UK’s Best Mortgage Broker

At Tembo, we specialise in helping the next generation get on the ladder. We’re experts in alternative buying schemes, and can compare your eligibility to over 20,000 mortgages. Create a free Tembo plan to see what options are open to you without applying.