What percentage of salary should go to mortgage?

Property prices and interest rates have risen significantly over the last few years, making it more important than ever to consider what is realistic to allocate to your mortgage costs, whether you’re looking at buying your first home or remortgaging onto a new deal. So what percentage of your salary should go towards your mortgage and what should you consider when choosing a mortgage term length? Let’s get into it.

How do mortgage payments work?

When you buy a property with a standard repayment mortgage, your monthly payments will be made up of capital (the amount you originally borrowed) and interest you pay to your lender. The amount of interest you pay will depend on the interest rate you’re offered, which is influenced by affordability factors like your deposit size, mortgage type, and credit score. Your interest rate is a percentage of your outstanding mortgage loan, which is why in the first few years your monthly repayments will mostly be made up of interest as your outstanding loan is greater. As time goes on and your outstanding mortgage debt decreases, the amount of interest you’ll pay will also decrease.

Mortgages can also be interest-only, meaning your monthly payments will only cover the interest charged on your loan. But once you reach the end of your interest-only term, you’ll need to pay back the capital you borrowed in the beginning. Interest-only mortgages are popular among Buy to Let investors and those looking to borrow in later life. They’re less suitable for first-time buyers and families, who may not have the ability to repay the capital at the end of the term without selling their home.

Learn more: How can I reduce my mortgage payments?

What is a normal mortgage term?

In the 70s, 80s and 90s, most people took out mortgages with a 25 year term. But as house prices have risen and it’s gotten harder to save a deposit, lenders have offered much longer mortgage terms of between 30 and even longer. Having a longer mortgage term gives you the benefit of more affordable mortgage repayments as your loan is spread across a longer time period. But the downside is that you’ll pay more interest too. Remember that the mortgage term you can take out will also be influenced by your age. Some lenders will want the oldest borrower to be no older than 75 years old by the time the mortgage ends, others have higher age limits.

