Rent vs Buy: What £1,200 gets you across Great Britain

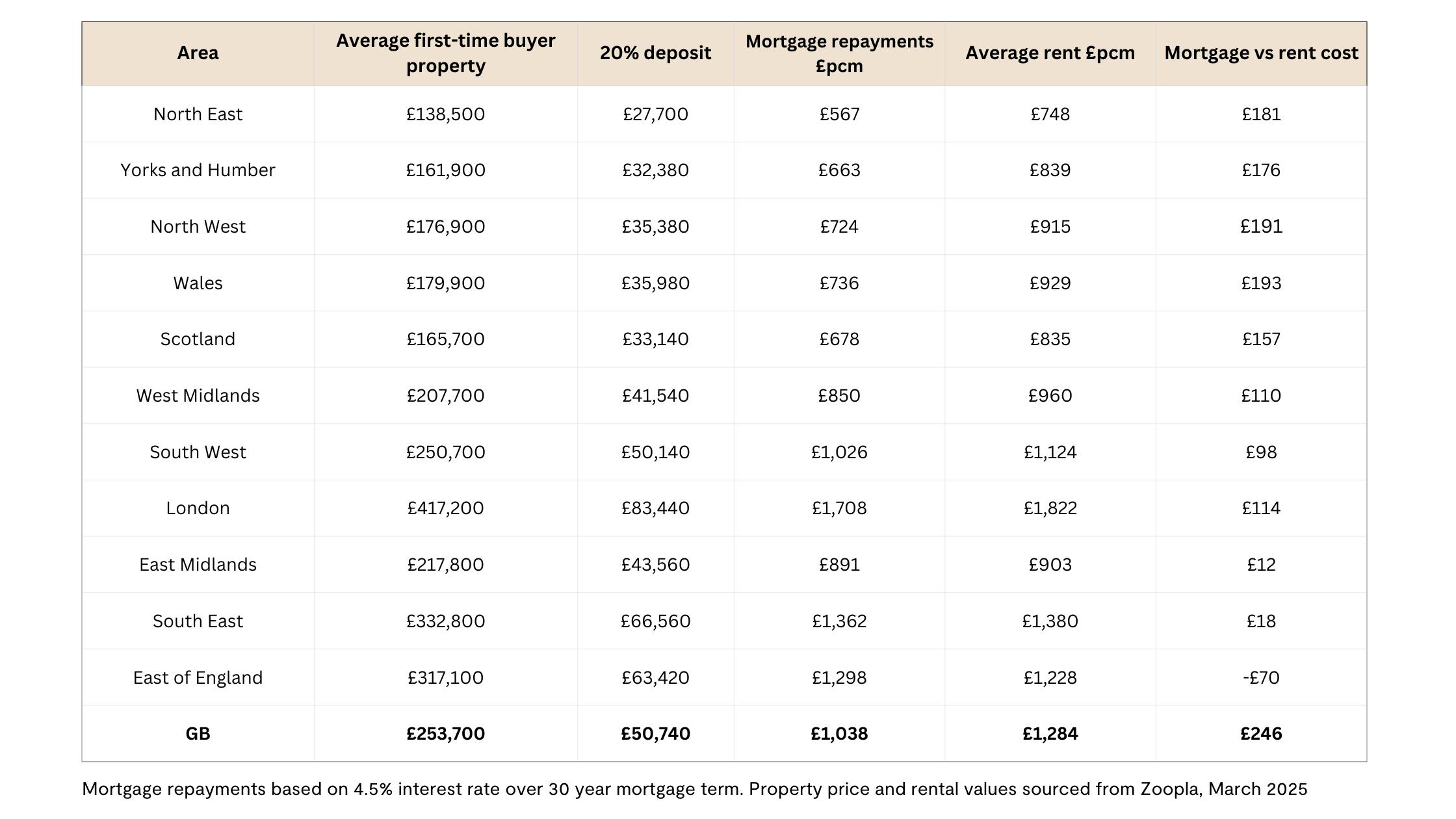

The average first-time buyer mortgage payment is now 20% lower than the average rent across Great Britain. But is buying always cheaper than renting? And if you’d like to buy your own home, which regions offer the best value for money?

The average rent is just over £1,200 per month. Let’s break down what £1,200 a month really gets you in rent vs mortgage payments, and how you could save a deposit faster or boost your affordability so you could buy sooner and leave renting forever.

See your true buying budget without applying

With a personalised Tembo plan, you can see all the ways you could get on the ladder, including indicative interest rates and repayments - all without applying.

North East

In the North East, the average first-time buyer property costs £138,500, so you’d need £27,700 for a 20% deposit. That would make your mortgage repayments around £567 a month (assuming a 4.5% rate over 30 years). That’s 24% (£181) cheaper than the average rent in the region, which sits at £748 per month.

If you’re struggling to save a 20% deposit, the good news is you might not need to. Many first-time buyers put down a 10% deposit, and some are able to buy with just a 5% deposit. Take a look at our 95% mortgages guide to learn more.

Learn more: What happens when interest rates rise?

You might also like: Newcastle house buying guide

Yorkshire and the Humber

In Yorkshire and the Humber, the average first-time buyer home is priced at £161,900, meaning you'd need a £32,380 deposit. Mortgage repayments would be about £663 a month on typical terms. That’s 21% (£176) lower than the average rent of £839. For many, buying could mean noticeably lower monthly housing costs compared to renting.

Learn more: Are house prices rising?

North West

Buying in the North West means targeting an average property price of £176,900, with a £35,380 deposit. Your mortgage repayments would be around £724 a month, which is 21% (£191) less than the average rent of £915. That difference could make buying much more appealing to renters who want to save month-to-month.