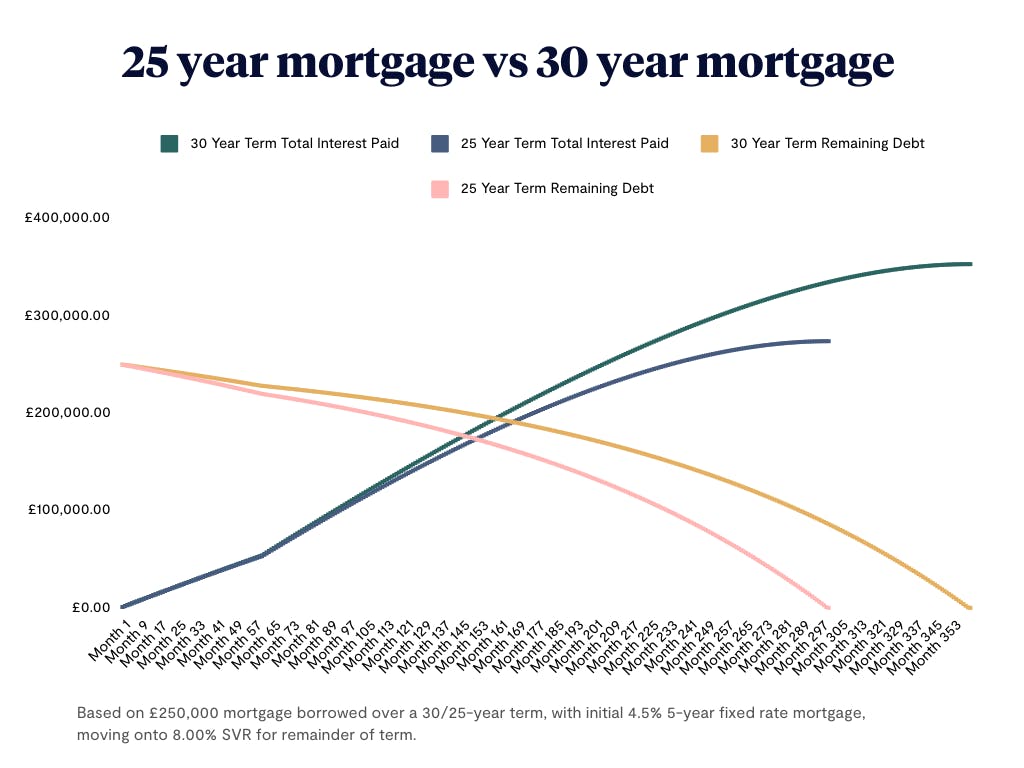

Let’s look at an example of how different mortgage terms influence what you pay over time. If you borrow £250,000, you’ll pay less interest over a 25-year mortgage than a 30-year mortgage:

We boost budgets by £88,000 on average

Voted the UK’s Best Mortgage Broker, Tembo specialises in helping the next generation make home happen. Discover your true affordability by creating a free Tembo plan today. It takes minutes, and there’s no credit check involved!

What is the best percentage of income for a mortgage?

The best percentage of your income you should pay towards your mortgage will depend on your living costs, responsibilities, and plans for the future. For example, if you have kids or want them in future, you’d like to start a business or travel the world, or you’re hoping to retire early, you’ll find it easier to reach your savings goals if your mortgage payments make up a smaller percentage of your income. But the amount a mortgage would take up of your monthly earnings will also be influenced by how much a lender is willing to lend to you, and how long you take to pay off your mortgage (i.e. the mortgage term you choose).

When you apply for a mortgage, the lender will have their own criteria to determine what is an affordable amount to loan to you based on your income and other factors. They’ll also carry out a series of affordability checks to determine how much you can comfortably afford. Some lenders may expect your monthly mortgage payments to exceed no more than 25% of your post-tax income. Others might allow a higher percentage of 35% or 45%.

You may find that some lenders will include other debts within that percentage, taking any credit card or car repayments into account too. Lenders might also ‘stress test’ your budget, making sure the repayments will still be affordable if your circumstances change and you experience a temporary drop in income or increase in expenses.

When assessing your affordability, lenders also tend to use something known as ‘income multiples’. This involves multiplying your income by a set figure (usually somewhere between 4 and 4.5) to calculate the maximum loan amount you could borrow. So, if you earn £30,000 a year and your lender uses a multiplier of 4, this means you can expect to borrow around £120,000. If you’re buying a house with your partner, friend or sibling and they earn £40,000, this could increase your mortgage amount to around £280,000, providing you meet the lender’s other criteria.

It may be possible to borrow up to 5 times or even 6 times your salary for a mortgage, but you’ll usually need to qualify for a professional mortgage, work as a key worker or earn a higher income. If you don’t fit into these categories, you could also increase what you can borrow through a guarantor mortgage like an Income Boost.

Learn more: Can I get a mortgage with adverse credit?

How much is recommended you spend on mortgage payments?

How much you should expect to spend on mortgage payments depends on your specific situation. You’ll need to strike a balance between ensuring your monthly repayments are affordable and long-term financial stability.