If you’re sick of renting and desperate to buy your own home ASAP, you could save a deposit faster with the help of a Lifetime ISA. Save up to £4,000 each tax year in our Cash Lifetime ISA and not only will you get our 3.8% AER (variable) interest rate, the government will boost your savings by 25% - up to £1,000 a year.

Learn more: Is now a good time to buy a house?

Lifetime ISA withdrawals for any purpose other than buying a first home (up to a value of £450,000) or for retirement incur a 25% government penalty, meaning you may get back less than you paid in.

London

London’s average first-time buyer property price is £417,200, requiring a hefty £83,440 deposit for 20%. Monthly repayments would be about £1,708, which is 6% (£114) less than the average rent of £1,822.

Although buying in the capital is technically cheaper than renting, the upfront costs can be an obstacle for many. Not only is it hard to save a deposit while forking out almost £2,000 a month on rent, it can be hard to get a big enough mortgage too, due to lenders’ affordability criteria.

That’s because when you apply for a mortgage, the lender will usually multiply your income by a set figure to determine how much to lend you. The exact figure varies between lenders, but most use a multiple of 4.5. This means that to secure a mortgage on a £417,200 home, a first-time buyer with a 20% deposit would typically need to earn £74,169 a year.

The good news is that some lenders will use higher income multipliers, such as 5 or even 6 times your income — especially if you have a good credit score and a ‘professional’ career with job security and pay rises that increase with inflation.

To learn more about affordability criteria and income multipliers, take a look at our guide to mortgage affordability.

Wales

In Wales, the average first-time buyer property costs £179,900, requiring £35,980 for a 20% deposit. Monthly mortgage repayments come in at roughly £736, which is 21% (£193) lower than the typical rent of £929. It’s a clear example of how buying can often be cheaper than renting in many parts of Wales.

On average, our customers boost their budget by £88,000

We’ve helped thousands of first-time buyers discover how they could afford their first home with the help of higher lending and affordability-boosting schemes. Create a Tembo plan to see what you could afford - it’s free!

Scotland

Scotland’s average first-time buyer property is £165,700, so you’d need £33,140 up front for a 20% deposit. That would make your monthly mortgage payments about £678. Compared to the average rent of £835, that’s 19% (£157) cheaper - highlighting that buying could help reduce monthly outgoings for those who can raise the deposit.

You might also like our guide to Stamp Duty in Scotland

East Midlands

In the East Midlands, buying a typical first-time buyer property at £217,800 would need £43,560 for a 20% deposit. Mortgage repayments would average £891 a month, just 1% (£12) cheaper than the region’s average rent of £903. This means that some buyers in the East Midlands might not feel that much better off month-to-month than they did while renting.

If you’d like to keep your mortgage costs as low as possible, it’s a good idea to speak to a mortgage broker. Here at Tembo, for example, we can compare thousands of mortgages across more than 100 lenders to find the right mortgage for you.

West Midlands

In the West Midlands, the average property for first-time buyers costs £207,700, which needs £41,540 for a 20% deposit. Mortgage repayments would be about £850 a month, 11% (£110) lower than the region’s average rent of £960. While the deposit is higher than in some regions, the monthly savings could still add up.

South East

For the South East, average first-time buyer homes cost £332,800, meaning £66,560 for a 20% deposit. Repayments would be about £1,362 a month, which is just 1% (£18) lower than the average rent of £1,380. Although there’s not much difference in monthly costs, owning can often have more long-term benefits, though the upfront costs can often be higher.

If you’d like to buy a home in the south east but you’re struggling to get a mortgage big enough for the home you want, take a look at our list of the top 10 first-time home buyer schemes. You might be surprised at just how many options you have — even without parental help.

Shared Ownership, for example, lets you buy a share of a home and pay rent on the rest. This reduces the size of the mortgage and deposit you need. Over time, you can “staircase” your way to full ownership by buying more shares in the property when you can afford to.

South West

If you’re looking in the South West, the average first-time buyer home costs £250,700, needing £50,140 for a 20% deposit. Mortgage repayments would be around £1,026 a month, which is 9% (£98) less than the average rent of £1,124.

Remember that if you’re struggling to save a 20% deposit, you may be able to get on the ladder with a much smaller amount. Take a look at our guide to no or low deposit mortgages to learn more.

Perfect for you: Should I buy a house?

East of England

In the East of England, it’s actually more expensive to buy. The average property price of £317,100 means putting down £63,420 as a 20% deposit, with repayments of around £1,298 a month. That’s 6% (£70) higher than the average rent of £1,228. It’s one of the few areas where renting might make more financial sense in the short term.

If you’re struggling to get a big enough mortgage for the home you want, it may be possible to boost your affordability and get a bigger mortgage. If you’ve got family support, you might be eligible for an Income Boost, which is a type of guarantor mortgage where you add a family member’s income to your mortgage application without adding them to the home itself.

If your parents bought their home when houses were much more affordable and they’ve seen the value of their property snowball over time, they could potentially use their home equity to help you get on the ladder yourself. With a Deposit Boost, we’ll help them release funds from their home and put it towards a deposit on your own. This could help you access a wider choice of mortgages and even increase your mortgage size.

Great Britain (Average)

Across Great Britain overall, the average first-time buyer home costs £253,700, needing a £50,740 deposit. Average mortgage repayments come in at £1,038 a month - 19% (£246) cheaper than the average rent of £1,284. Nationally, buying tends to be significantly cheaper month-to-month for those who can clear the deposit hurdle.

See how much you could afford with Tembo

Discover which budget boosting schemes you could be eligible for by creating a Tembo plan today. It takes just a matter of minutes to complete and will give you an insight into your true borrowing potential.