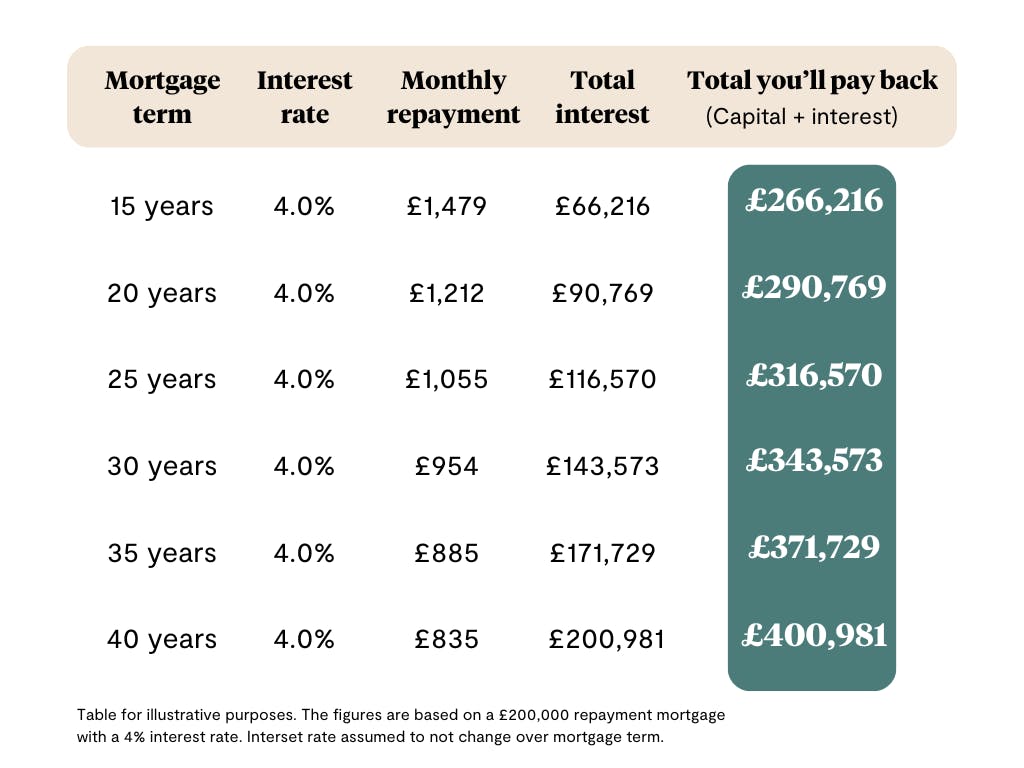

For example, let’s imagine you want to borrow £200,000 and you’re eligible for a mortgage with a 4% interest rate. Your monthly mortgage repayments would be £1,055 a month if you take out a 25-year mortgage term. You’d repay £316,570 in total over the full 25 years in capital and interest.

Choosing a 35-year term instead would mean your monthly payments would drop to £885 (saving £170 a month), but because your mortgage term is 10 years longer, you’ll pay £371829 in total — that’s £55,159 more overall.

Take a look at the table below to see how your mortgage term can affect your monthly mortgage payments and the amount of interest you’ll pay.

The interest rates shown are an indication only and are not guaranteed. Current rates may have changed by the time you come to apply.

What should you consider when deciding on mortgage payments?

If you have an unpredictable income, smaller mortgage payments of just 10 to 20% of your earnings could give you peace of mind. You need to be sure that if your income ever drops, you can keep up with your repayments. If you have other debts such as personal loans, credit card repayments or car payments, keeping your mortgage payments as low as possible will make it easier to stay on track.

If you have children, a partner or a spouse who depends on your income, spending a large percentage of your income on housing costs could lead to stress and uncertainty. By keeping your mortgage repayments as low as possible, you may find it easier to provide for your family and save for the future.

However, since paying off your mortgage sooner can save you thousands (or even tens of thousands) of pounds in interest, you’ll need to weigh up the pros and cons of both long and short-term mortgages.

Looking for a happy medium? You could take out a medium to long-term mortgage and make overpayments when you can. Take a look at our guide to overpaying your mortgage to learn more.

If you’re looking at buying your first home, it can be reassuring to look at what you currently spend on rent. If you’re currently spending 40% of your income or more on rent, spending a similar percentage on mortgage payments may seem realistic.

Plus, by getting on the property ladder you can build equity for the future, paint your walls and finally get a dog! But don’t forget to factor other homeownership costs into your budget, such as furniture, decorating, insurance, repairs, ground rent, and maintenance costs.

Learn more: How to get mortgage-ready while renting

See what rate you could be offered

Create a free, personalised Tembo plan to see what mortgage rates you could be offered and indicative monthly repayments - without applying. We’ll show you the monthly costs of all the ways you could get on the ladder, including schemes you might not have heard of!